Outlook on September 24:

Analytical overview of major pairs on the H1 scale:

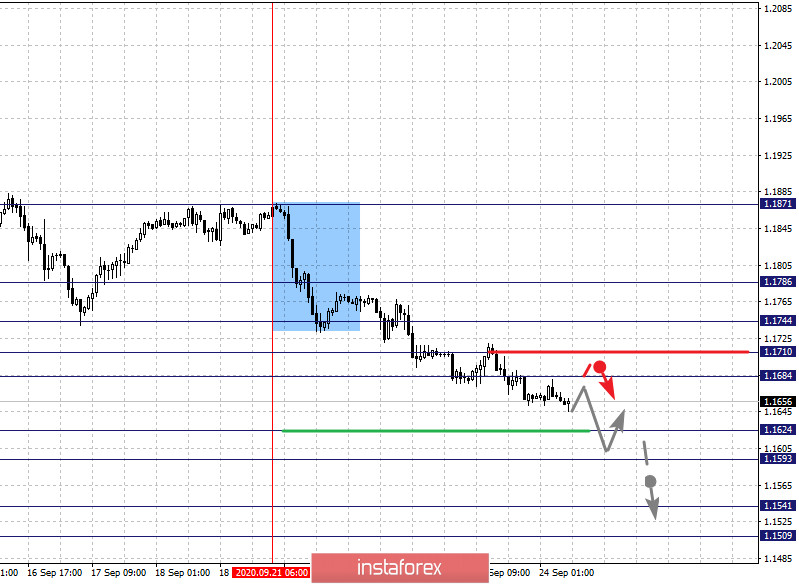

The key levels for the euro/dollar pair on the H1 chart are 1.1786, 1.1744, 1.1710, 1.1684, 1.1624, 1.1593, 1.1541 and 1.1509. We are following the descending structure from September 21 here. A short-term downward movement is expected in the range of 1.1624 - 1.1593. Now, if the last level breaks down, it will lead to a strong decline. The next target will be 1.1541. For the potential value for the bottom, we consider the level 1.1509. Upon reaching which, we expect consolidation and upward pullback.

A short-term upward movement is possibly in the range of 1.1710 - 1.1684. In case of breakdown of the last value, it will lead to a deep correction. The target here is 1.1744, which is the key support level for a downward structure and its breakdown will be conducive to the formation of initial conditions for an upward cycle. In this case, the potential target is 1.1786.

The main trend is the descending structure from September 21

Trading recommendations:

