Usually, the macroeconomic calendar is completely empty on Mondays, which resulted in a calm situation in the market. However, yesterday was totally different. A lot of interesting data was published, which, as a result, undermined the dollar's position – it loses its position throughout the day.

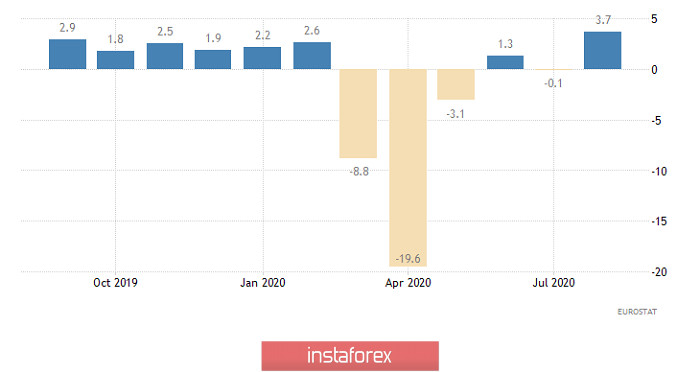

This process was initiated by the publication of Europe's final data on PMIs. The preliminary data showed that the service business activity index fell from 50.5 to 47.6, and the composite index, from 51.9 to 50.1. However, the service PMI declined to 48.0, and the composite PMI only to 50.4. Nevertheless, investors have already incorporated a larger-scale decline in indices long before, so they had to urgently adjust their positions, which triggered the dollar's weakening process. Just an hour later, data on retail sales supported the euro's growth, which scared investors, for a moment as the previous 0.4% growth rate was revised downward by -0.1%. That is, there was no growth in the previous month, but a drop in sales, considering the beginning of deflation in Europe. However, this month's rate of decline was immediately replaced by growth, and not by the expected 1.8%, but by as much as 3.7%. Such growth rates more than compensate for the second consecutive month of decline in consumer prices.

Retail Sales (Europe):

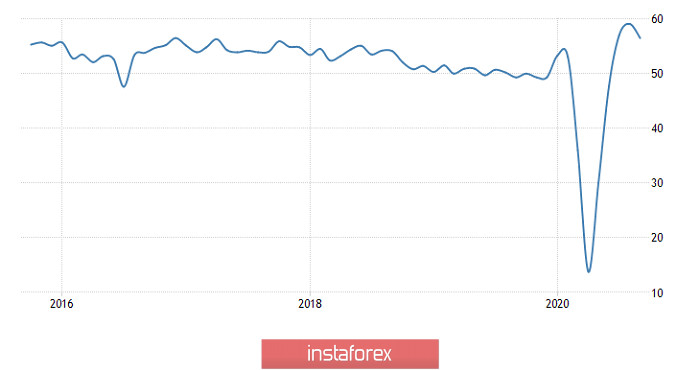

The pound did not lag behind the euro, since its growth was driven by the same business activity indices. Let me remind you that the preliminary assessment showed a decline in the business activity index in the service sector from 58.8 to 55.1, while the composite business activity index went from 59.1 to 55.7. For the final data, it showed that the PMI in the services sector fell to 56.1, while the composite PMI fell to 56.5. That is, as in the situation with the Eurocurrency, there is a smaller decline in the indices. Thus, investors needed to revise their positions towards strengthening the pound.

Composite PMI (UK):

