The British pound rose in the market last Friday, due to reports that UK Prime Minister Boris Johnson will hold a meeting with European Commission president Ursula von der Leyen this weekend. Such renewed the hopes that a trade deal may be signed between the two countries after Brexit.

According to reports, both parties agreed to provide one more month for negotiations on the post-Brexit trade agreement, with President von der Leyen saying that sufficient progress has been achieved at present, and all that is needed is the last impetus to conclude a trade deal. Most likely, granting one more month will postpone the EU's appeal to the court, which was centered on the controversial internal market bill submitted by the UK.

Although this decision does not necessarily point to a conclusion of a deal, it was not entirely useless, as both sides demonstrated their determination to find a "common language". In a joint statement, both Johnson and von der Leyen highlighted the importance of finding a compromise, if at all possible, to build a solid foundation for a strategic relationship between the EU and the UK in the future.

In that regard, demand for the British pound rose actively in the market, but it is still not strong enough to go beyond the weekly high. Nevertheless, the pound returned to a quote of 1.2975, around which the GBP / USD pair will continue to fluctuate this week. A breakout above this resistance will lead to a large bullish move towards 1.3090 and 1.3180, while a breakout below, together with negative reports on the coronavirus, will bring the pound to a quote of 1.2975, and then to a quote of 1.2690 or 1.2580.

EUR / USD

As for the euro, large movements were not seen in the market last Friday, even amid the release of important reports for the eurozone economy. The data for inflation, which is very crucial to the EU, came out much worse than economists' forecasts, and this is due to a drop in consumer prices. The report indicated that in September this year, consumer prices in the eurozone fell 0.3% lower compared to the same period in 2019, so as a result, core inflation to 0.2%, which is lesser than its 0.4% value in August.

The main target set by the ECB is an inflation around 2%, but most recently, the regulator revised it and allowed a target value beyond 2.0%. However, this is only temporary as it is implemented just to compensate for losses during a low inflation period.

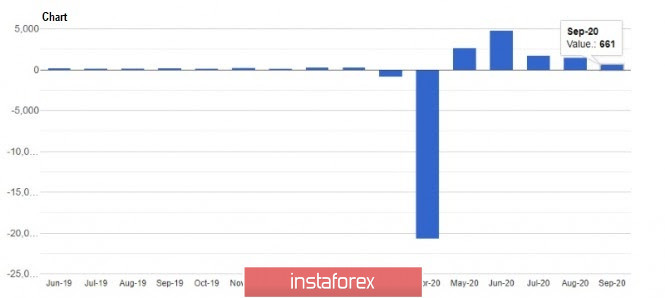

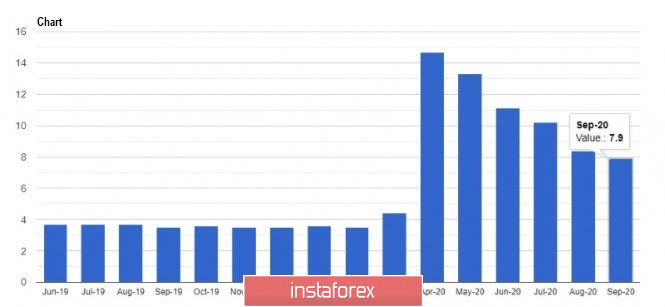

Meanwhile, statistics for jobs outside of agriculture in the United States was also published, but even if it showed an increase of 661,000, the data still came out worse than economists' forecasts. Regardless, the unemployment rate did drop to 7.9%, which suggests that the US economy is on a very good pace of recovery, and that it has already restored half of the jobs lost since the start of the coronavirus pandemic.

General business conditions in New York also came out, and according to the report published by the ISM, it jumped considerably high to 56.1 points in September. The index has already surpassed the pre-crisis value in February, which indicates a fairly high rate of economic growth. However, expectations for the next 6 months are not so good.

In another note, Dallas Fed president Robert Kaplan offered options for further assistance from the Federal Reserve. During an interview, he said that the latest employment data were in line with the expectations, however, there is a high risk that the economic recovery will begin to slow down. Thus, a new stimulus program must be adopted, and this is the Fed's emergency long-term borrowing program. The Fed, providing a more active and long-term support, will further stimulate the US economy, which will make it possible to more resiliently overcome the coronavirus pandemic.

About the EUR/USD pair, the level 1.1755 remains the pivot, with which a breakout above will raise demand for the European currency and bring it to a quote of 1.1800 or 1.1840. However, price may drop to lows 1.1660 and 1.1610 if the pair breaks below the level of 1.1710.