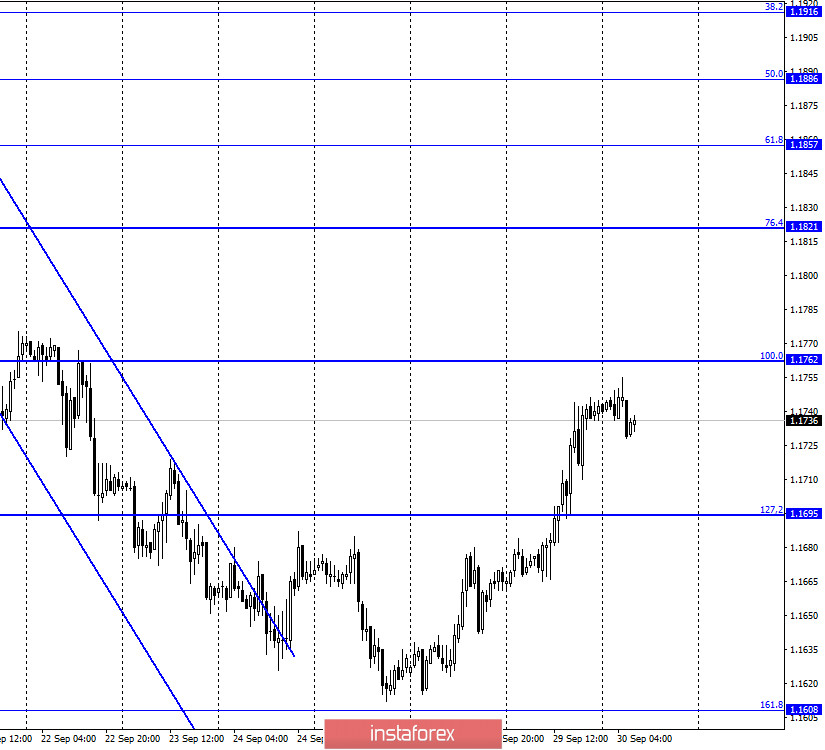

EUR/USD – 1H.

On September 29, the EUR/USD pair continued the growth process in the direction of the corrective level of 100.0% (1.1762). The rebound of quotes from this Fibo level will work in favor of the US currency and start falling in the direction of the corrective level of 127.2% (1.1695). Fixing the pair's rate above this level will increase the probability of further growth towards the level of 76.4% (1.1821). A lot of attention from traders and analysts was paid yesterday to the televised debate between Donald Trump and Joseph Biden. As we can see, the graphic picture of the pair did not change much after this "important" event. To be honest, I don't understand why so much attention was paid to this event, since this is a common practice before any presidential election. Yes, it can affect the political ratings of both opponents, however, it is unlikely to be much. Moreover, it is clear to everyone that both candidates, whoever they are, will say something that can at least theoretically increase their popularity among the electorate. They will talk and behave in a way that will increase their ratings and lower the ratings of the enemy. The ratings of Trump and Biden have not changed recently, the gap is still about 10%. At the debate, each of the presidential candidates answered 6 questions that are most interesting to the American nation right now, however, the answers to these questions remained in the shadow of personal exchanges and altercations between Trump and Biden on the air. Both candidates did not hesitate to insult each other without giving any really important information.

