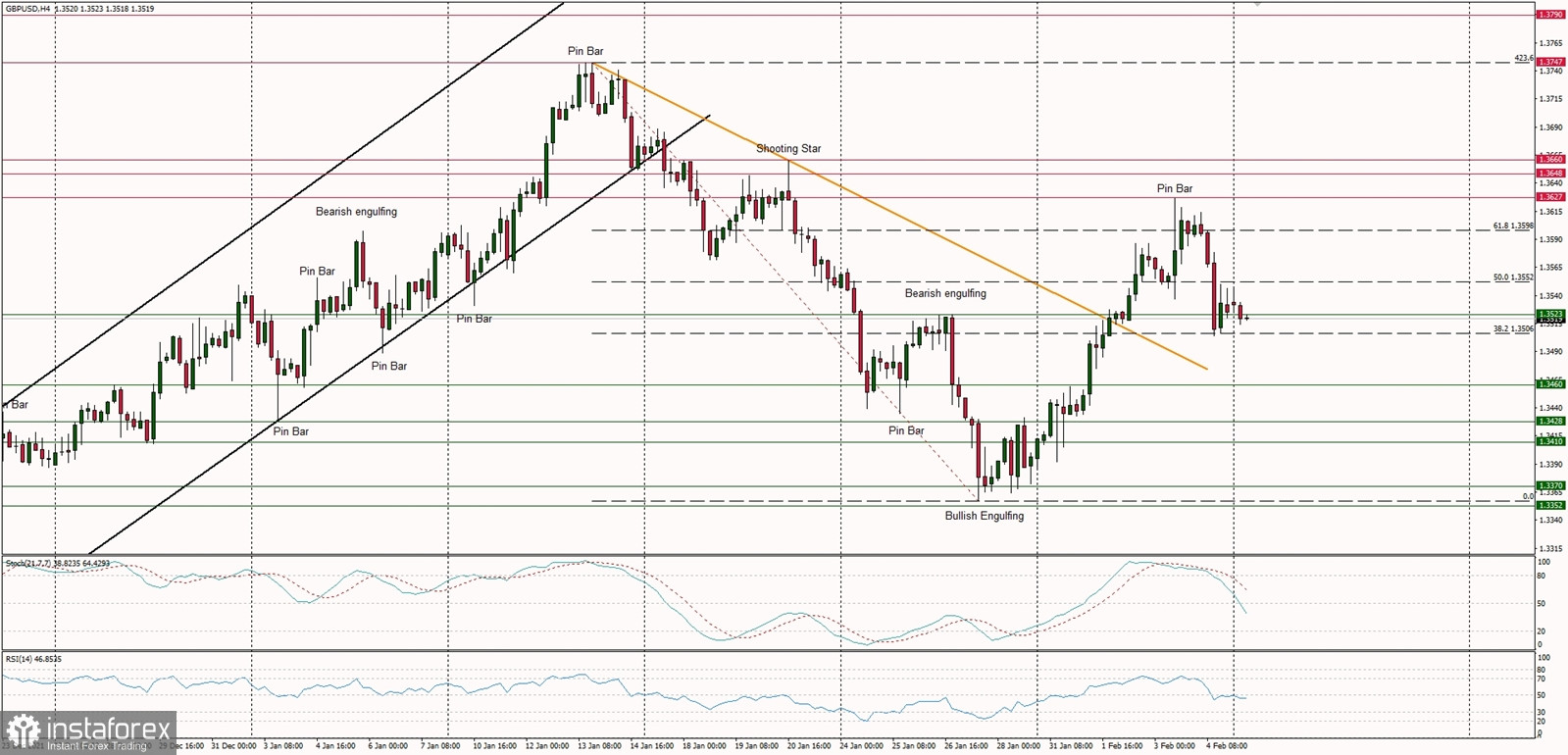

Technical Market Outlook

The GBP/USD pair has retrace a little bit more than 61% of the last wave down and the local high was made at 1.3626 before the bounce was capped. The pull-back went to the technical support seen at 1.3523 and the market is currently consolidating around this level. The breakout above the short-term trend line resistance is a positive signal of the bullish strength, so after the test of the trend line (around the level of 1.3475) the up move might be continued.

Weekly Pivot Points:

WR3 - 1.3889

WR2 - 1.3758

WR1 - 1.3647

Weekly Pivot - 1.3514

WS1 - 1.3404

WS2 - 1.3278

WS3 - 1.3169

Trading Outlook:

The up trend is being continued, but the up move might be terminated due to the Shooting Star candlestick pattern made at the daily time frame chart at the level of 1.3717. The overall move from the level of 1.3170 looks like a V-shape reversal pattern, so in the long-term the trend might be about to change from the multi-month down trend to the up trend. Please keep an eye on the level of 1.3500, because any sustained breakout below this level will change the outlook back to the bearish again.