Crypto Industry News:

Ethereum software company ConsenSys acquired the Ethereum MyCrypto interface with the goal of integrating MyCrypto into the MetaMask wallet and improving the security of all products.

MetaMask is an extension that allows you to access distributed applications that support Ethereum or "Dapps" in your web browser.

MetaMask co-founder Dan Finlay said the combination of the MetaMask mobile app and browser extension with the web product and MyCrypto desktop application "will connect people to the world of Web3 in more ways."

The tremendous opportunities of the NFT metaverse are changing the situation for Metamask, a wallet service provider. The company announced that it has surpassed 10 million monthly active users (MAUs), placing it among the most active wallets used in the digital currency ecosystem. ConsenSys noted that the MyCrypto team's experience in building smart contract integrations will make those in MetaMask richer.

In November, ConsenSys, the blockchain startup behind the Metamask portfolio, raised $ 200 million in a new funding round, boosting its valuation to $ 3.2 billion.

Technical Market Outlook

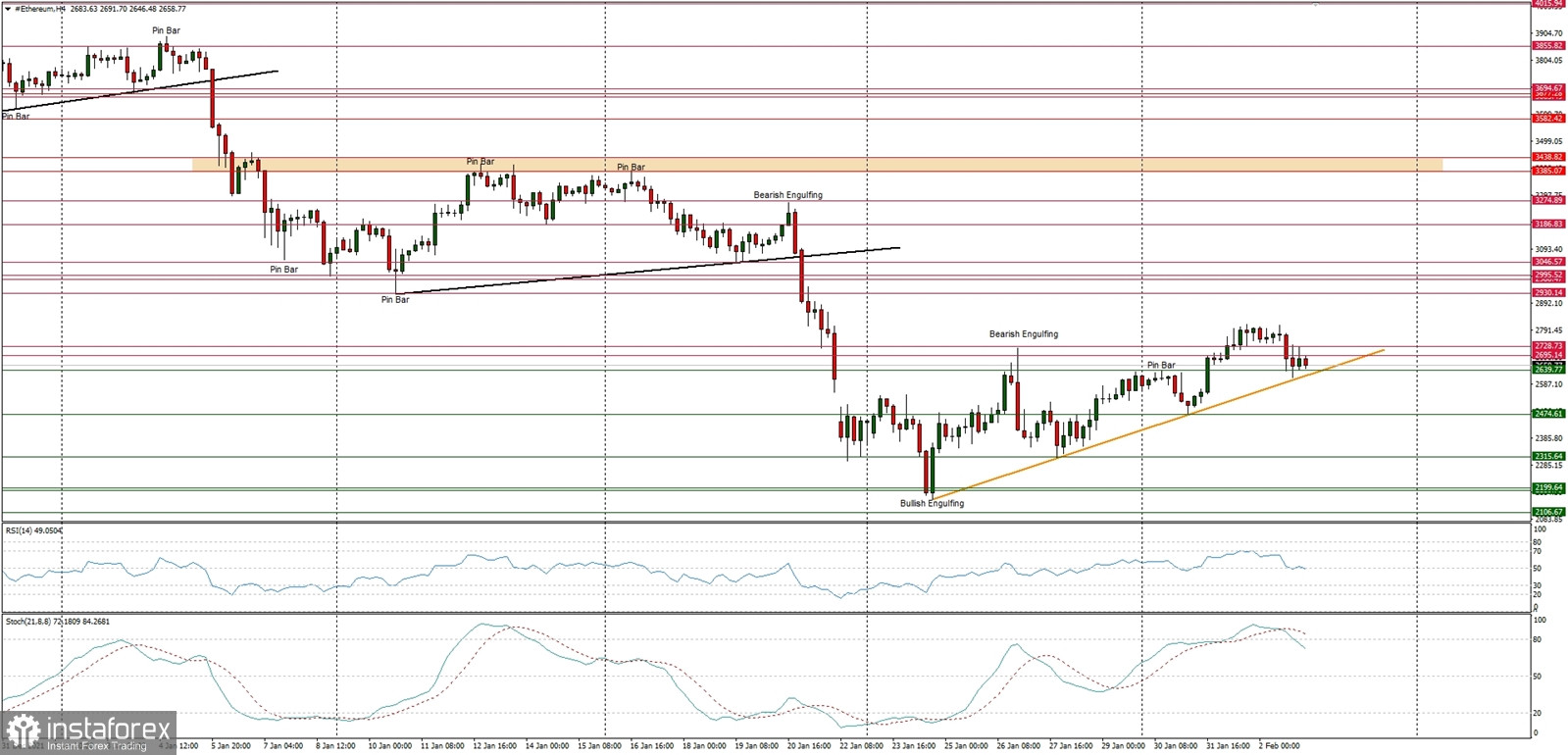

The ETH/USD pair has made a new local high at the level of $2,812 and is heading higher towards the next target seen at $2,930 and $3,000. So fat the bulls has manage to keep the market above the trend line support, however, if the up move is capped and the down move would resume, then the next target for bears is seen at the level of $2,190, $2,000, $1,941 and $1,731 - this is the line in sand before a collapse under the $1,000 level. The market conditions are extremely oversold on Daily time frame and are slowly moving up, so this might help the bulls to bounce higher.

Weekly Pivot Points:

WR3 - $3,405

WR2 - $3,068

WR1 - $2,823

Weekly Pivot - $2,486

WS1 - $2,264

WS2 - $1,931

WS3 - $1,682

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $3k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $4,868 and the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term retracement level for bulls.