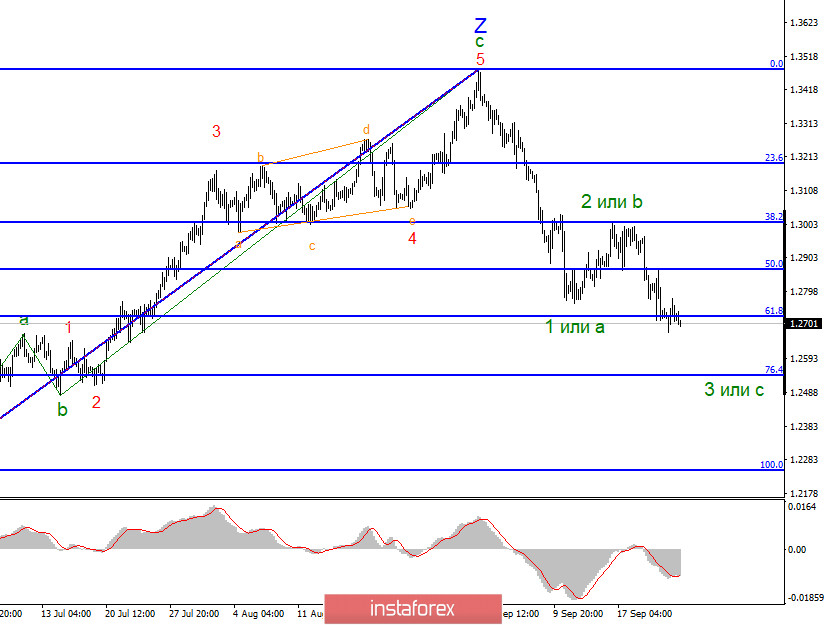

On a large scale, GBP/USD has entered the downtrend phase. The ongoing decline suggests the idea that wave 2 or b is complete within this phase. So, wave 2 looks shorter. Another thought is that the low of the expected wave 1 or a has been broken successfully. This enables a conclusion that the market is poised for further selling the pound sterling. The chart displays clearly that demand for GBP is sharply down in the recent weeks that is caused by a number of reasons.

Yesterday GBP/USD lost a few basis points. Thus, a new section of the downtrend is being built within the expected wave 3 or c. In case the 61.8% fibo is broken, this will prompt the idea that the market is ready for further sell-offs of GBP. The whole descending section of the trend line is going to be long. At present, demand for GBP is near zero.

Over the last few weeks or nearly a month, the market is mulling over the prospects of the UK economy. First, investors got to know that the talks between London and Brussels were in the gridlock. Later, the market found out about the controversial bill proposed by Boris Johnson which admits some breaches of the agreement on Northern Ireland made last year with the EU. This week, investors are absorbing remarks from Bank of England Governor Andrew Bailey. He dropped some hints that the regulator is serious about negative interest rates in the near future. To sum up, GBP lacks fundamentals for growth in September. This is what happened in reality. However, the worst was yet to come. A week ago, Boris Johnson acknowledged the second coronavirus wave in the UK and imposed new restrictions on business. Besides, he called on the Britons to observe lockdown rules and increased fines for their violation.

According to the official data, the daily rate of confirmed COVID-19 cases surged to 5,000 as of September 22. So, if the infection rate goes on soaring, it will exceed those rates recorded at the peak of the pandemic this spring. In this context, analysts warn that the UK economy is facing another daunting challenge. Interestingly, Boris Johnson rejected the idea of total shutdown. However, even some restrictive measures that cannot be avoided amid growing infection rates are enough for the economy to lose momentum. The British economy has not recovered in full after coronavirus shocks in the spring. Brexit is going to come as a double whammy. Thus, the UK is braced for more turbulence in 2021. No wonder, the sterling is facing bleak prospects. The ongoing wave structure which displays a lengthy downtrend confirms this conclusion.

Conclusions and trading tips

GBP/USD is likely to have completed upward wave Z. So, the uptrend is over. At the same time, I suggest the scenario of building correctional wave 2 or b which could have been complete at near 38.2%. The failed attempt to break this level gives traders the opportunity to begin selling the pair with targets at near 1.2721 and 1.2539 that are 61.8% and 76.4% Fibonacci retracement bearing in mind formation of the third wave.