The composite index of the largest companies in the region Stoxx Europe 600 rose by 0.68% and amounted to 465.28 points.

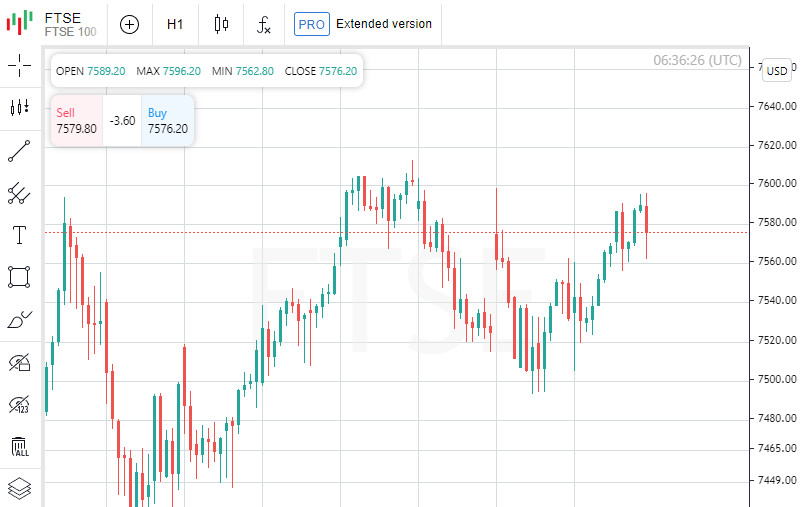

The French CAC 40 index increased by 0.83%, the German DAX - by 0.71%, the British FTSE 100 - by 0.76%. Meanwhile, Spain's IBEX 35 and Italy's FTSE MIB were down 0.36% and 1.03%, respectively.

Investors continued to analyze the results of the first meeting of the European Central Bank this year, summed up last week. The ECB kept key monetary policy parameters unchanged, including a benchmark lending rate at zero, a deposit rate at minus 0.5% and a margin lending rate at 0.25%.

Dutch central bank chairman and ECB board member Klaas Knoth said on Sunday that he expects the first rate hike of 25 basis points in the fourth quarter of this year. At the same time, he predicts that inflation will remain above 4% for most of 2022. Eurozone consumer prices rose 5.1% year-on-year in January, more than doubling the ECB's 2% inflation target.

Knot also added that he expects a second rate hike in the spring of 2023.

Meanwhile, yesterday it became known that the volume of industrial production in Germany in December fell by 0.3% compared with the previous month. Analysts on average had expected a rise of 0.4%. In November, the volume of industrial production in Germany, according to revised data, increased by 0.3%, and did not decrease by 0.2%, as previously reported.

The output of capital goods increased last month by 2.5%, intermediate goods - by 0.6%. At the same time, the output of consumer goods turned out to be 0.5% less than the level of the previous month. Electricity generation decreased in December by 0.7%, construction volumes fell by 7.3%.

Shares in copper producer Aurubis AG rose 3.2%. The company said it increased its quarterly net income by almost 85%.

Shares of the world's oldest operating bank, Banca Monte dei Paschi di Siena SpA, rose 0.5% on news of a change in CEO. Instead of Guido Bastianini, the bank will be headed by Luigi Lovalho.

British real estate developer Taylor Wimpey plc rose 0.5% on news of the appointment of Jenny Daly as the company's new chief executive officer. She will take office April 26.

Among the Stoxx 600 components, gainers on Monday were cruise ship operator Carnival Plc (+6.6%), Norwegian solar energy producer Scatec ASA (+6%), and German food delivery operator HelloFresh SE (+4.9%). ) and Danish bank Danske Bank (+4.2%).

The decline leaders were papers of two Belgian real estate companies: Cofinimmo (-5.9%) and Aedifica (-5%). These companies were at the center of a scandal involving nursing home operator Oprea SA.