The dollar came under severe pressure yesterday and was losing ground against all major currencies. At the same time, all this happened after all of yesterday's data were released, which were simply ignored. And it's all about the increased concern of investors about the sustainability of the US economic recovery. This process is under serious threat. Congress still cannot accept at least some sort of plan to support the economy; several large companies have already officially announced that they are planning massive cuts. And we are talking about tens of thousands of jobs. Considering that this applies to the largest companies, it is natural that their subcontractors would also lay off staff. In other words, the coming layoffs will affect hundreds of thousands of people. This means that the observed recovery of the labor market may be only a temporary phenomenon. Of course, all large companies that have announced future cuts argue that it is necessary to take measures of state support for the economy.

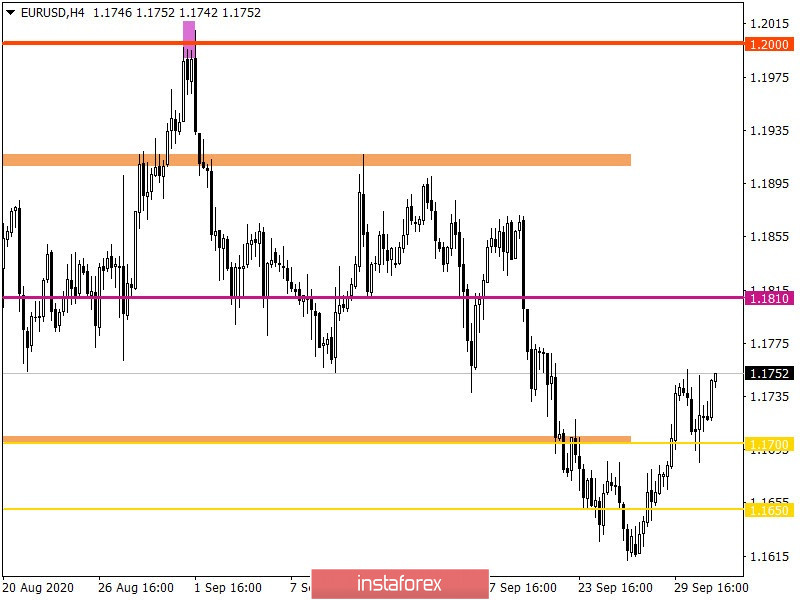

At the same time, US data came out slightly better than forecasts. Thus, the final data on GDP for the second quarter showed that the economy is not decreasing by -9.1%, but by -9.0%. The economy grew by 0.3% in the first quarter. Nevertheless, the decline was slightly less than predicted. Moreover, according to the ADP report, employment increased by 749,000. And this despite the fact that growth was predicted to reach 610,000. So in reality, everything turned out to be much better than expected. However, in the light of statements made by a number of major employers, changes in employment are no longer as interesting.

GDP Change (United States):

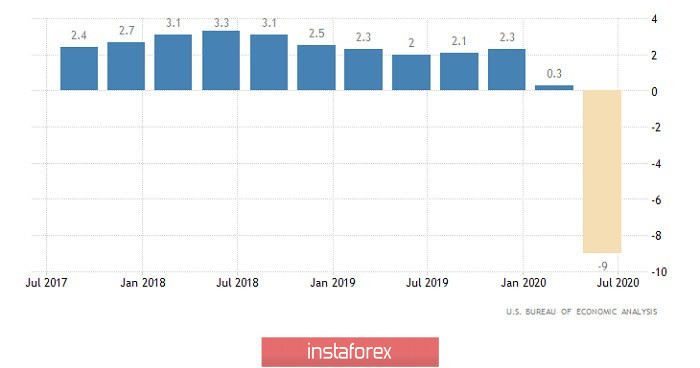

Apparently, macroeconomic data will still be ignored. At least until tomorrow's release of the United States Department of Labor report. Therefore, the expected rise in the unemployment rate from 7.9% to 8.2% in Europe will also be ignored. Although the negative nature of these data will be offset by a slowdown in the decline in producer prices from -3.3% to -2.6%.

Unemployment rate (Europe):

The data on claims for unemployment benefits in the United States will likely go unnoticed. Whatever one may say, but their significance is much less than the changes in employment. Moreover, in the light of the plans of the largest employers, the decrease in the number of applications for benefits looks like a temporary phenomenon. Nevertheless, the number of initial applications may decrease from 870,000 to 855,000. Expectations for the number of repeated requests from 12,580,000 to 12,300,000.

Repetitive Unemployment Insurance Claims (United States):

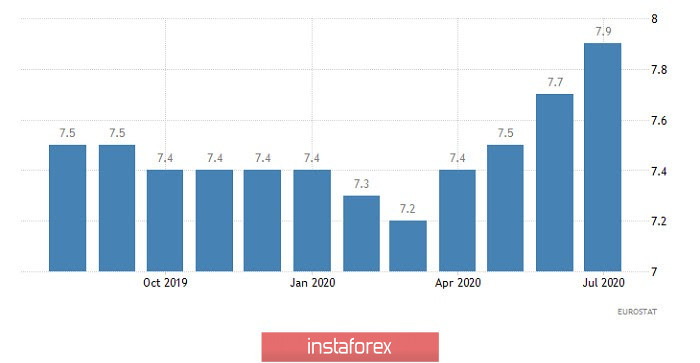

The euro/dollar pair is in a correctional phase from a local low of 1.1612, as a result of which market participants managed to reach a variable resistance level of 1.1755, where the quote is currently moving.

If we proceed from the quote's current location, then we can see an attempt to break through the 1.1755 level, but there were no clear fixations of the price beyond its borders.

High activity is recorded with regard to market dynamics, where the ratio of speculative transactions continues to grow.

Considering the trading chart in general terms (daily period), we can see a corrective move relative to the decline of 1.2010 ---> 1.1612, where the quote once again returned to the boundaries of the previously passed horizontal channel.

We can assume that if the price settles higher than 1.1755 in a four-hour period, then we can not exclude that a correctional course will subsequently form in the direction of 1.1800. Otherwise, we expect an alternating fluctuation in the range of 1.1710/1.1755.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on the minute and hour periods signal a buy due to the price concentration within the 1.1755 level. The daily period, as before, signals a sell, reflecting the scale of the September decline.