The Australian Dollar, along with the US Dollar, continues the recovery process. The Australian Dollar is showing fairly good growth for the third day in a row. During the Asian session on Friday, the pair approached the next resistance level of 0.7180-- the average line of the Bollinger Bands indicator on the daily chart-- and is currently trying to gain a foothold above it. Since the beginning of October, this is the third attempt to gain advantage over the target, which will open the way to the 72nd figure.

However, the trajectory of the pair mirrors the trajectory of the US Dollar index which this week shows wave-like dynamics. If you look at a wider time range, we will see that the index is gradually sliding down with regular upward pullbacks. The Australian dollar, in turn, is gradually recovering its positions after falling to the base of the 70th figure--t he key support level of 0.7000. It received some support from the Reserve Bank of Australia this week so a further weakening of the US dollar will not only settle within the 72nd figure, but also test the resistance level of 0.7270 which corresponds to the upper limit of the Kumo cloud on the daily chart. In other words, the prospects for the upward trend depend on the status of the US Dollar.

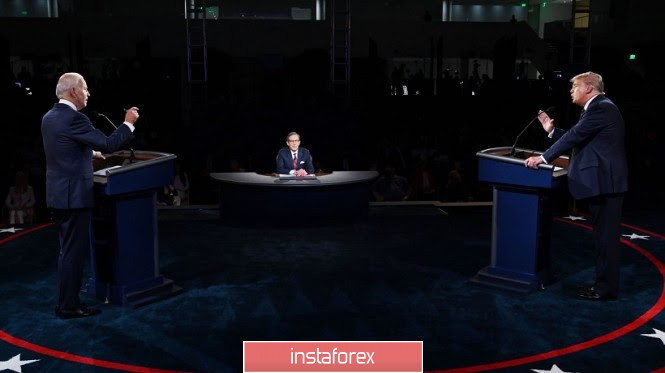

Meanwhile, recent political events in the US are putting pressure on their Dollar. The presidential election is just over three weeks away so all of Trump and Biden's actions should be attributed to this. The only difference is that Donald Trump is already President as well as a presidential candidate. His campaign promises are closely intertwined with his real intentions as President. Trump, at times, contradicts himself. For example, over the weekend, he loudly declared that the negotiation process on agreeing a new package of stimulus measures was completed. He said that the Democrats did not agree to compromise, so the parties left the negotiating table. In response to this statement, the US stock market noticeably sank and the Dollar began to enjoy increased demand amid rising anti-risk sentiment.

Trump received a barrage of criticism, both from Democrats and some Republicans. In addition to this, the need for additional assistance this week was also stated by the Head of the Federal Reserve, who warned that otherwise, the American economy will again plunge into recession. Against the background of these statements, the Trump did a 180 degree turn and changed his mind, resuming negotiations with the Democrats. At the same time, he set a condition, stating that it is necessary to adopt a separate bill on assistance to the aviation industry. At this stage, the first disagreements arose in the resumed negotiations: the Democrats reported that they were ready to consider the aviation bill separately only if a comprehensive bill on providing assistance to the American economy was agreed and submitted to Congress.

The US Dollar reacted negatively to all the above events. Trump's statements and actions are becoming somewhat chaotic and this fact causes some nervousness in the markets. For example, yesterday, Trump announced that he would withdraw US troops from Afghanistan in full force "before Christmas" (meaning before the end of this year). This statement caused confusion among the head of NATO, Jens Stoltenberg. He answered that the issue of withdrawing the military from the country will be taken jointly by all participants in the operation in Afghanistan and not by individual members of the Alliance.

Inconsistent and contradictory statements of Trump-- including anti-Chinese sentiments-- can explain why he is behind Biden in opinion polls. The current situation hits the Dollar with a rebound, which reacts negatively to political instability and unpredictable decisions/statements of the Head of the White house.

Given this uncertain state of the US Dollar, buyers of AUD/USD pair have every chance to enter the area of the 72nd figure and get close to the resistance level of 0.7270. The reserve Bank of Australia did not sink the Australian Dollar this week. Though in the run-up to the October meeting, rumors were actively discussed in the market that the RBA would either lower the interest rate or announce its reduction. The Australian regulator refrained from such decisions or statements, thereby supporting the position of their dollar.

The fundamental picture for the pair is in favor of the Australian currency, primarily due to the weakness of the US Dollar. This means that the priority is given to long positions that can be opened when the pair is fixed above the 0.7180 mark (above the middle line of the Bollinger Bands indicator). The main goal of the upper breakthrough is the resistance level of 0.7270. This is the upper limit of the Kumo cloud on D1.