Buy: 1.1684 Take profit: 1.1710

Buy: 1.1712 Take profit: 1.1744

Sell: 1.1623 Take profit: 1.1594

Sell: 1.1592 Take profit: 1.1541

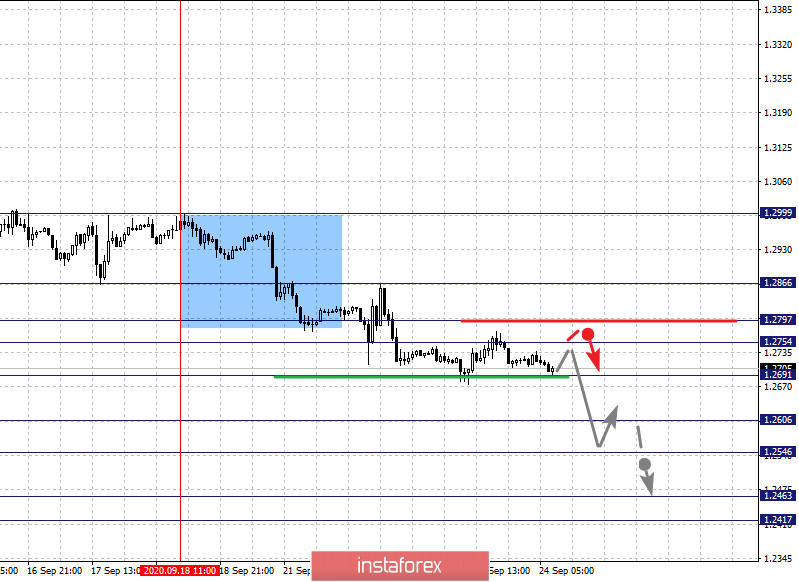

The key levels for the pound/dollar pair are 1.2866, 1.2797, 1.2754, 1.2691, 1.2606, 1.2546, 1.2463 and 1.2417. Here, we are following the development of the descending structure from September 18. Moreover, the downward movement is expected to continue after breaking through the level of 1.2690. In this case, the target is 1.2606. On the other hand, there is a short-term downward movement, as well as consolidation in the range of 1.2606 - 1.2546. If the last value breaks down, it will lead to a strong decline. Our next target will be 1.2463. For the potential value for the bottom, we have the level of 1.2417. Upon reaching which, we expect consolidation and upward pullback.

A short-term upward movement is expected in the range of 1.2754 - 1.2797. If the last value breaks down, it will lead to a deep correction. The next target is 1.2866, which is the key support for the downward structure.

The main trend is the descending structure from September 18

Trading recommendations:

Buy: 1.2754 Take profit: 1.2796

Buy: 1.2798 Take profit: 1.2866

Sell: 1.2689 Take profit: 1.2607

Sell: 1.2605 Take profit: 1.2547

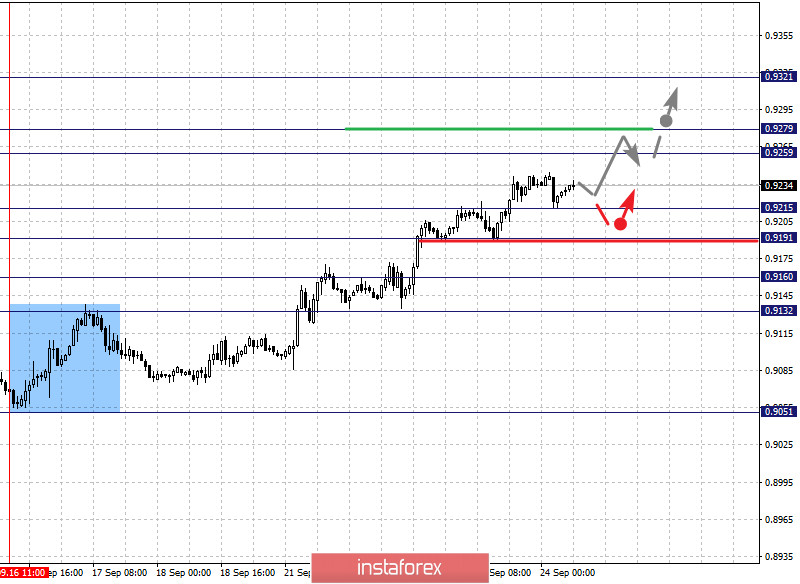

The key levels for the dollar/franc pair are 0.9321, 0.9279, 0.9259, 0.9215, 0.9191, 0.9160 and 0.9132. We are following the upward structure from September 16 here. Now, a short-term upward movement is expected in the range of 0.9259 - 0.9279. The breakdown of the last value will allow us to count on a movement to a potential target of 0.9321. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 0.9215 - 0.9191. If the last value breaks down, it will lead to a deep correction. Here, the target is 0.9160, which is the key support for the top and the price passing this level will cancel the formation of initial conditions for a downward cycle. The first potential target here is 0.9132.

