The debate between Donald Trump and Joe Biden did not allow gold to rise above $ 1,900 an ounce. A Democrat victory would strengthen its position in the race for the presidency and lead to a weakening of the US dollar. It was difficult to give preference to any of the candidates, as the dialogue turned into a mixture of constant interruptions of opponents, sarcasm, and even insults. The degree of uncertainty did not decrease at all, and the US currency perked up.

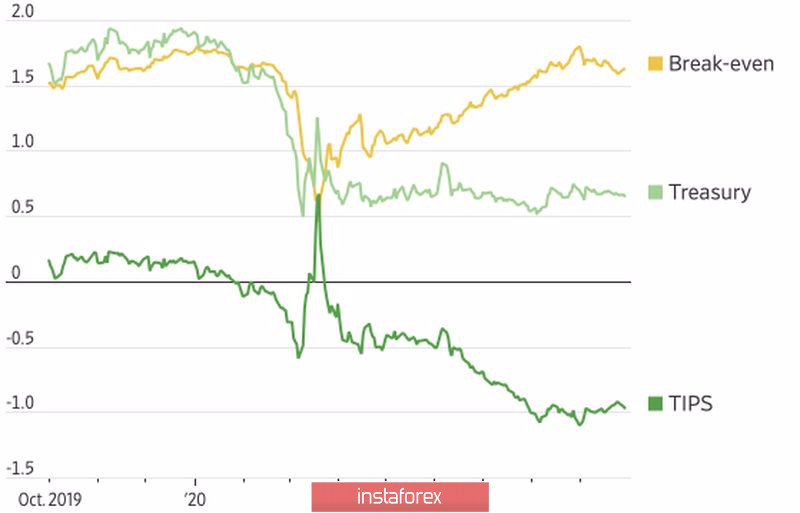

Although gold is one of the most effective tools for investment in 2020, September is likely to be the worst month for it in almost four years. Blame it on the rising US dollar and lower inflation expectations. They are measured using the break-even rate – the difference in the yield of Treasury bonds and inflation-protected bonds (TIPS). The precious metal is traditionally perceived as a hedging tool for risks associated with rising consumer prices, thus, this kind of change in the US debt market situation suggests an unfavorable background for it.

Trends in the debt market of the USA

In my opinion, the decline in inflation expectations is a direct consequence of the strengthening of the US dollar and the inability of Democrats and Republicans to find common ground on expanding fiscal stimulus. The new project is $ 2.2 trillion less than the previous one, however, Steve Mnuchin previously said that the White House is ready to go for only $ 1.5 trillion. At the same time, Donald Trump intends to promote a compromise, and the fact that Congress will be re-elected in 5 weeks increases the likelihood of reaching an agreement. It is unlikely that any lawmakers will want to be accused of refusing to approve additional aid for tactical partisan-political reasons.

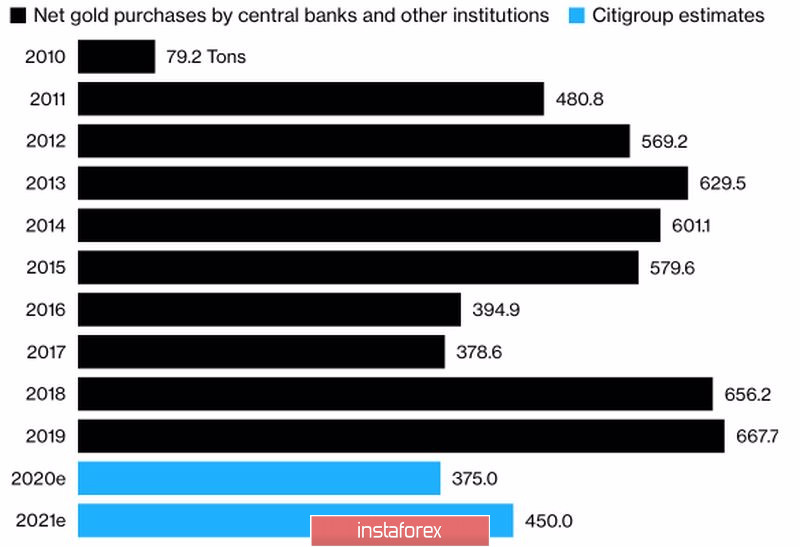

The expansion of the fiscal stimulus will increase the break-even rate, which is a bullish factor for XAU/USD. Support for gold in the medium and long term can be provided by an increase in the activity of central banks in the field of purchases of physical metal. Citigroup estimates that in 2021 this figure will grow from the current 375 tons to 450 tons. China and Russia, which has taken the path of de-dollarization, will actively acquire the precious metal.

Dynamics of gold purchases by central banks

In my opinion, gold may return to growth. As history shows, it takes time after a recession to reach historical highs. The 2011 peak occurred two years after the 2008-2009 crisis. Yes, its nature in 2020 is different from the previous one, however, the Fed preferred to act ahead of the curve and spread rumors about tightening monetary policy at the slightest sign of inflation rising to 2%. Currently, the Central Bank will not do this. It is unlikely that we will see an increase in the federal funds rate before 2023-2024.

I recommend keeping the gold longs formed from the level of $ 1860 per ounce and increasing them on the breakout of the $ 1905 and $ 1930 resistances. The stop order should be moved to the break-even point. A drop in quotes to $ 1840 will allow you to buy an asset cheaper.

Gold, the daily chart