Crypto Industry News:

Sheila Warren, Director of Blockchain Technology and DLT at the World Economic Forum (WF), will be appointed CEO of the Crypto Council for Innovation (CCI) in February.

In a recent statement, the CCI announced that from February 2, Warren will lead an alliance of cryptocurrency-friendly companies aimed at supporting lawmakers in regulating cryptocurrencies and Blockchain. CCI board member Fred Ehrsam praised the CEO's "in-depth knowledge of cryptocurrencies" in addition to her experience working with governments around the world.

Formed in April 2021, the CCI includes supporters such as Coinbase, Fidelity Digital Assets, Paradigm, Ribbit Capital, Andreessen Horowitz, and Block - formerly Square. In July, the group held a virtual event called "The B Word," exploring how institutions could potentially adopt Bitcoin and Blockchain technology.

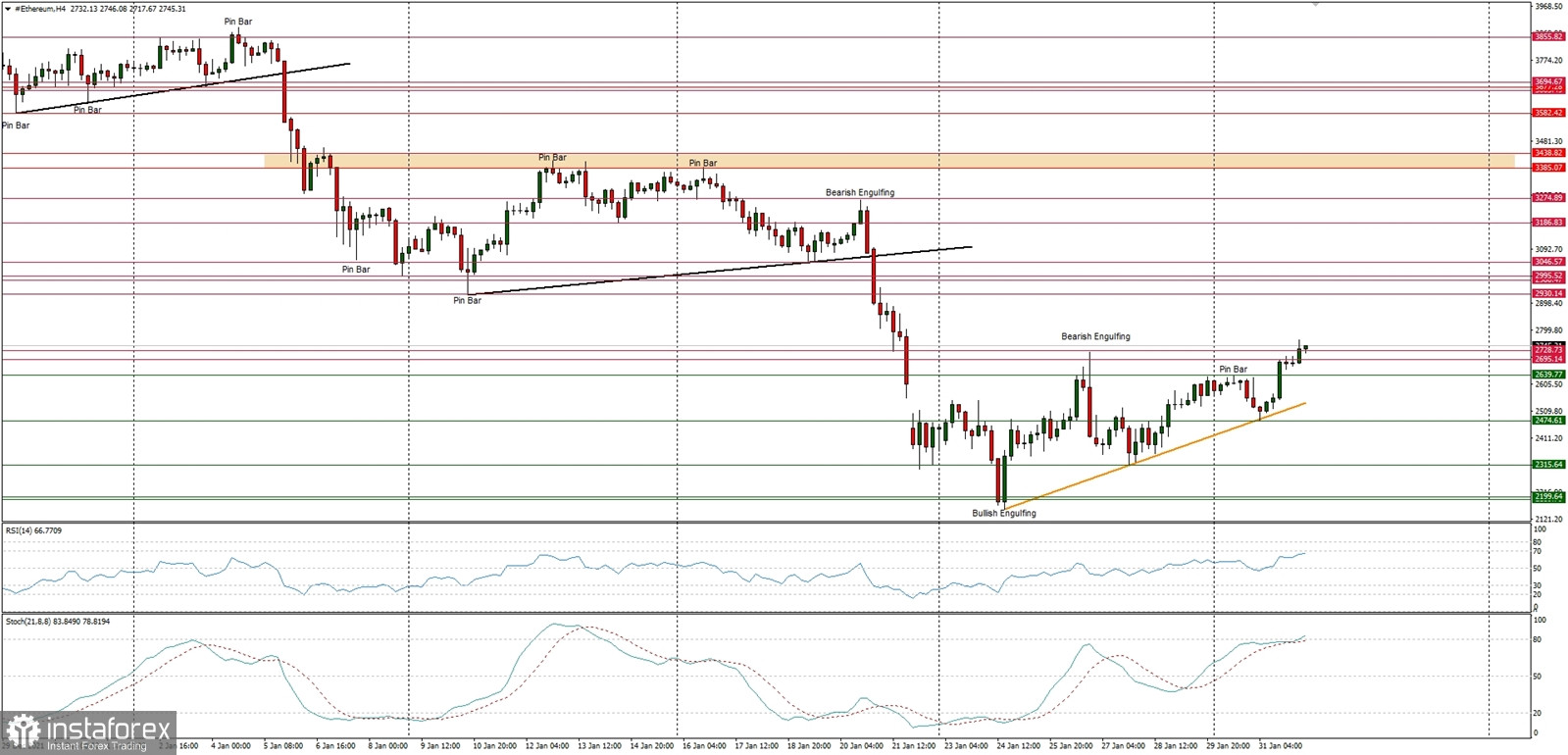

Technical Market Outlook

After the bounce from the short-term trend line support, the ETH/USD pair has broken above the technical resistance seen at the level of $2,728 and is heading higher towards the next target seen at $2,930 and $3,000. However, if the up move is capped and the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. The market conditions are extremely oversold on Daily time frame, so this might help the demand side to bounce higher.

Weekly Pivot Points:

WR3 - $3,405

WR2 - $3,068

WR1 - $2,823

Weekly Pivot - $2,486

WS1 - $2,264

WS2 - $1,931

WS3 - $1,682

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.