The sharp gap in the PMI indices resulted in an unsurprising failure of the buyers of the euro to gain support from major players. And after regaining the resistance level of 1.1695, buyers retreated again in anticipation of new benchmarks.

It has been repeatedly said that the Eurozone is seriously losing and will continue to lose the pace of economic recovery. The summer surge, after the first phase of the coronavirus pandemic, revived the economy and led to its rapid growth against the background of the cuts that occurred from April to June 2020.

However, now that economic activity is slowing down and the growing number of Covid-19 infections is causing alarm, the talks of a rapid recovery of the euro is slowly fading. On the contrary, we are already talking about an escape from risky assets to more conservative and reliable instruments, which also reflects the large drop in gold that has been observed recently.

The technical picture of the EURUSD pair has not changed significantly. The bears missed the resistance of 1.1695, but only to follow the stop orders of speculative players. The pressure on the euro will most likely continue in the near future, and the weak PMI data for the US services and manufacturing sector, which is expected Wednesday afternoon, may cause a new wave of decline in the euro. To resume the bearish trend, sellers need to break through the support of 1.1650, which will open the way to the lows of 1.1590 and 1.1540. If we talk about the probability of an upward correction, then we need to understand that as long as trading is conducted below the level of 1.1735, there will be no prerequisites for a bearish reversal. Only the return of this range will allow us to talk about the recovery of risky assets in the resistance area of 1.

So, what did the purchasing managers' indices of the Eurozone countries bring us?

A sharp reduction in the service sector, or rather its activity, suggests that the fear of contracting coronavirus affects people and their visits to public places, including various types of institutions, from household to entertainment. The tourism business once again plunges, not having time to move away from the reduction during the first wave of the coronavirus pandemic. And this is an important factor that determines activity. Stopping the economic recovery before the second wave of the coronavirus pandemic could be fatal for the European system as a whole. The EU recovery fund alone will clearly not be enough. Countries will start saving themselves alone, changing their monetary and fiscal policies as they see fit. But while we do not want to talk about such a gloomy scenario, in fact, not everything is as bad as they say. The ECB '

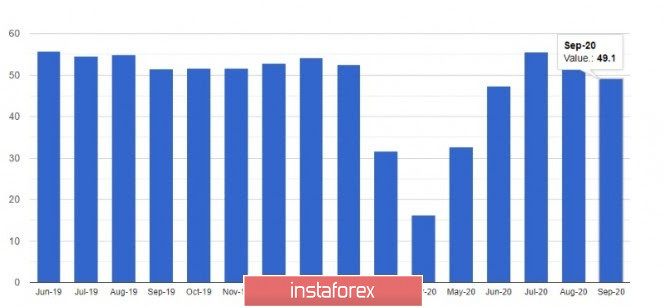

The service sector both in France and Germany suffered the most, where the indices crept into territory below 50 points, thereby indicating a reduction in activity. In Germany, the index of managers for the service sector fell to 49.1 points, and in France, the same indicator fell to 47.5 points. There was also serious weakness in activity in the service sector in the UK and Spain. All this remained in light of the growing cases of COVID-19 cases worldwide.

The increase in the composite index, which hovered one step above the precipice indicating a slowdown, was supported by the activity of the manufacturing sector, which significantly increased, especially in Germany. Given that global trade continued to gain momentum after the lifting of a number of restrictions, this significantly affected the manufacturing sector, pushing for higher activity.

With regard to the overall figures for the euro area, the IHS Markit report indicated that the composite PMI for the euro area in September 2020 fell to 50.1 points from 51.9 points in August. The manufacturing PMI rose to 53.7 from 51.7, while the services PMI dropped to 47.6 from 50.5 in August.

From this, it can be concluded that the return of global economic activity to pre-crisis levels will be difficult and much will depend on the pandemic and the return to growth of the service sector, especially in those countries where it has the greatest weight. This is the UK, Spain, France and Italy respectively.

Another rather interesting report was published on Wednesday, which indicated that German consumer sentiment should stabilize in October after a sharp decline in September this year. At the very least, we managed to avoid a new sharp drop in the indicator. According to leading data from the GfK research group, the German consumer confidence index rose slightly in October 2020 by about 1.6 points, compared to the 1.7 points in September. Economists expected a more active recovery of the indicator in October at the level of -0.5 points.

GBPUSD

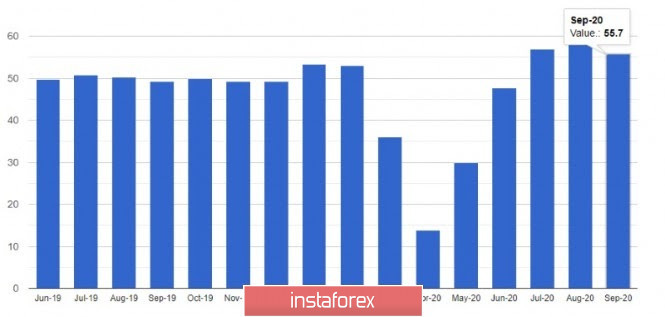

As for reports on business activity in the UK, the released data did not provide serious support to the pound, which only partially reduced losses against the US dollar from monthly lows. The report indicates that the composite index of activity in the service sector and in the manufacturing sector, fell to 55.7 points in September this year against the 59.1 points in August. Initial estimates expected the index to be 56.9 points. Meanwhile, the slowdown in the Eurozone was mainly due to a reduction in the service sector, which is quite important for the UK.

The index for the service sector fell from a high of 58.8 points to 55.1, while the manufacturing sector showed a less active decline to 54.3 points against 55.2 points.

As for the technical picture of the GBPUSD pair, buyers of the pound briefly secured themselves by climbing to the support of 1.2710. However, its breakdown will lead to increased pressure on the pair and a larger decline in the trading instrument already in the area of the lows of 1.2645 and 1.2580. We can talk about minimal prospects for an upward correction in GBPUSD only after fixing above the resistance of 1.2790, which in the future will allow us to count on a larger growth of the pair in the area of the level of 1.2865.