The main trend is the upward cycle of September 16

Trading recommendations:

Buy : 0.9259 Take profit: 0.9279

Buy : 0.9281 Take profit: 0.9320

Sell: 0.9215 Take profit: 0.9192

Sell: 0.9189 Take profit: 0.9160

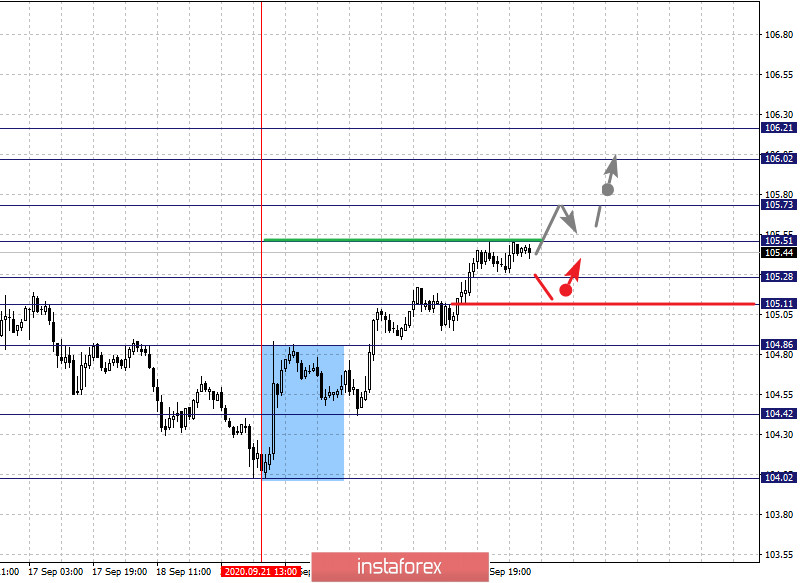

The key levels for the dollar/yen are 106.21, 106.02, 105.73, 105.51, 105.28, 105.11 and 104.86. We are following the development of the downward pattern from September 21. Moreover, a short-term upward movement is expected in the range of 105.51 - 105.73. If the last value breaks down, it will lead to a strong growth. Here, the target is 106.02. We consider the level 106.21 as a potential value for the top. Upon reaching which, we expect consolidation and downward pullback.

A short-term downward movement is expected in the range of 105.28 - 105.11. In case that the last value breaks down, it will lead to a deep correction. The target is 104.86, which is a key support for the upward structure.

The main trend is the upward structure from September 21

Trading recommendations:

Buy: 105.52 Take profit: 105.71

Buy : 105.75 Take profit: 106.02

Sell: 105.28 Take profit: 105.12

Sell: 105.08 Take profit: 104.86

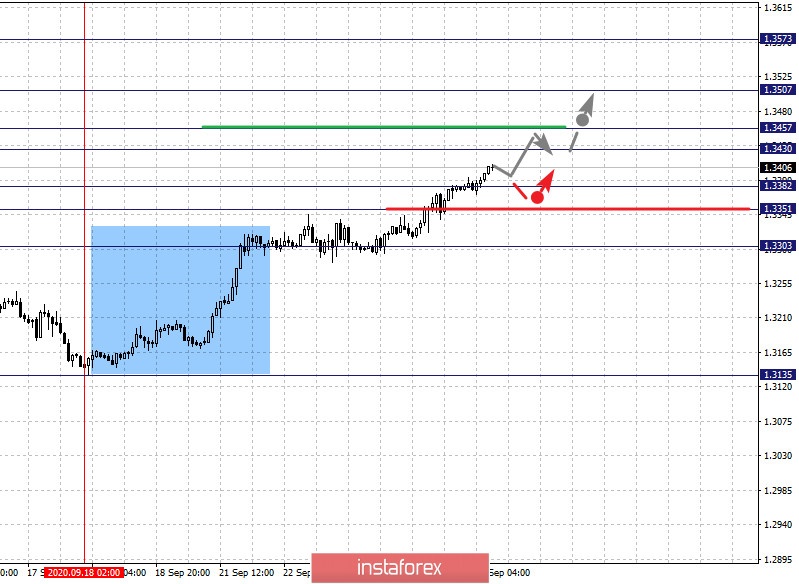

The key levels for the USD/CAD pair are 1.3573, 1.3507, 1.3457, 1.3430, 1.3382, 1.3351 and 1.3303. Here, we consider the upward structure of September 18 as medium-term. The upward movement is expected to continue after the price passes the noise range 1.3430 - 1.3457. In this case, the target is 1.3507 and there is consolidation near this level. On the other hand, we consider the level 1.3573 as a potential value for the top. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 1.3382 - 1.3351. If the last value breaks down, it will lead to a deep correction. The target is 1.3303, which is a key support for the main trend.

