What is needed to open long positions on EUR/USD

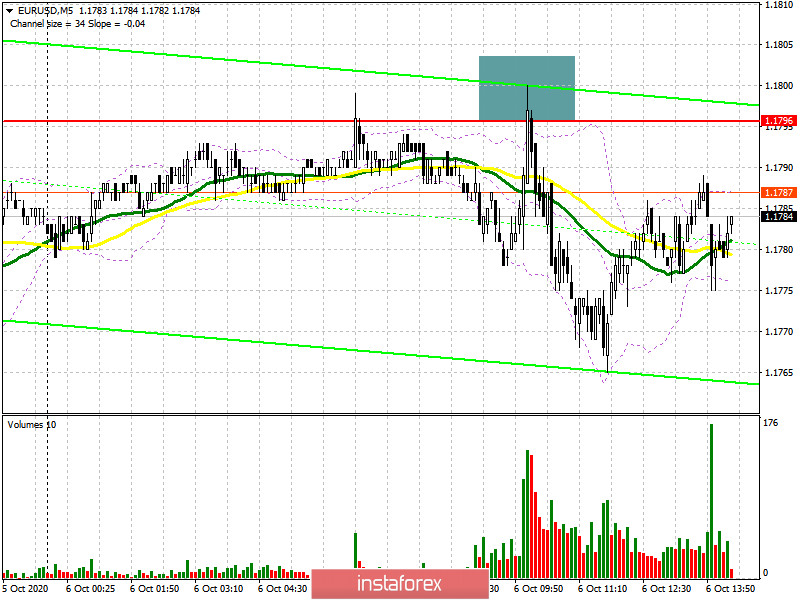

In the first half of the trading day, I considered the selling idea after a fake breakout of 1.1796. This is exactly what actually happened. Looking at the 5-minute chart, you see that the bears are trying to set the tone after an attempt to push the price beyond this resistance. Afterwards, the pair retraced to the level below 1.1796. The speech of ECB President Christine Lagarde also hurt the EUR bullish momentum because the policymaker expanded mainly on further prospects of easing monetary policy.

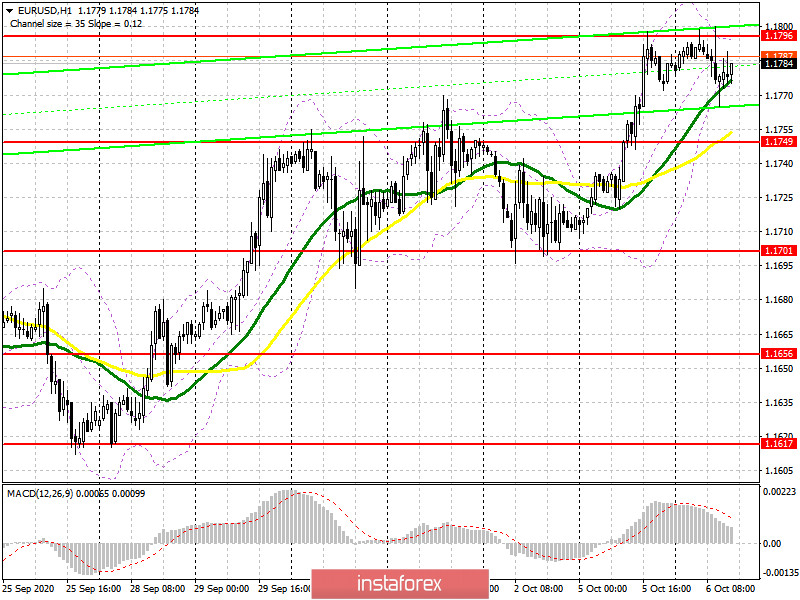

From the technical viewpoint, the chart looks the same. A further rise of the pair depends entirely on the level of 1.1796. If this level is breached and the price holds firmly higher like it was yesterday with 1.1749, the door will be open for long positions, betting on a further upward correction to a higher high of 1.1833 where I recommend profit taking. A more distant target is seen at 1.1868. Today the economic calendar lacks any fundamental data, so investors are focused on the Eurogroup summit. The euzorone's finance ministers are going to discuss the plan of allocating the EU recovery fund. The decision could support the single European currency.

If EUR/USD moves downwards, it would be better to be cautious about buying the pair but wait until the price forms new support following 1.1749 where we could open long positions on condition of a fake breakout. Moving averages, which are playing in favor of the buyers, are passing that area. If case the pair does not move sharply from that level, I advise you to cancel pong positions until a low of 1.1701 is tested, from where EUR is expected to rebound rapidly 20-30 pips during the first test.What is needed to open short positions on EUR/USD

The bears have already achieved their aim, having locked EUR at 1.1796. As long as the pair is trading below that level, EUR is expected to decline further. Now, the bears set a more important aim to seize again support of 1.1749. In case the pair fixes below that level, there will be a larger area for entering short positions so that the sellers will again hold the upper hand. The bears will push the pair down to 1.1701 where I recommend profit taking. A more distant target is seen as support of 1.1656. ECB President Christine Lagarde is also due to speak later today. So, this scenario is likely to be implemented. Alternatively, if the bulls enable a breakout of resistance of 1.1796 in the second half of the trading day, it would be better not to rush selling the pair but wait until the price climbs to new resistance of 1.1833. Another option is to sell EUR at once during a retracement from a high of 1.1868 bearing in mind an intraday 20-30 pips correction.

Looking back, the Commitment of Traders report (COT) from September 29 recorded that traders were reducing both long and short positions. Perhaps the lack of good targets and the COVID-19 resurgence in Europe discouraged large market players to increase long positions on EUR. At the same time, traders are not poised to buy USD ahead of the presidential election in the US. Thus, long non-commercial positions fell to 241,967 from 247,049 while short non-commercial positions dropped to 53,851 from 56,227. The overall non-commercial net positions also decreased to 188,116 from 190,822 a week ago. This signals the wait-and-see mood of new market players. Nevertheless, the bullish sentiment on EUR remains valid for the medium term. The deeper EUR declines against USD – the more attractive EUR will be for new investors.

Signals of technical indicators

Moving averages

The pair is trading below 30- and 50-period moving averages. It indicates that the bullish outlook for EUR is still valid.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

EUR growth will be capped by the upper level of the indicator at near 1.1835. In case EUR declines, the lower border of the indicator at near 1.1755 will act as support.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position is the difference between short and long positions of non-commercial traders.