European stock indices are rising by 1-3% in the European session, while the euro resumed growth across the entire spectrum of the currency market. However, it is not yet possible to say for sure whether there is a corrective growth, which will end with a new period of sales, or the euro trying to take the lead again amid clear problems in the US economy.

During the months of pandemic hysteria, the US dollar was seen as a safe haven, but even so, its growth was very limited. At the moment, there are strong fundamental changes which are not in favor of the dollar. For the first time since the global financial crisis of 2008-2009, the rate of net national savings in the second quarter of 2020 reached a negative limit, amounting to -1%, while the quarterly drop of 3.9% is the strongest since 1947. The current account deficit is growing rapidly, and in these conditions, the Fed will not leave the markets and focus on targeting inflation. In this case, a lack of liquidity is inevitable, so the dollar is likely to start taking over the lead in the medium term, especially against commodity currencies.

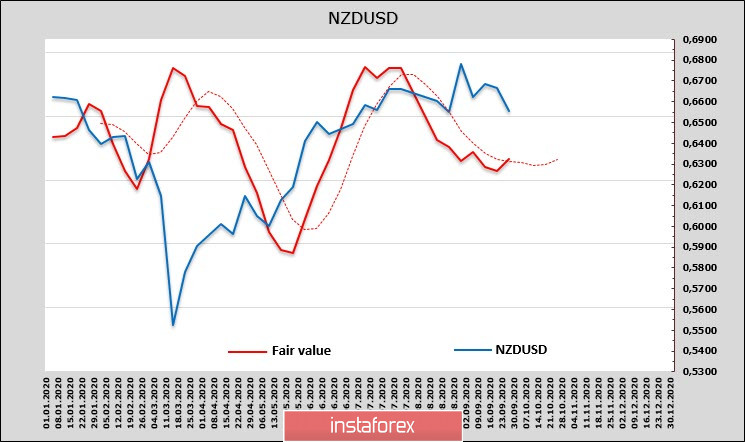

NZD/USD

As expected, the RBNZ left the rate unchanged at 0.25% and the QE program at $100 billion during last week's meeting. Against the background of an obvious slowdown in the recovery of the New Zealand economy, the lack of new support measures could lead to an increase in negative sentiment, and primarily to a decline in inflation expectations. But the results of the meeting were reached neutrally by markets, and there are two clear explanations for this.

First, the RBNZ pointedly follows the strategy adopted in March, which gives investors additional confidence. According to this strategy, the rate cut will occur in April next year, which the RBNZ actually confirmed.

Second, the expected QE will take the form of a "bank financing program for lending", this program is being developed and will be adopted by the end of the year, that is, the economy will not be left without support.

We can make a reasonable conclusion that the RBNZ has no grounds for active extraordinary measures, which will eventually give the NZD additional support.

According to the CFTC report, the position on the NZD remains neutral. The net long position slightly increased again to 0.322 billion after declining last week. In turn, speculators do not adhere to a single direction. The calculated price indicated an upward reversal, which may signal the completion of a corrective decline.

The most likely scenario for the next few days is going into a side range. The support zone is at 0.6490/6510. In case of a decline, buying can be considered with the goal of rising to the resistance zone 0.6770/90.

AUDUSD

The apparent slowdown in the economic recovery after the failure in Q2 has not spared Australia. Exports of goods declined in August compared to July by 2%, imports by 7%, and retail trade fell by 4.2%. As we can see, 3 months of recovery ended with a return to the negative zone.

The AUD net long position remained practically unchanged over the reporting week, amounting to 1.172 billion. The target price almost equaled the spot price, but there is no clear direction.

Technically, the AUD/USD pair is kept in the support zone of 0.7030/60. The growth is only possible if two key factors coincide at once – it will be possible to avoid a liquidity crisis in the US dollar and the general market sentiment will start to lean towards positivity. There is strong uncertainty in both parameters, and the short-term chances of the dollar starting to weaken are low. From here, the most likely scenario looks like this: growth attempts will be blocked in the resistance zone of 0.7100/10, which is a good level for selling. This will be followed by an attempt to test the recent low of 0.7005, which is likely to end in success.