Crypto Industry News:

According to government estimates, Russian citizens reportedly have 16.5 trillion rubles ($ 214 billion) in cryptocurrency.

Russians own around 12% of all global cryptocurrency resources. The cryptocurrency stock estimate was calculated from an analysis of the IP addresses of some of the country's top crypto exchange users along with several other data points, Kremlin-related people said. An analysis of the crypto assets of Russian citizens is carried out to obtain an overview of the cryptocurrency market and formulate new regulations. The proposals have not yet been finalized.

The estimate is believed to be lower given that crypto laws are not yet clear in the country and many users prefer to use anonymous tools to carry out transactions.

The latest estimate for cryptocurrency holdings is a big leap from data released by Anatoly Aksakov, head of the lower house of parliament's financial markets committee in December. According to a media report in December 2021, the Russians owned a crypto worth 5 trillion rubles.

Russia is currently the third largest contributor to Bitcoin mining, and Putin admitted the same, calling for the use of excess energy to mine cryptocurrencies. With the ministry of finance and the president on board, Russia may soon regulate the trading and mining of cryptocurrencies.

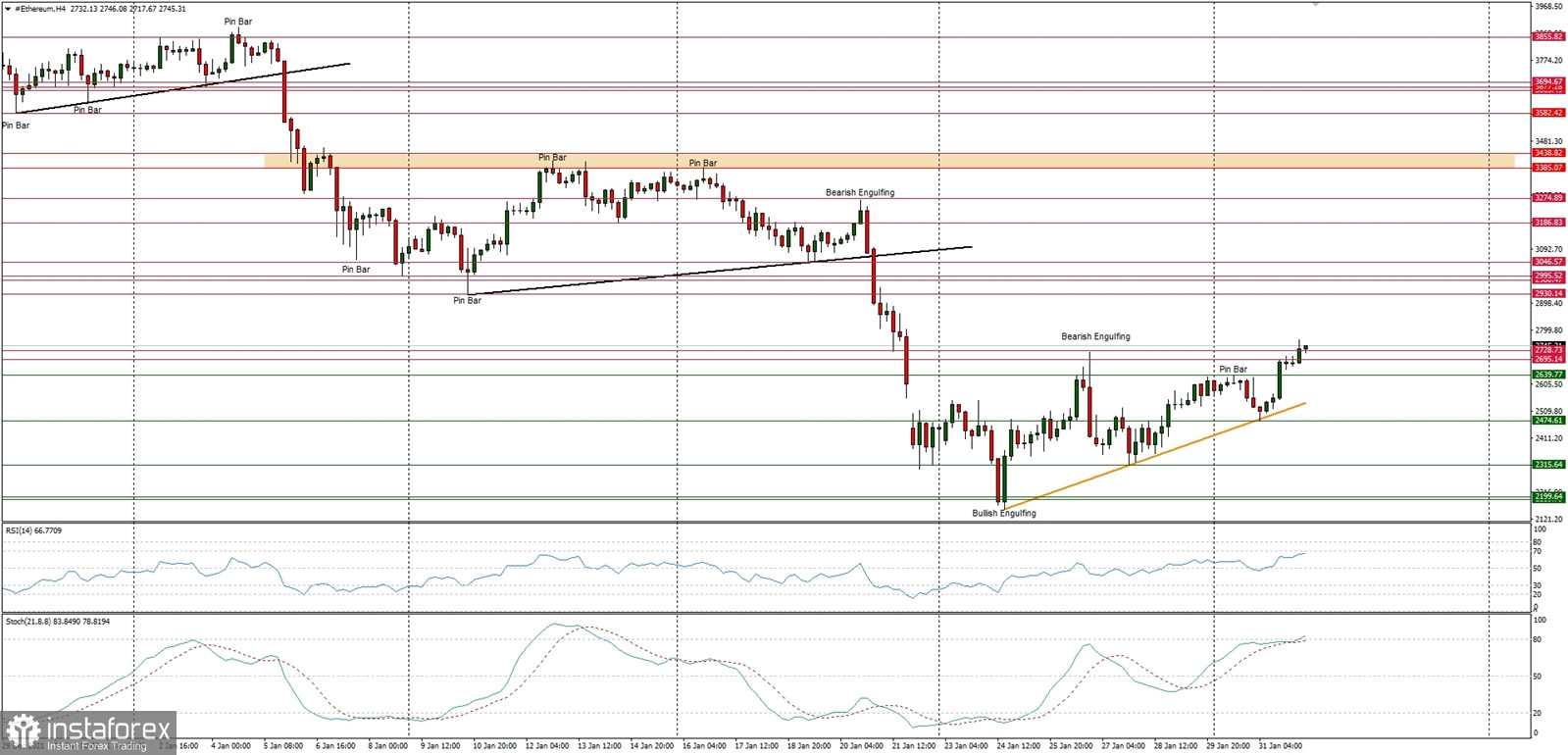

Technical Market Outlook

The ETH/USD pair has broken above the technical resistance seen at the level of $2,728, made a new local high at the level of $2,812 and is heading higher towards the next target seen at $2,930 and $3,000. However, if the up move is capped and the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. The market conditions are extremely oversold on Daily time frame and are slowly moving up, so this might help the bulls to bounce higher.

Weekly Pivot Points:

WR3 - $3,405

WR2 - $3,068

WR1 - $2,823

Weekly Pivot - $2,486

WS1 - $2,264

WS2 - $1,931

WS3 - $1,682

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.