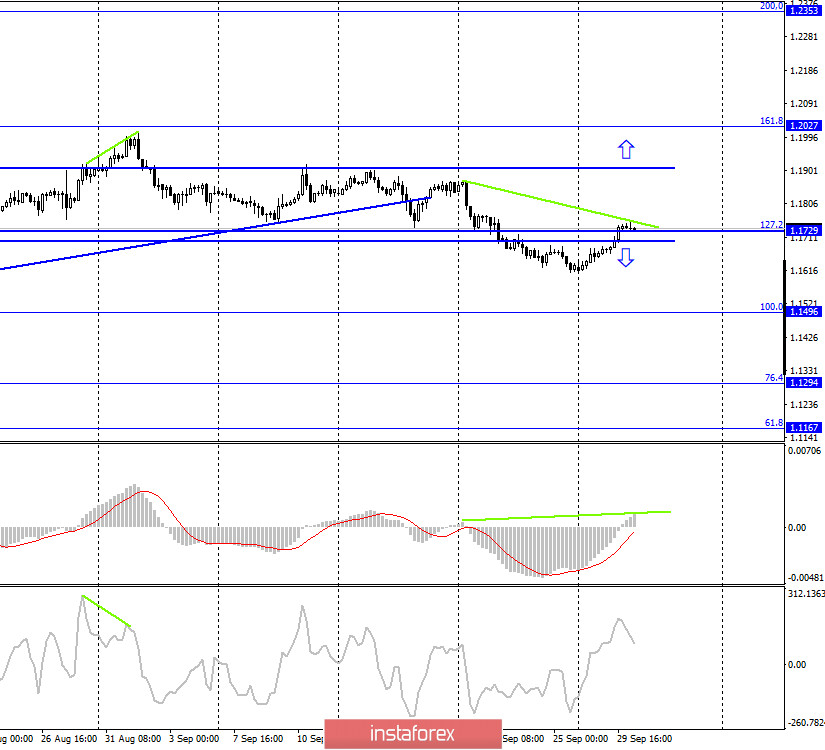

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair have consolidated above the corrective level of 127.2% (1.1729), which now allows us to count on continued growth in the direction of the upper border of the side corridor, from which it left a few days ago. However, the bearish divergence of the MACD indicator also allows us to expect a reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the EUR/USD pair performed a sharp reversal in favor of the EU currency and began the process of returning to the weak level of 261.8% (1.1825). However, a drop in prices still looks more likely.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On September 29, there were no important economic reports. The pair continued to trade quite calmly.

News calendar for the US and the EU:

EU - ECB President Christine Lagarde will deliver a speech (07:30 GMT).

US - change in the number of employees from ADP (12:15 GMT).

US - change in GDP for the quarter (12:30 GMT).

On September 30, the calendar of economic events contains a speech by the ECB Chairman and two rather important reports in America. Each one can trigger a reaction from traders.

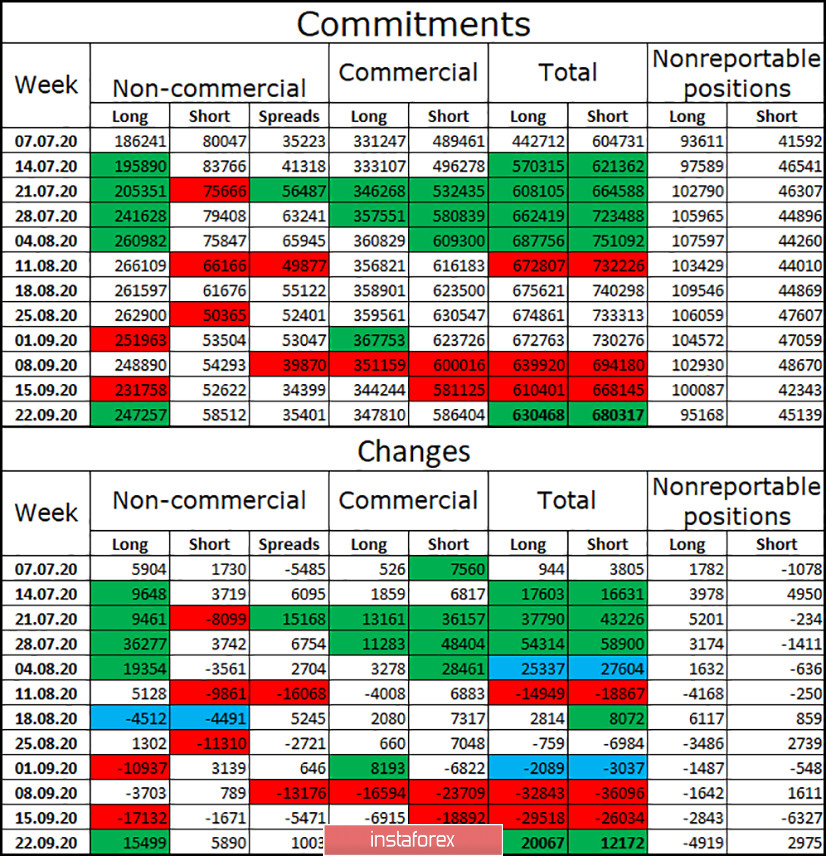

COT (Commitments of Traders) report:

The latest COT report was again very interesting. A week earlier, it turned out that the "Non-Commercial" group was actively getting rid of long-term contracts for the euro currency. This week, the COT report showed that speculators were again actively increasing long-contracts for the euro. There were 15,499 of them open. This group of traders also opened short contracts in the amount of 5,890. A week earlier, I concluded that the mood of traders is changing in the direction of "bearish", however, the new COT report showed that it is again becoming "bullish". This means that the pair's fall may end in the near future. Moreover, there are five times more long contracts than short contracts in the hands of speculators. This means that professional traders are counting on the new growth of the European currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1608, if a close is made under the level of 127.2% (1.1729) on the 4-hour chart and bearish divergence is formed. I recommend buying the pair today if it closes above the level of 100.0% (1.1762) with the target level of 76.4% (1.1821).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.