Markets focused on the recovering Donald Trump, the election race, the stimulus package negotiation, and the publication of the FOMC minutes. Let's try to predict which of the factors will have the greatest impact on the USD.

On Monday, US President Donald Trump was discharged from the hospital and is now continuing the recovery process at the White House. This news in itself does not arouse much interest and even less excitement in the markets. For markets, political implications are more important. So, the worst-case scenario, Trump, and, accordingly, the dollar was avoided. As previously suggested, he urged his fellow citizens not to be afraid of the virus and not to let it "dominate" life. He also did not forget to remind about the imminent appearance of a vaccine against coronavirus.

However, the incumbent president will still need strength to bypass his main rival. According to some polls, Joe Biden is 14 percentage points ahead of Trump in popularity among voters.

What steps will Trump take? He is likely to be quite persistent in trying to push through a new stimulus package for the US economy before the elections. A deal between Democrats and Republicans could indeed take place. Any hint of an agreement will make the stock and foreign exchange markets go up. If you look at the recent dynamics of stocks, you can say that investors have begun to prepare for a deal.

As a reminder, negotiations on a new package have been at an impasse since August. Democrats have proposed another version of the $ 2.2 trillion appropriation bill, but the White House has so far opposed such tactics.

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin discussed the allocation of the new stimulus package, on Monday, through a telephone conversation. A similar conversation is scheduled for Tuesday.

A deal could be struck, opening the door to much needed financial support for the economy. Risky assets will receive fuel while the dollar is under pressure. Meanwhile, the delay in the adoption of the second stimulus package will play against risky assets and in favor of the greenback.

It is worth noting that hints of new incentives to support economic recovery came from the head of the ECB. According to Christine Lagarde, the eurozone economy still looks depressed, while the regulator has the opportunity to drive rates below zero. Investors will surely study the speeches of Lagarde and Powell.

Significant releases in the US this week include the publication of the minutes of the FOMC meeting on Wednesday. Financial officials were quite clear about their position last month. The Central Bank does not plan to raise the rate in the next three years, as inflation is still below the target level and unemployment is at a historically high level. Market players expect the forthcoming protocol to strengthen the Fed's dovish position. For the dollar, this will be more negative than positive driver.

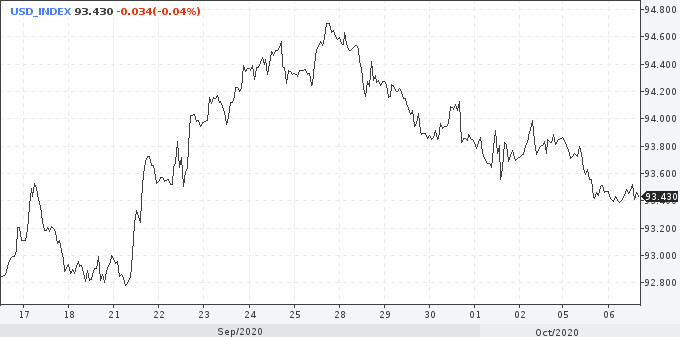

Now, the USD's downward trend continues. The interest in selling has been increasing for several days already. The dollar index opened the American session with minor losses at around 93.40.