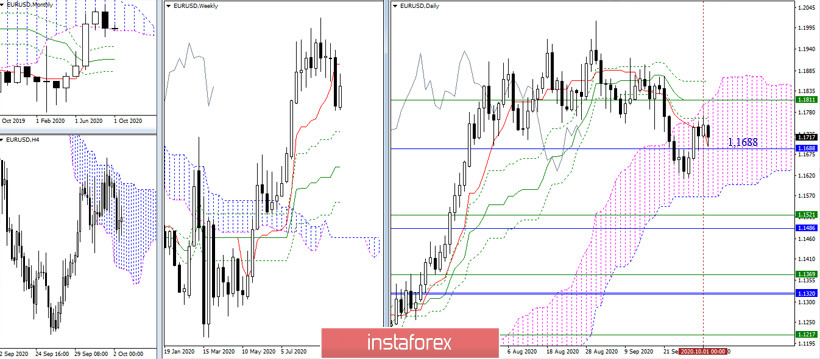

EUR / USD

We are near the end of a new trading week. In September's closing, the bulls managed to prevent the most optimistic final for the opponent. The support (1.1688) for monthly cloud is relevant again and the pair is in the correction zone. Moreover, further stages of strengthening bullish moods can now be described as follows: elimination of the daily dead cross and restoration of support for the weekly short-term trend (weekly Tenkan 1.1811 + daily Kijun 1.1812 + daily Fibo Kijun 1.1859); recovery of the upward trend (high extremum 1.2011); and rise to the upper limit of the monthly cloud (1.2167).

If the bears manage to break through the support at 1.1688 and restore the trend (1.1612), the result of interaction with a fairly wide support zone of 1.1567 (the lower limit of the daily cloud) - 1.1521 (weekly Fibo Kijun) - 1.1486 (monthly Fibo Kijun) will be important.

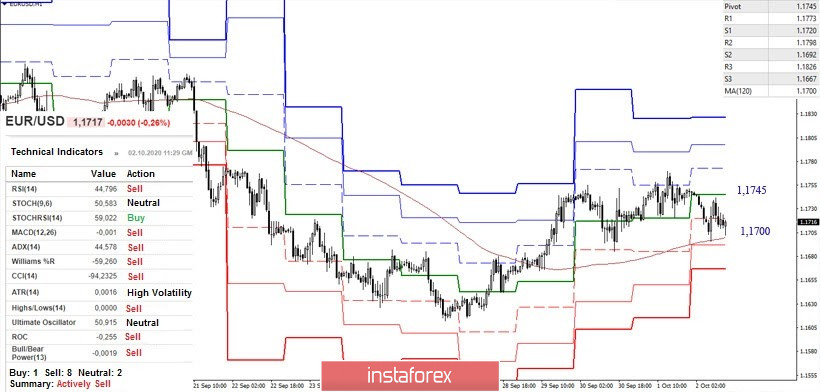

On the other hand, the bulls in the smaller time frames are now fighting for the advantages that they successfully got earlier, but the situation is quite risky. The support of the loss of the weekly short-term trend (1.1700) is now being tested and may swing the scales again in favor of the downward trend. The next task will be to restore the downward trend (1.1612). These H1 prospects are now in unity with the expectations of the upper time frames, and support for the weekly short-term trend (1.1700) is strengthened by the monthly level (1.1688). If the bulls manage to keep what they have achieved and regain the central pivot level (1.1745), then the resistance of the classic pivot levels will be the further upward pivot points (1.1773 - 1.1798 - 1.1826) within the day.

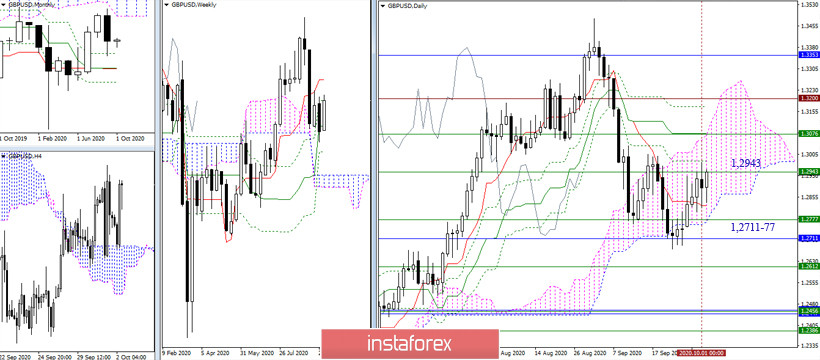

GBP / USD

The pair reached a strong and important support level at 1.2777 (weekly Kijun + lower limit of the daily cloud) - 1.2711 (monthly Fibo Kijun) before September's trading closed. However, reaching this zone did not allow the bulls to consolidate the maximum bearish sentiment in September and so, the sentiment that formed a long lower shadow on the monthly candlestick remains and is likely to be reflected at the current close of the week.

For the bulls, the next important levels are now located at 1.2943 (weekly and daily Fibo Kijun) - 1.3077 (upper limit of the daily cloud + daily Kijun + weekly Tenkan) - 1.32 (historical level + the final line of the day Ichimoku cross). Meanwhile, for the bears, the zone of 1.2777-11 is still very important. The nearest support can be noted at 1.2612 (weekly Fibo Kijun), then the most strengthened and defining zone will wait for the bears in the area of 1.2450, where many strong levels have accumulated from different time frames.

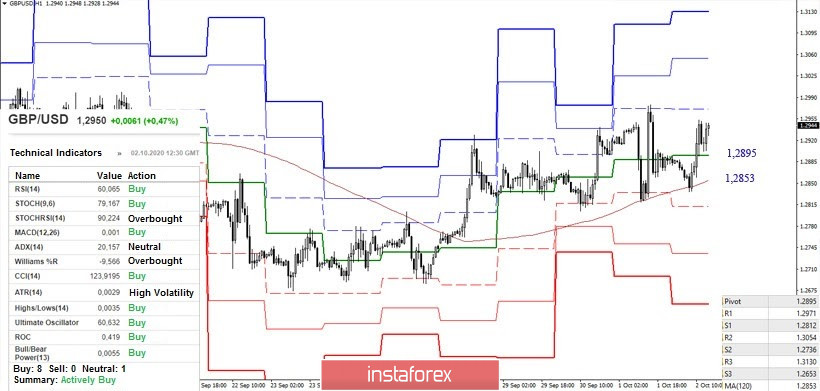

In the smaller time frames, bulls try to defend their current advantages by using the key supports on H1 - the central pivot level (1.2895) and the weekly long-term trend (1.2853). The pivot points for further growth within the day are the resistances of the classic pivot levels 1.2971 - 1.3054 - 1.3130. In case of consolidation below (1.2895-53), the current balance of power will change at H1, and the main task of the bears will be to restore the downward trend (1.2674). Here, the nearest supports are found at (S1) 1.2812 and (S2) 1.2736.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classical), Moving Average (120)