The AUD/USD currency pair started the trading week in a weak manner, continuing to trade in a flat, in the area of the middle of the 71st figure. Last week, the bulls of the indicated pair could not break through the resistance level of 0.7200, after which they left and drifted. Therefore, the pair traded in a narrow price range of 0.7150-0.7180 for three days in a row. During the Asian session on Monday, the AUD pushed off from the lower limit of this range, but later showed sluggish growth, remaining within the flat.

In general, the currency market ignored the main events this weekend – in particular, Trump's hospitalization and the political battles over Brexit. The US dollar index started the trading week with a slight decline, but there was no impulse decline, so the indicator was stuck at the border of 93rd and 94th figures. At the same time, major dollar pairs showed a similar course - the gaps (in almost all cases) were closed before the start of the European session.

The general level of uncertainty puts pressure on traders, who, judging by the dynamics of the "major group" currency pairs, do not dare to open large positions either in favor of the dollar or against it. In turn, the Australian dollar is waiting for RBA's October meeting, which will be held tomorrow, October 6. The fact is that rumors have been actively circulating in the market over the past two weeks that two Central Banks – the RBA and the BoE will soon decide to let the interest rates enter the negative zone. And if the British head regulator does not explicitly exclude such a scenario, then the situation looks different in the case of the Australian Central Bank. The RBA members have not stated their intentions to take this step. The corresponding rumors appeared after the release of vague data on the Australian labor market and after RBA's head, Guy Debelle's subsequent comments. Last week, he said that "negative rates were and are in the arsenal of the Central Bank, but this does not mean that this leverage is on the agenda." He also noted that it is possible that the peak of COVID-19 is over.

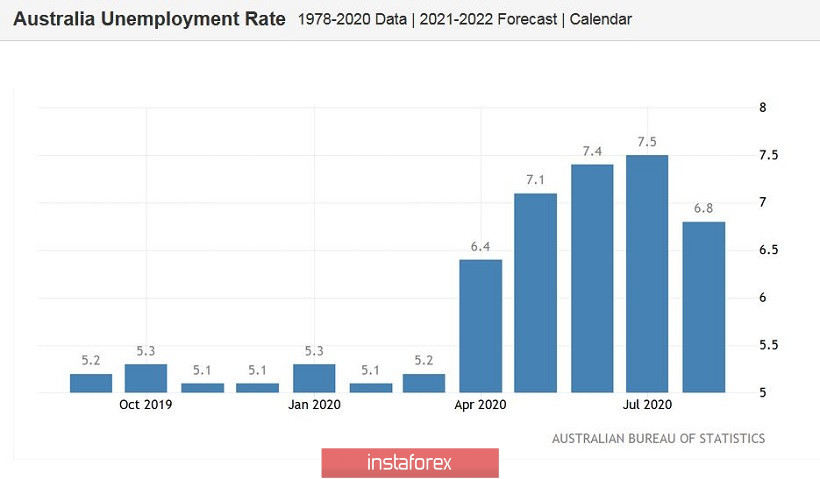

However, such statements can hardly be called "announcing" a rate cut, but the market was still concerned about such an option. Moreover, the latest data on the labor market really turned out to be quite contradictory, although there are pros and cons here. Thus, the unemployment rate in August fell to 6.8%, while most experts forecasted a growth to 7.7%. The unemployment declined for the first time after four consecutive months of growth.

We have another component of the release: the growth in the values of employees. On the one hand, the indicator showed strong dynamics – it increased by 111 thousand, instead of a decline of 40 thousand. On closer examination, it turned out that the growth was primarily due to part-time employment, while full employment showed a much more modest (twice lower) result. In August, part-time workers increased by 76 thousand (in July, the indicator was at the 80-thousand mark). The indicator of full employment increased by 36 thousand in August, and by almost 40 thousand in July. In this case, we can already talk about "unhealthy trends" in the labor market. At the same time, the August figures reflected the situation in Victoria, Australia. Let me remind you that the authorities of this state imposed a quarantine there, gradually tightening restrictive measures up to the introduction of a curfew in Melbourne. Here, the August data reflected the peak of the COVID-19 in the country.

On another note, the situation in Australian inflation is even worse. According to the latest data, the consumer price index in quarterly terms collapsed into a negative zone for the first time since spring 2016, it dropped to -1.9% instead of the forecasted -2%. In annual terms, the indicator also turned out to be below zero: the indicator came out at the level of -0.3%. As we can see, Australia's inflation remains a "weak link", which may also affect the mood of the RBA members.

At the same time, the Australian regulator will take a wait-and-see position following the results of tomorrow's meeting and will not rush to conclusions. Firstly, the data published in September (except for inflation) are unclear, but RBA members can focus on the positive aspects of the reports. Secondly, members of the Australian government will present next year's draft budget tomorrow (but after the RBA meeting). In many ways, this is a fundamental document; therefore, the members of the regulator are unlikely to decide on any drastic steps or statements before its presentation.

In other words, the October meeting of the RBA will be a passing one, although the rhetoric of the regulator's members is likely to soften due to the terrible inflation data (this also includes low consumer activity, growing household debt and weak dynamics of wage growth). At the same time, the Central Bank is unlikely to announce a rate cut. This fact will provide significant (albeit likely short-term) support for the Australian dollar, as the market continues to factor in the 60% probability that the RBA will cut rates in its pricing. Therefore, long positions for the AUD/USD pair can currently be considered with the first goal of 0.7200 (the middle line of the Bollinger Bands on the daily chart), while a more ambitious target is located slightly higher at 0.7260 (the upper limit of the Kumo cloud on the same time frame).