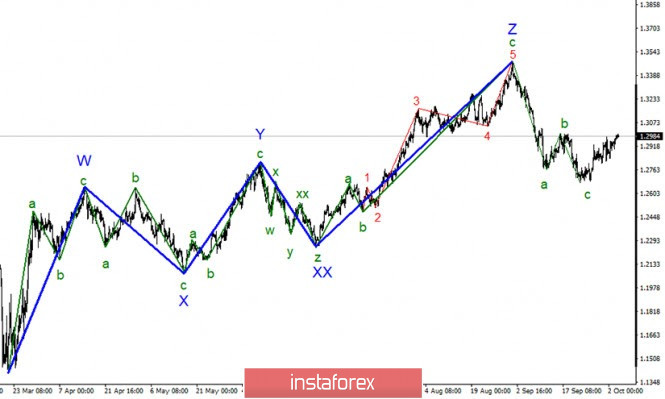

In the most global terms, the construction of a downward movement of the trend continues. However, the departure of quotes from the lows reached over the past few days is suggesting that the entire section of the trend has taken a three-wave form and has already been completed as it begins on September 1. At least it looks convincing enough. If this assumption is correct, then the current positions may continue to increase quotes within the new upward wave as part of the upward section of the trend that begins on March 19. Naturally, in this case, it will take an even more complex and extended form.

On closer inspection, it is clear that the wave marking really took a three-wave form and at the same time looks quite convincing. The failure of the attempt to break the 61.8% Fibonacci level further assures only that the descending set of waves is complete. The departure of quotes from the reached lows really suggests that the markets are ready to build a new uptrend. However, it is now quite difficult to say what form it will take and whether it will be a continuation of the section of the trend that began last March 19. The unsuccessful attempt to break the 38.2% Fibonacci mark may keep the instrument from further increasing and call into question the option of building an upward wave.

All the attention of the markets for the GBP/USD instrument is still focused on events related to Brexit. The next round of negotiations on the trade agreement which is due to take effect on January 1, 2021 ended last week. Michel Barnier, head of the EU negotiating team, says that tangible progress has not been achieved. He concluded that there are serious differences between the parties. Thus, based on the results of the next week's negotiations, I still cannot conclude that the parties are moving towards signing an agreement. Rather, they continue to stand in one place. The heads of the UK and the EU, Boris Johnson and Ursula Von Der Leyen, understand this, they agreed to extend the talks for another month based on a telephone conversation that happened last Saturday. The Briton is still in demand in the currency market, thanks to events taking place in America. The wave pattern so far also suggests a further increase. But the 30 figure or 38.2% Fibonacci level will be really important. If the attempt to overcome it is unsuccessful, then the decline in quotes may resume with targets located below the 27th figure.

General conclusions and recommendations:

The Pound-Dollar instrument has presumably completed the construction of a downward trend section. However, not until a successful attempt breaking through at 38.2% Fibonacci level, I would recommend not to rush with new purchases of the British. The news background in the UK is now such that demand for its currency may fall at any time. A break of the 30 figure will indicate the readiness of the markets for new purchases of the pound and further increase in quotations. Then I recommend buying a tool with targets located near 1.3191 and 1.3480, which corresponds to 23,% and 0.0% Fibonacci, for each new MACD signal up.