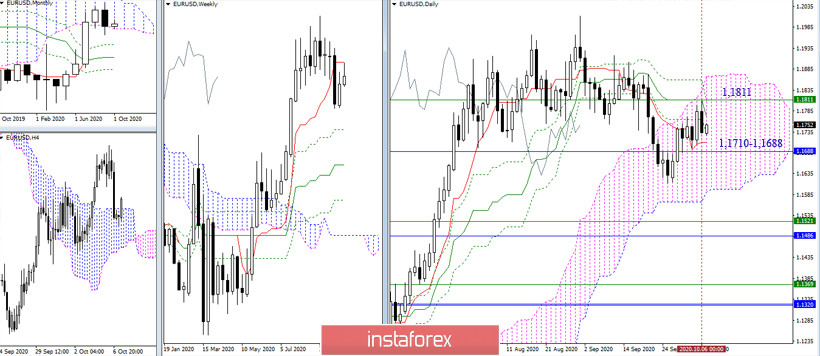

EUR / USD

A daily rebound was formed after reaching important resistance (1.1811 weekly Tenkan + daily Kijun) at the higher time frames. The nearest significant support zone is located at 1.1710 - 1.1688 (daily Tenkan + lower limit of the monthly cloud). Now, a consolidation below which will contribute to the formation of a weekly rebound from the reached resistances, as well as make the main bearish task to restore the downward trend.

The euro/dollar pair broke through the key supports of the lower time frames earlier. At the moment, the euro is testing the consolidated central pivot level (1.1757) and the weekly long-term trend (1.1744) again. If the situation is a retest, then the pivot points within the day will be the support levels of 1.1707 - 1.1680 - 1.1630. If we manage to consolidate above, then the bulls will seek to match the opponent's achievements yesterday. In this regard, the next pivot points will be 1.1784 - 1.1834 - 1.1861.

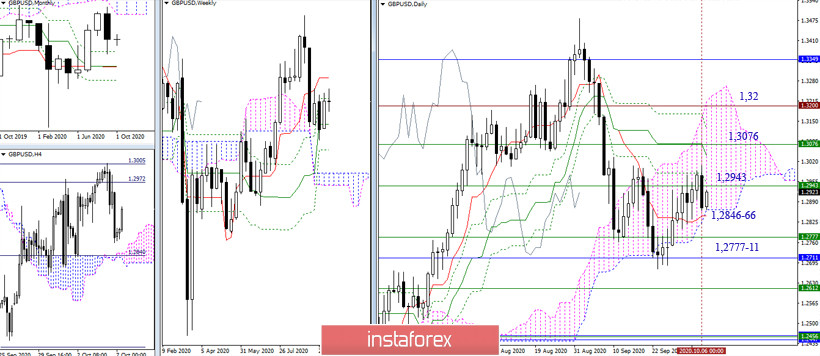

GBP / USD

Yesterday's decline and formation of a rebound allowed the pair to go back to the support levels of 1.2846-66 (daily Tenkan + lower limit of the daily cloud). A reliable consolidation below can inspire the bears to attack the level of 1.2777 11 (weekly Kijun + monthly Fibo Kijun), followed by recovering the downward trend. In turn, the elimination of the rebound and the continued growth may delay the implementation of bearish plans for a long time and open up new pivot points (1.3076 - 1.32) for the bulls.

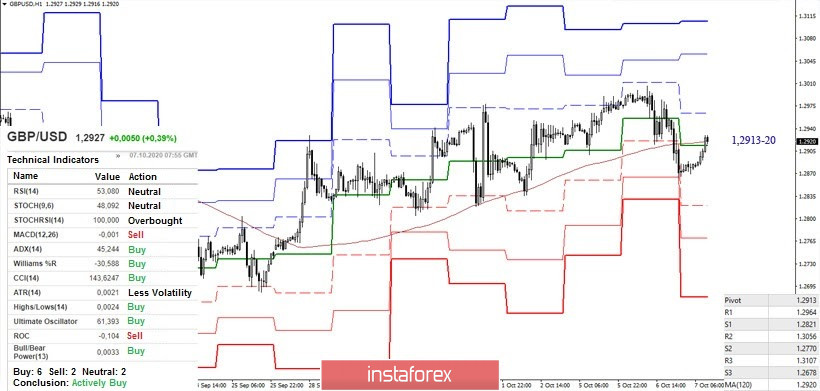

The pound/dollar pair is retesting the overcame key supports in the lower time frames; today, they are joining forces around 1.2913-20 (central pivot level + weekly long-term trend). The formation of the rebound and the continuation of the decline will return the relevance to the support levels of 1.2821 - 1.2770 - 1.2678. Moreover, a consolidation above may indicate the pair's determination to stay in the daily cloud and return the advantages to the bulls in the smaller time frames. In this case, the main goal is to restore the upward trend (1.3006).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)