Crypto Industry News:

Bitcoin's main investor - MicroStrategy - announced another big BTC purchase during the market downturn to collect a total of 125,051 BTC by Monday.

According to the official US Securities and Exchange Commission form filed on Tuesday, MicroStrategy bought 660 BTC between December 30, 2021 and January 31, 2022 for "about $ 25 million" in cash.

The average BTC purchase price was $ 37,865 per BTC, including fees and expenses, the report notes. As of January 31, MicroStrategy had approximately $ 3.78 billion in BTC at an average purchase price of approximately $ 30,200 per coin, fees and expenses included.

The latest report comes shortly after the SEC reportedly rejected MicroStrategy's accounting practices for Bitcoin, causing the company's shares to plunge in mid-January.

The latest Bitcoin purchase is clearly not that big compared to the recent purchases made by MicroStrategy. In December 2021, MicroStrategy announced two large BTC purchases, consecutively 1,434 BTC from November 29 to December 9 at an average of $ 57,477 per coin, and then 1,914 BTC from December 9 to 29 at an average of $ 49,229 per coin.

Technical Market Outlook

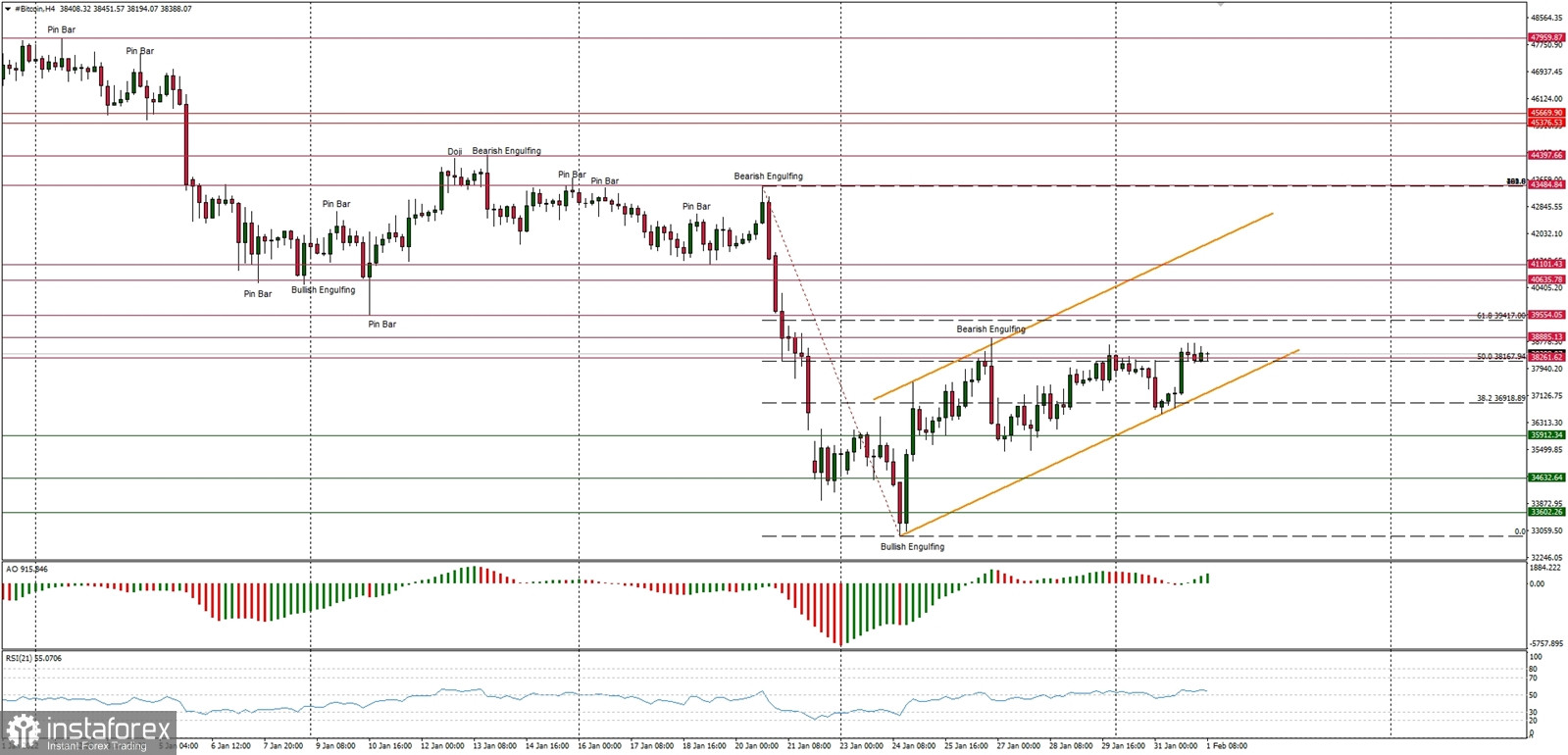

The BTC/USD pair has almost hit the 61% Fibonacci retracement level at $39,417 as the local high was made at $39,239. The up move had ended with a Pin Bar candlestick, so the bears might start a pull-back. The local low was made at the level of $36,710, but the key short-term technical support is seen at $35,912. The market conditions are extremely oversold at daily time-frame chart, but the momentum is still weak and negative. This is not a good situation for bulls as the bears are still in control and might push the price way lower soon. The next technical support is seen at $35,912 and $34,632.

Weekly Pivot Points:

WR3 - $46,518

WR2 - $42,733

WR1 - $40,610

Weekly Pivot - $36,641

WS1 - $34,413

WS2 - $30,618

WS3 - $28,634

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.