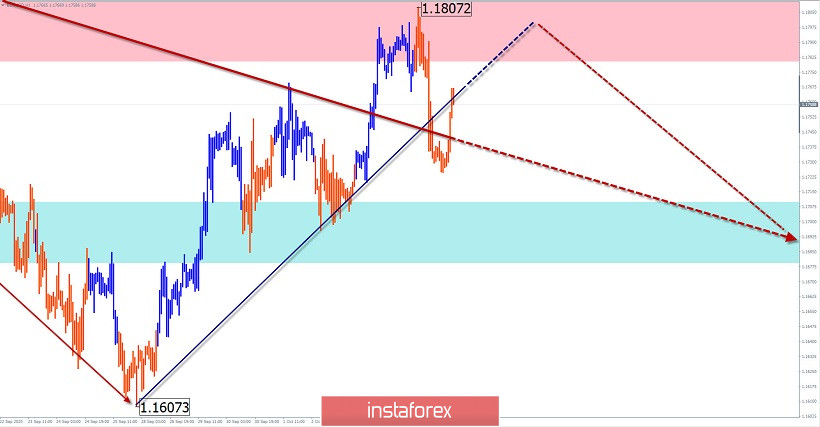

EUR/USD

Analysis:

The direction of the euro's price movement in recent months has been set by a downward correction. The wave developed mainly sideways, having the appearance of a stretched plane. On September 28, the ascending section started. As the formation of the rise, a wave level of movement is gradually approaching to a reversal scale.

Forecast:

A flat movement in the corridor between the nearest zones is expected today. An upward trend is expected in the next trading session. By the end of the day, you can expect a change in the exchange rate and a repeated decline in the instrument.

Potential reversal zones

Resistance:

- 1.1780/1.1810

Support:

- 1.1710/1.1680

Recommendations:

Trading the euro in the market in the next 24 hours is possible with a reduced lot within the intraday, according to the expected sequence.

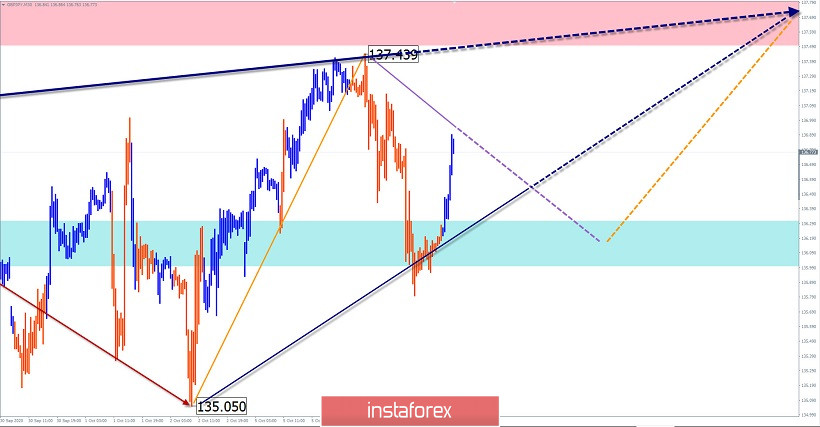

GBP/JPY

Analysis:

The last incomplete wave structure in the pair's market is the descending wave from June 5. Its last section started on September 1. Within its framework, a correction has been formed in the last 2 weeks, which is still incomplete. The price is approaching the lower limit of the preliminary target zone.

Forecast:

A general upward movement is expected in the next 24 hours. A short-term decline is likely in the European session. A break of the upper limit of resistance within the current day is not excluded.

Potential reversal zones

Resistance:

- 137.50/

137.80

Support:

- 136.30/136.00

Recommendations:

Until clear reversal signals appear, it is recommended to focus on buying the instrument. It is worth considering the limited potential of the current recovery.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!