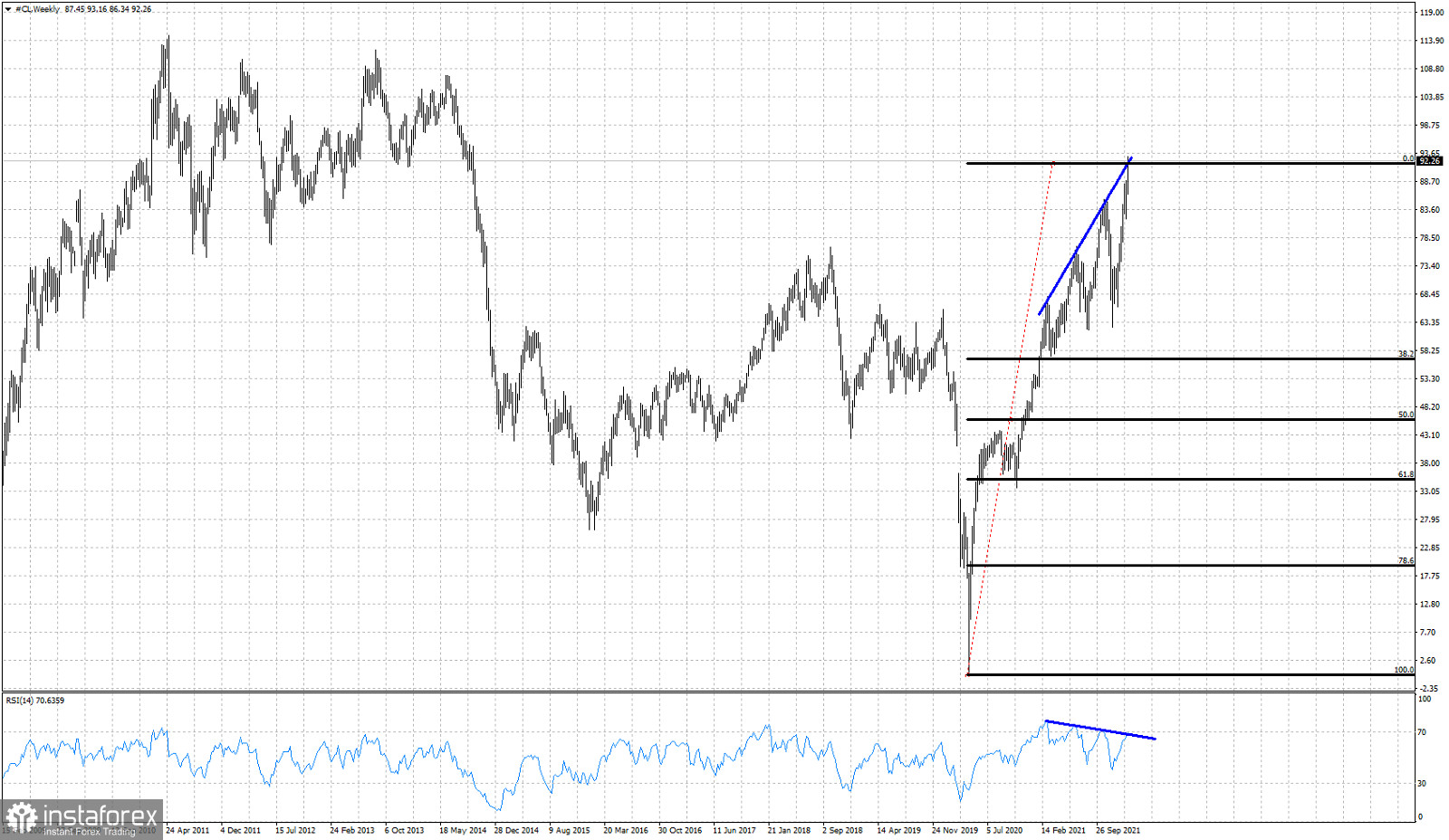

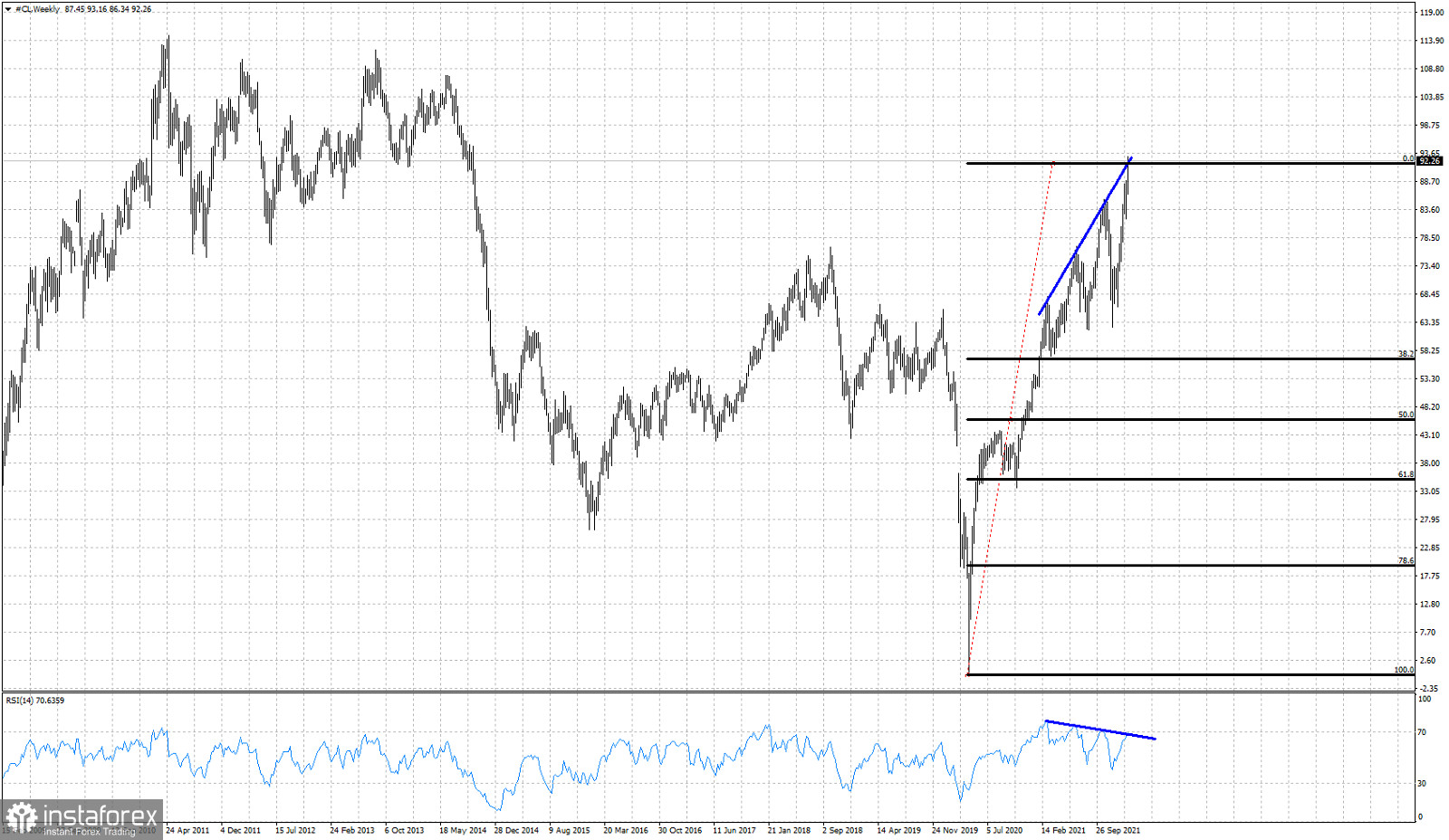

In short no. I believe Oil prices are at their final stages of advance. Traders should be looking to take profits and protect their gains, as we believe it is a matter of time before a major reversal unfolds and Oil is back below $80.

Blue lines - bearish divergence

Black lines- Fibonacci retracement

Oil prices are technically in a bullish trend making higher highs and higher lows. The weekly RSI is providing us with an important warning. The RSI is not following price to new higher highs. This bearish divergence is an important warning that should not be ignored. This divergence is not a sell or reversal signal. Only a warning.

Using the Elliott wave analysis, we see that Oil prices are most probably at the 5th and final wave of the impulse that started at the beginning of December just above $60. The 5th could very well be over or it might have some room to the upside to go. The point however is that we are close to the end of this impulse wave structure. A pull back towards $80 is our minimum expectation. The Elliott wave theory does not give buy or sell signals. The strategy is formed according to each traders risk tolerance. The message I want to convey is that bulls need to be extra cautious. Everyone is talking about reaching $100 round price level. Is it worth the risk after such a rise? I don't believe so.