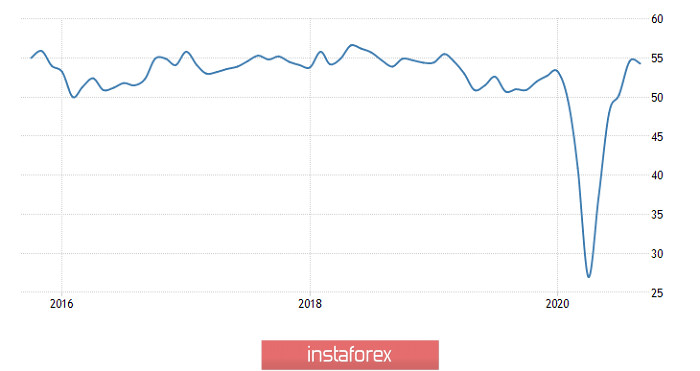

The fact that Europe's final data on PMIs were better than preliminary estimates inspired hope that the US will have a similar situation. However, it turned out to be slightly different. The preliminary estimate indicated that the index of business activity in the services sector fell from 55.0 to 54.6, and this estimate was fully confirmed. If we talk about the composite index of business activity, it was forecasted to decline from 54.6 to 54.4, but it dropped to 54.3. In conclusion, the final data was worse than forecasted.

Composite PMI (United States):

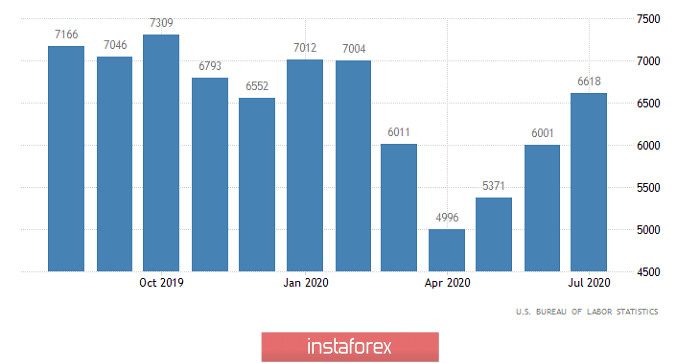

Nevertheless, the USD has a great chance to recover some of its losses. To do this, you should recall that the last report of the United States Department of Labor was exceptional, as the labor market is recovering even faster than expected. Today, data on open vacancies will be published, the number of which may grow from 6 618 thousand to 6 685 thousand. If these forecasts are confirmed, the labor market will continue to recover at a fairly rapid pace.

Job Openings (United States):

The EUR/USD pair showed high activity yesterday. As a result, the quote approached the price level of 1.1800, where a slowdown occurred. We can assume a temporary price fluctuation within 1.1770/1.1800, where there will be a following clear movement in the market, depending on the fixation points.

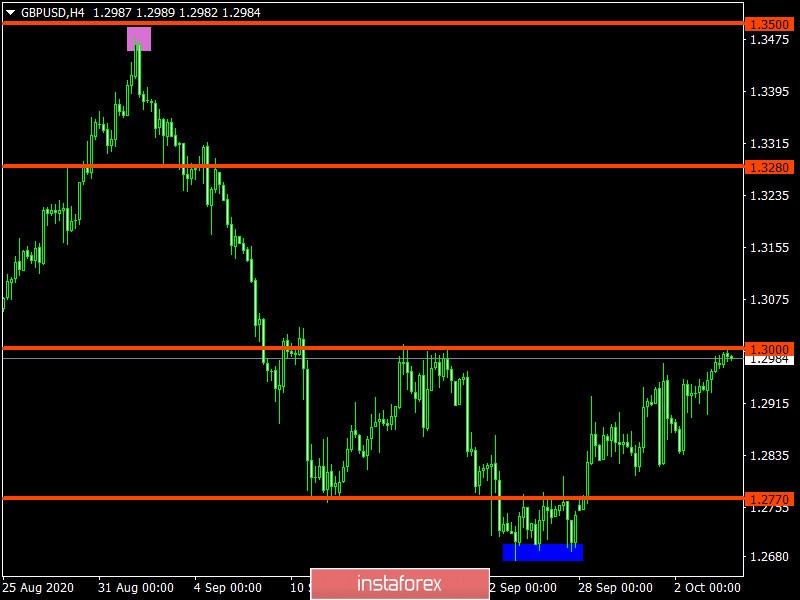

The GBP/USD pair, in the correction stage from a local low of 1.2674, reached an important psychological level of 1.3000, where a slowdown occurred. We can assume that without price consolidation above the coordinate level of 1.3000 in an H4 time frame, a natural rebound will occur, which will return the pound to the level of 1.2900.