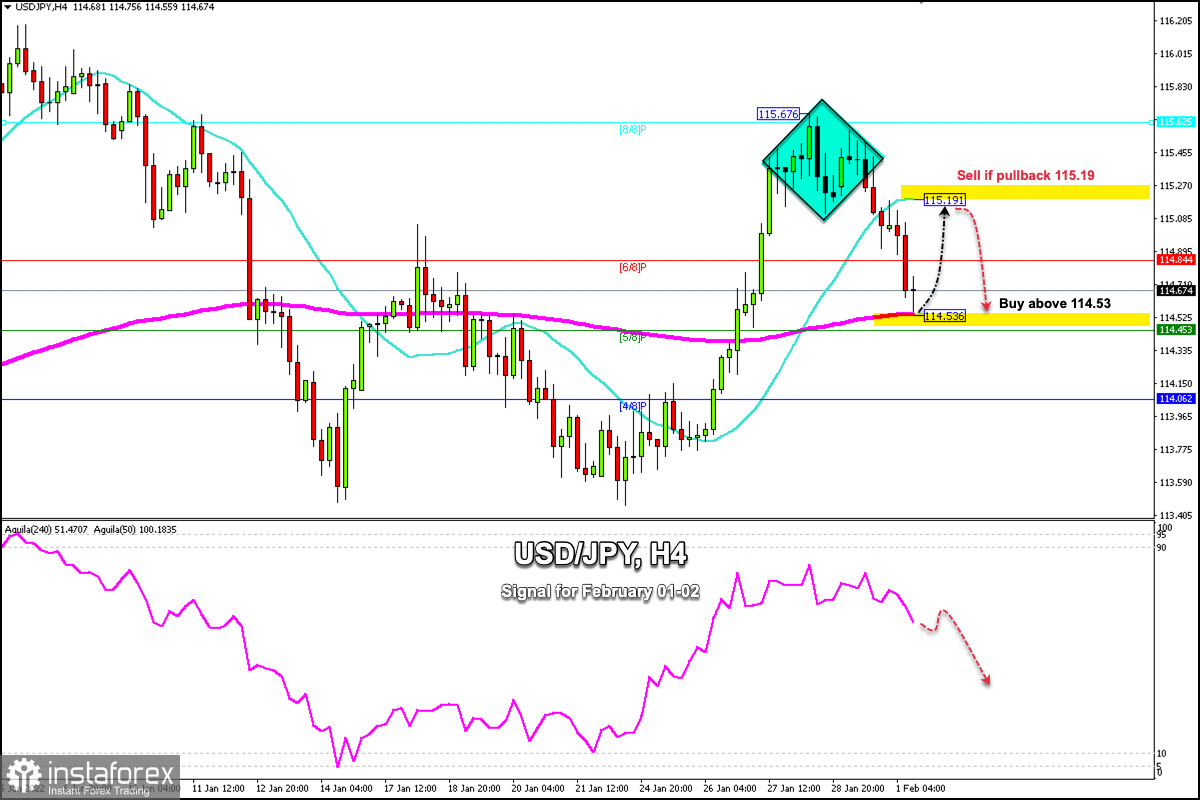

The USD/JPY pair is trading around the zone 200 EMA and below the 21 SMA located at 115.19. On Friday, it peaked at 115.67 but again failed to hold above 115.62 (8/8) and lost momentum.

The 8/8 level acted as strong resistance, which prevented the yen from continuing its upward movement. This is an area of strong resistance that has been a barrier for the yen in the past.

The US dollar opened the week under pressure, correcting lower after the rally as a result of the FOMC meeting. The Japanese yen took advantage of the US dollar's fall. So, the yen strengthened, falling to 114.53 against the greenback.

Yesterday in our analysis, we pointed out the bearish potential of the diamond pattern, you can review this strategy here.

The 200 EMA located at 114.53 has become strong support for the yen. If it consolidates above this level in the coming hours, a technical bounce towards the 21 SMA around 115.19 is expected.

On the other hand, a daily close below the 200 EMA and below 5/8 Murray will cause a bearish move that could occur towards the area 114.06 and until the low of January 24, at 113.46.

The eagle indicator has a bearish bias and any correction in the yen is likely to be viewed as an opportunity to continue selling. A pullback towards 115.19 will be an opportunity to sell with targets at 114.53 (200 EMA) and up to 114.06 (4/8).

Our trading plan for the next few hours is to buy above the 200 EMA and sell below the 21 SMA. We believe that this zone will be the range where USD/JPY will trade until the release of the US non-farm payroll data on Friday.