Ethereum (ETH/USD) has seen a 50% gain in value since the lows of $2,151. Although Ether has performed well, investors should be careful with new investments, as there could be a technical correction in the next few days.

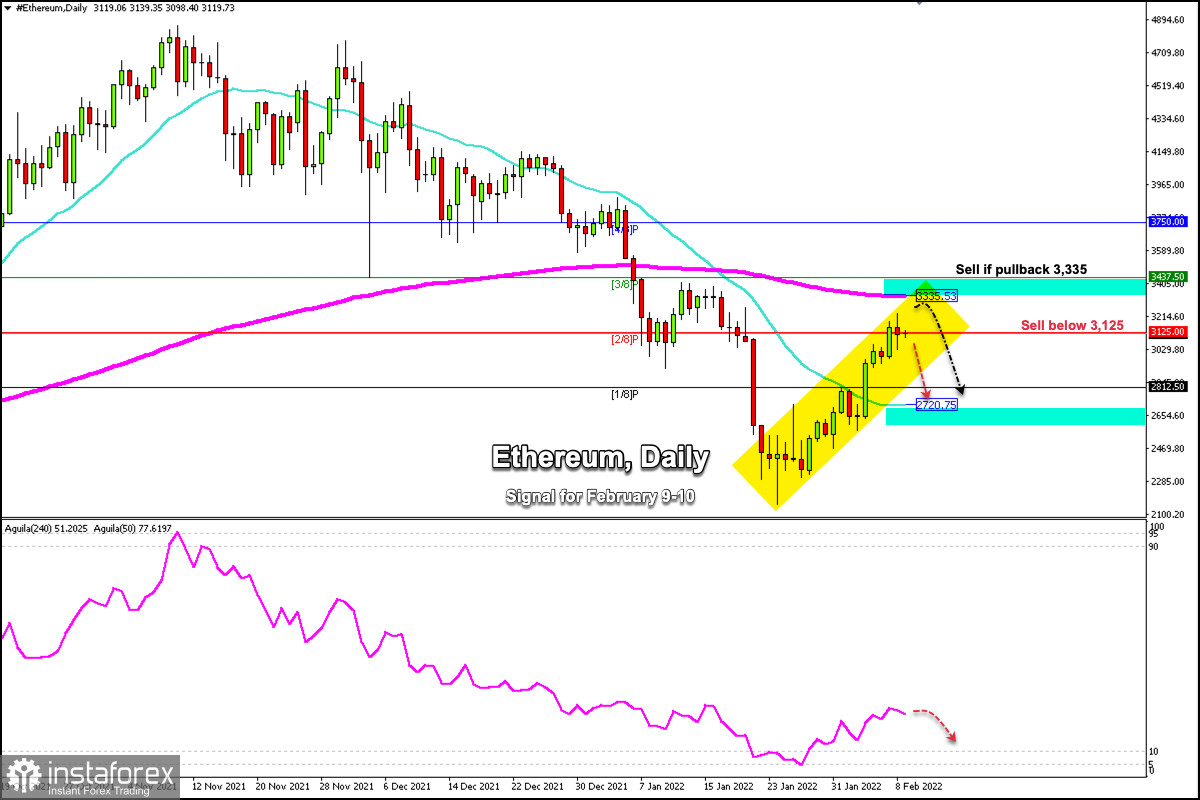

According to the daily chart, Ethereum has strong resistance at the 200 EMA around 3,335.

Ether price is now consolidating near 2/8 of a Murray. The next key support is near 2,812 (1/8) and the 21 SMA at 2,720. Below this zone, there is a risk of a strong drop.

In the next few days, the inflation data for the United States will be published. If this data triggers the alarm for the Fed to increase its interest rate in March, Bitcoin and Ether could fall towards the levels of 30,000 and 2,000.

The uptrend formed since January 24 is still prevailing. A sharp break below the psychological level of $3,000 could expect an acceleration to the downside towards the 21 SMA at 2,720.

Ether could retest the support of the SMA 21 around 2,720. If it consolidates in this area, a technical bounce could occur again and it will give us an opportunity to buy with targets at 3,150 (2/8) and up to 3,335 (200 EMA).

The short- and medium-term outlook for Ether remains negative. The cryptocurrency market is under downward pressure given that the United States is willing to increase its interest rates up to four times this year.This could affect the strength of Bitcoin and Ethereum in the coming months. ETH could fall towards the levels of 2,000 or even $1,500.

Our trading plan for the next few hours is to sell Ether below 2/8 Murray with targets towards the 21 SMA at 2,720. On the other hand, a pullback towards 3,335 (200 EMA) will be an opportunity to sell as long as it remains below that level.

Support and Resistance Levels for February 9 - 10, 2022

Resistance (3) 3,437

Resistance (2) 3,334

Resistance (1) 3,208

----------------------------

Support (1) 3,017

Support (2) 2,918

Support (3) 2,812

***********************************************************

Scenario

Timeframe H4

Recommendation: sell below o if pullback

Entry Point 3,125; 3,335

Take Profit 2,812, 2,720

Stop Loss 3,250, 3,450

Murray Levels 3,750 (4/8), 3,437 (3/8), 3,125 (2/8), 2,812 (1/8)

***************************************************************************