Yesterday, the US stock exchanges closed around 2%, which was helped by a number of factors. First, there is growing confidence in the new $ 2.2 trillion bailout package being pushed by Democrats. The growing confidence is supported by opinion polls, and according to which, Biden is leading the presidential elections, which also supports the market's confidence that if Biden wins, the Fed will provide additional liquidity to the markets, which will greatly support the economy and reduce demand for the dollar.

Secondly, the ISM index for the services sector rose to 57.8p, which exceeded both the forecast and the August values. The report itself is moderately positive, but what is important is that the employment index exceeded the 50p level for the first time in a long period, which partially lowered the pessimism from the employment report on Friday.

Biden's breakaway was largely the result of a report that Trump was infected by COVID-19. However, the current US President does not intend to give up and is ready to return to the White House today, which will certainly increase his chances in the upcoming elections again, and add uncertainty to the dollar.

In general, the return of interest in risk should be noted today, which will give an advantage to commodity currencies.

USD/CAD

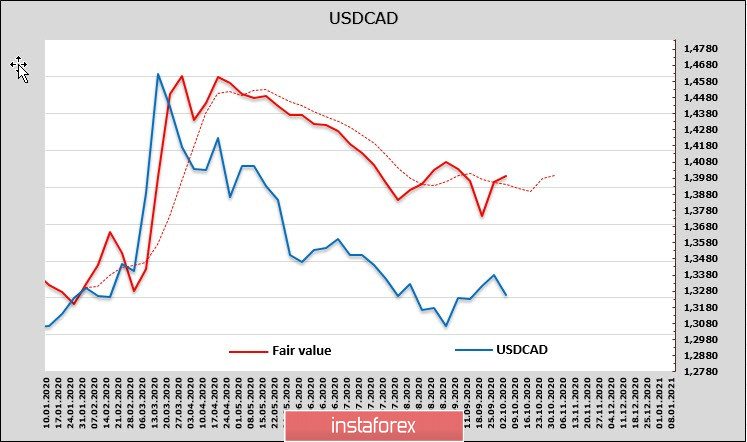

The Canadian dollar continues to be trapped due to political issues in the United States, since the way in which consumer demand will be supported will largely depend on its results. The Canadian economy is largely focused on US exports, so the key factors affecting the exchange rate are the price of oil, the state of the industrial sector and the pace of recovery in consumer demand in the United States.

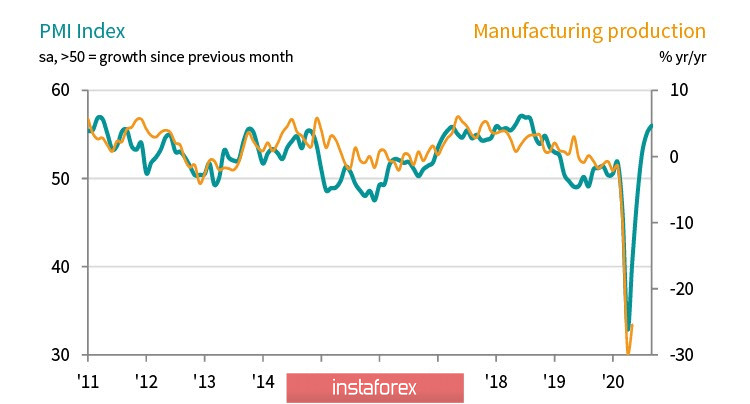

On the second issue, the situation is generally favorable – the PMI in the manufacturing sector in September came out at 56p., which is better than forecasts and August values. As a result, the growth of industrial production and exports should be expected.

On the other hand, we have contradicting forecasts for the labor market in Canada, the unemployment rate is expected to decline and at the same time, a slowdown in employment growth.

The CAD net short position, in turn, remained unchanged, with USD/CAD still below the estimated price. There is a big chance that the low of 1.2991 from September 1 is a long-term basis, and the trend has turned upward.

In general, there is no good reason for the Canadian dollar to sharply move. The most likely scenario before this week ends is trading in a range with a slight upward trend. Here, the support is located at 1.3240/60, while a decline to 1.3140/60 is unlikely. The target is a local high of 1.3210/20, while the medium-term target is at 1.3550.

USD/JPY

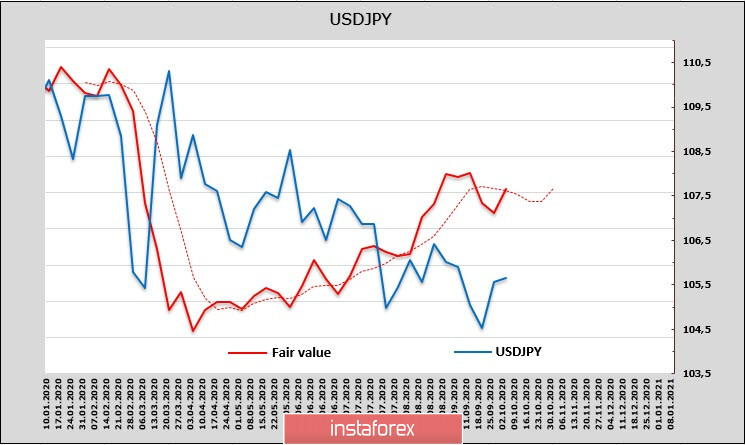

The expected upward pullback after failing due to pandemic restrictions turned out to be noticeably weaker than forecasts. The quarterly poll (TANKAN) for index for large producers in Q3 came out at -27p, which is slightly better than -34p., from a quarter earlier. In any case, it indicates a serious crisis in the industrial sector of Japan, which is not in a better position than during the crisis of 2008/09. For the services sector, the index is 12p, against the forecasted 9p, which is also worse than forecasts.

There is still no clarity about the fate of Abenomics and the government's new plan to replace it. Most likely, an impulse, which will indicate the future direction of yen, will only appear if there will be news regarding this.

Yen's long position declined by 591 million to 2.933 billion. The advantage is still noticeable, but in the context of the overall growth in demand for the dollar, the probability of continued growth of USD/JPY looks higher. At the same time, the estimated fair price is firmly stuck in the range, and there is no clear impulse that can take the yen out of this range yet.

Due to a lack of impulse, entering the zone of 106.70/107 is delayed. But in general, the priority should be given to the upward direction, both due to the growth in demand for the dollar and the general direction of the market towards the demand for risky assets.