Crypto Industry News:

Salvadoran President Nayib Bukele made another bullish forecast for Bitcoin shortly after the International Monetary Fund called on his government to remove Bitcoin's legal tender status. Bukele tweeted that Bitcoin would eventually see "a giant price increase" due to the limited supply of just 21 million digital coins.

The president cited the Bitcoin shortage case, stressing that there are "over 50 million millionaires "and there are not enough Bitcoins if each of them would like to own at least 1 BTC.

"It is not enough for even half of them. The enormous price increases are only a matter of time," wrote Bukele.

The president's comments came shortly after the International Monetary Fund (IMF) called on El Salvador to stop recognizing Bitcoin as legal tender due to threats to financial stability and consumer protection.

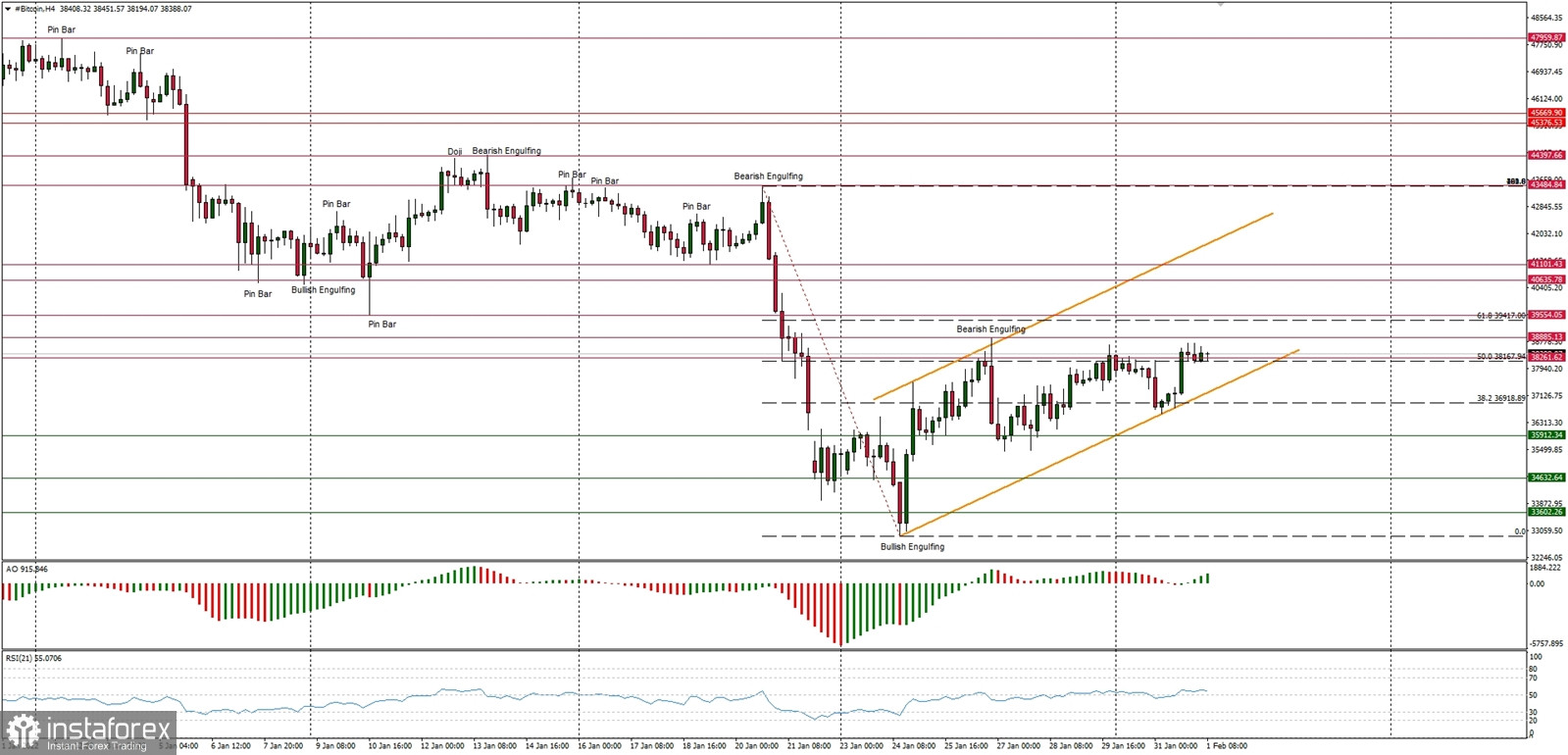

Technical Market Outlook

The BTC/USD pair is currently trading above the level of 50% Fibonacci retracement of the last wave down and the bulla are targeting the 61% Fibonacci retracement level next. The local low was made at the level of $36,710, but the key short-term technical support is seen at $35,912. The market conditions are extremely oversold at daily time-frame chart, but the momentum is still weak and negative. This is not a good situation for bulls as the bears are still in control and might push the price way lower soon. The next technical support is seen at $35,912 and $34,632.

Weekly Pivot Points:

WR3 - $46,518

WR2 - $42,733

WR1 - $40,610

Weekly Pivot - $36,641

WS1 - $34,413

WS2 - $30,618

WS3 - $28,634

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.