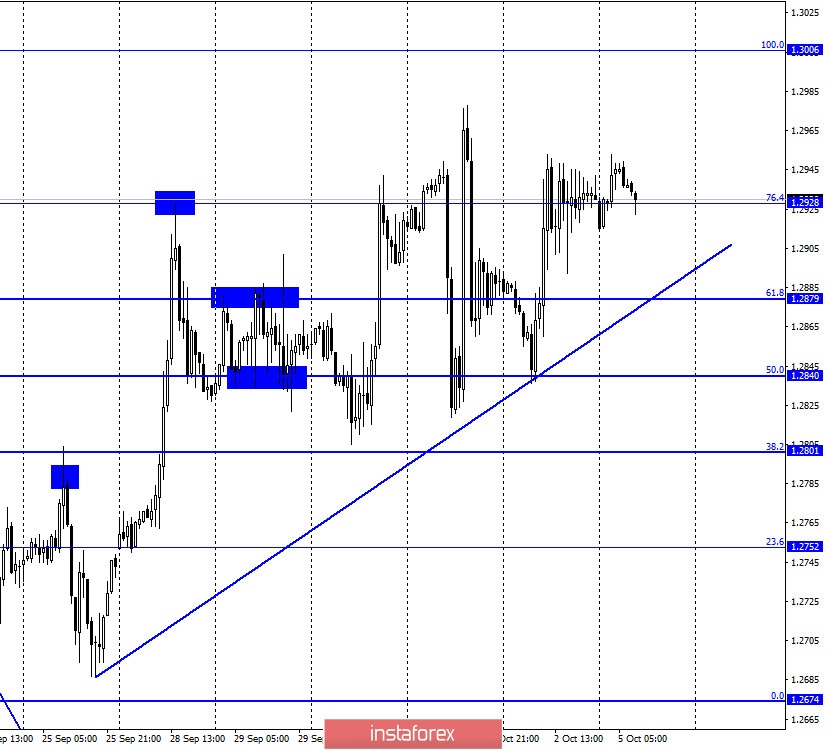

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair continued to move from side to side in the last trading day. There was quite a lot of news on Friday, however, if the euro/dollar was almost immobilized, the pound/dollar continued to move quite actively. The upward trend line has slightly changed its angle of inclination and now again characterizes the mood of traders as "bullish". However, this weekend, it became known about a telephone conversation between the head of the European Commission Ursula von der Leyen and British Prime Minister Boris Johnson. Let me remind you that the main topic for the British pound remains the topic of Brexit and the agreement with the European Union on trade after Brexit. During telephone conversations, the parties agreed to extend the terms of discussion of the trade agreement. Thus, the European Union can be said to have recognized that Boris Johnson's card is strong and he has no trump cards in return. Recall that the EU initiated legal proceedings because of London's position on the new draft law "on the internal market". Now it turns out that this trial will be put on pause or be purely formal. Of course, the question remains: who will concede to the agreement? However, if von der Leyen and Johnson extended the terms of negotiations, then there is still some progress. In general, if a week ago the situation reached almost a critical state, now it is a period of relieving excessive tension.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed another consolidation above the corrective level of 50.0% (1.2867). But since the pair is now "flying" from side to side, it is extremely difficult to predict further growth or decline. The bearish divergence of the CCI indicator still allows traders to count on a slight drop in quotes in the direction of the Fibo level of 61.8% (1.2720). However, in the current environment, anything can happen.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 61.8% (1.2709) and a reversal in favor of the British currency with the resumption of the growth process in the direction of the corrective level of 76.4% (1.3016). Closing the pair's rate above this level will increase the probability of further growth towards the next level of 100.0% (1.3513).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

There were no significant economic reports in the UK on Friday. All the news and data from the US had almost no effect on the pair's movement.

News calendar for the US and UK:

UK - services PMI (08:30 GMT).

UK - Bank of England MPC member Andy Haldane will deliver a speech (08:30 GMT).

US - ISM composite index for the non-manufacturing sector (14:00 GMT).

On October 5, a speech by a member of the Board of the Bank of England will be held in the UK, and the ISM index will be held in the US. In addition, I recommend that traders carefully monitor the information background from the United States and Britain, as there may be a lot of news coming from there in the coming days.

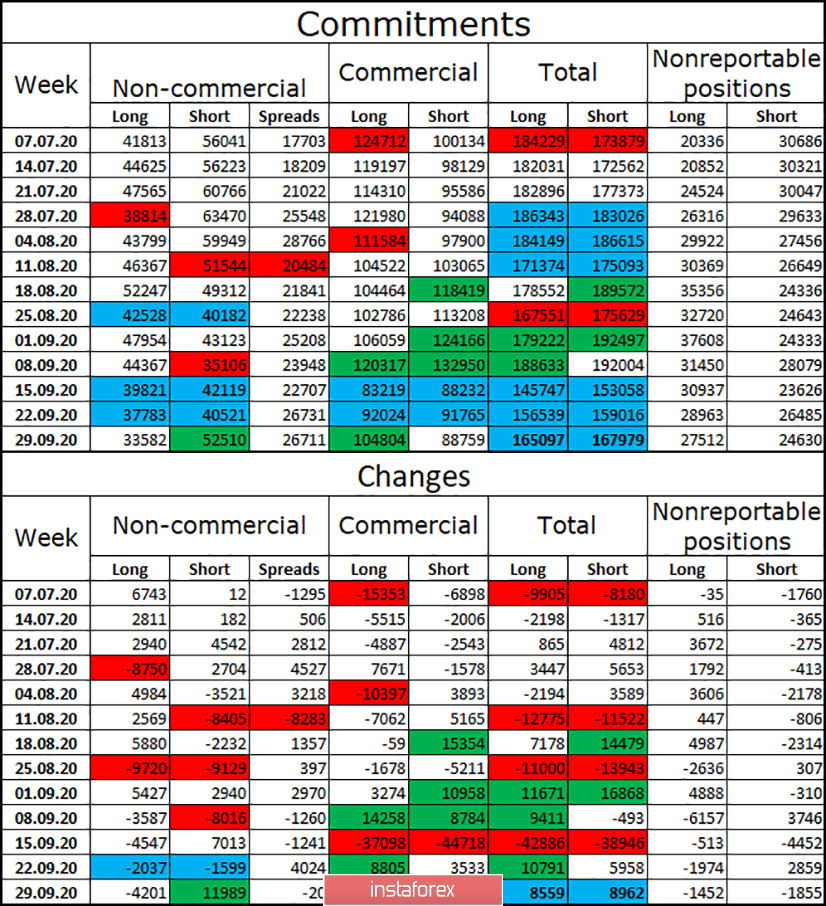

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed a sharp increase in the number of short contracts in the "Non-commercial" category. This means that this group of traders believes that the British pound will continue to fall, although it has been growing in recent days. Now the total number of short contracts focused on the hands of speculators exceeds the total number of long contracts. Thus, we can conclude that major traders are again changing their mood to "bearish". In total, during the reporting week, all categories of traders opened approximately the same number of contracts.

Forecast for GBP/USD and recommendations for traders:

Today, I do not recommend trading the GBP/USD pair as the British pound continues to fling from side to side, all-important levels are ignored.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.