The story of fiscal stimulus, namely the suspension of the negotiation process initiated by Donald Trump, brought a lot of noise to world markets. Now, investors seem to have calmed down a bit. They are probably driven by the saying: whatever is done is for the best.

The current President lags behind his main rival Joe Biden in the rating, and this gap is gradually increasing. Market players do not rule out a Biden victory and see some advantages in this. The administration of the new President will quickly resolve the issue of allocating money to support the economy. The stimulus package may not be available until after the election, but it will certainly be available after.

On Wednesday, Donald Trump backed down in some way and announced his readiness to sign separate stimulus measures. Congress did not delay with this and voted for the government's bills, which, in particular, include measures to support airlines.

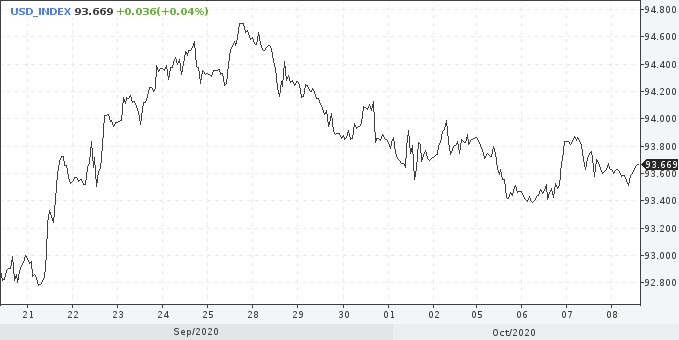

No matter who wins, the economy will not be left without support. Such expectations helped to improve the mood. As a result, defensive assets such as the Japanese yen and the US dollar suffered losses.

The recovery in stocks was also supported by hints of further easing by the Federal Reserve. Upon the release of the minutes of the September meeting, most of the participants believe that the economy will be supported by an increase in budget spending, and some are open to further debate about the prolongation of the Fed's bond purchase program.

Meanwhile, the dollar showed weak gains on Thursday in the absence of new messages on the stimulus package and a weak increase in risk appetite. During the US session, investors will evaluate weekly employment data in the US. Statistics should show that the world's largest economy is recovering slowly and needs support.

In addition, there will be several speeches from Fed representatives, which are expected to highlight the Central Bank's messages made this week. It all boils down to approving stimulus measures, but for some reason, Washington expresses doubts about this, which misleads the markets and forces them to think out the outcome of events on their own.

So, Biden's election victory should bring swift approval of fiscal stimulus and more. A change in the US administration will cause adjustments in relations with Iran. Thus, the Islamic state can immediately increase oil exports by almost 2 million barrels per day. Former senior official of the US Department of Energy, Joe Mcmonigle, also warned about this.

Recall that the candidates for the US presidency have already talked about the possibility of resuming the nuclear deal with Iran, which Trump broke in 2018. Since then, the volume of oil production in Iran has almost halved due to US sanctions.

The prospects for oil production growth in Iran and Libya will be the main topic of discussion by the OPEC+ deal participants at the December meeting. Note that participants in the long-running civil war in Libya signed a truce last month. The country's oil industry was able to resume operations.