The main trend is the local upward structure of September 18

Trading recommendations:

Buy: 1.3457 Take profit: 1.3507

Buy : 1.3509 Take profit: 1.3573

Sell: 1.3382 Take profit: 1.3351

Sell: 1.3349 Take profit: 1.3305

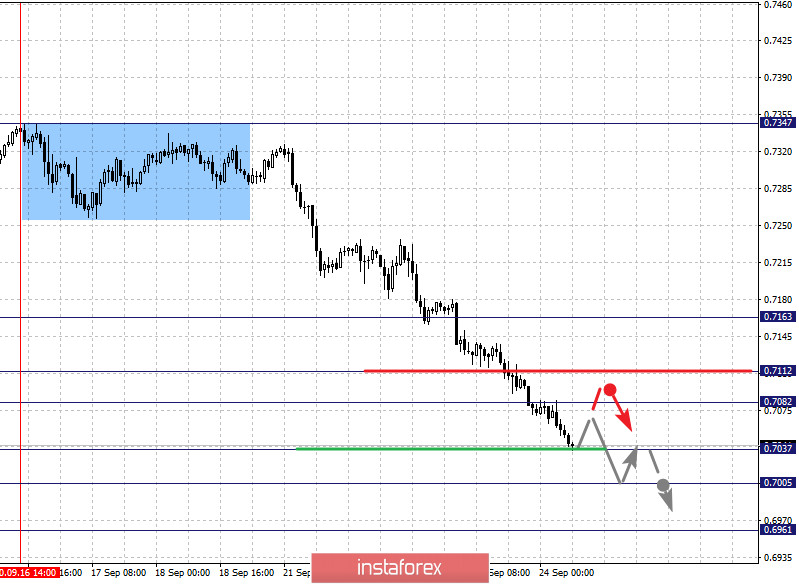

The key levels for the AUD/USD pair are 0.7163, 0.7112, 0.7082, 0.7037, 0.7005 and 0.6961. Now, we are following the development of the downward trend cycle from September 16. Here, a short-term downward movement is expected in the range of 0.7037 - 0.7005, breaking through the last value will lead to a movement to a potential target - 0.6961. We expect an upward pullback from this level.

A short-term upward movement is possible in the range of 0.7082 - 0.7112. The breakdown of the last value will lead to a deep correction, which will lead us to the next target of 0.7163.

The main trend is the downward cycle from September 16

Trading recommendations:

Buy: 0.7082 Take profit: 0.7112

Buy: 0.7114 Take profit: 0.7160

Sell : 0.7035 Take profit : 0.7007

Sell: 0.7003 Take profit: 0.6965

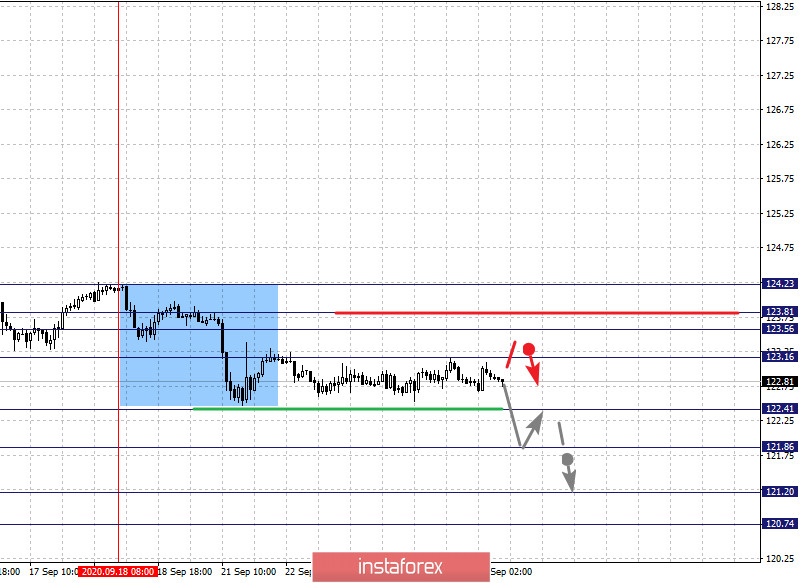

The key levels for the euro/yen pair are 124.23, 123.81, 123.56, 123.16, 122.41, 121.86, 121.20 and 120.74. We are following the local descending structure from September 18 here. So now, decline is expected to continue after breaking through the level of 122.41. In this case, the target is 121.86 and there is consolidation near this level. If the target breaks down, it will lead to a sharp decline. Here, our next target is 121.20. For the potential value for the bottom, we consider the level of 120.74. Upon reaching which, we expect consolidation and upward pullback.

Meanwhile, leaving into a correction is expected after the breakdown of 123.16. The target is 123.56, while the range of 123.56 - 123.81 is the key support for the downward structure. The price passing this range will lead to the development of an upward structure. Here, the first potential target is 124.23.

The main trend is the local descending structure of September 18

Trading recommendations:

Buy: 123.16 Take profit: 123.56

Buy: 123.81 Take profit: 124.23

Sell: 122.40 Take profit: 121.88

Sell: 121.84 Take profit: 121.20

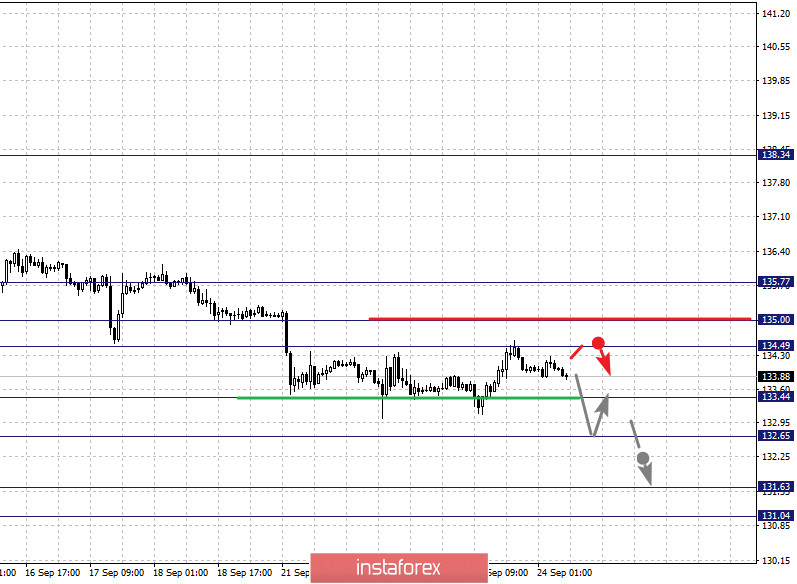

The key levels for the pound/yen pair are 135.77, 135.00, 134.49, 133.44, 132.65, 131.63 and 131.04. Here, we are following the local descending structure from September 10th. A short-term downward movement is expected in the range of 133.44 - 132.65. If the last value breaks down, it will lead to a strong decline The target here is 131.63. For the potential value for the bottom, we consider the level of 131.04. Upon reaching which, we expect an upward pullback.

A short-term upward movement is expected in the range of 134.49 - 135.00 and breaking through the last value will lead to a deep correction. The next target is 135.77, which is the key support for the downward structure.

The main trend is the local descending structure of September 10

Trading recommendations:

Buy: 134.49 Take profit: 135.00

Buy: 135.03 Take profit: 135.75

Sell: 133.44 Take profit: 132.67

Sell: 132.63 Take profit: 131.63