Yesterday, the EUR/USD pair managed to show local activity based on a 20-hour stagnation in the borders of 1.1760/1.1780, which resulted in a breakdown of 1.1760. Everything was fast and to no avail. Now, we can see that the downward activity led only to speculative manipulations, after which the quote returned to where it all started.

On the other hand, emotional market behavior is already considered to be something normal, and the dynamics are often natural inertia in relation to short-term time periods.

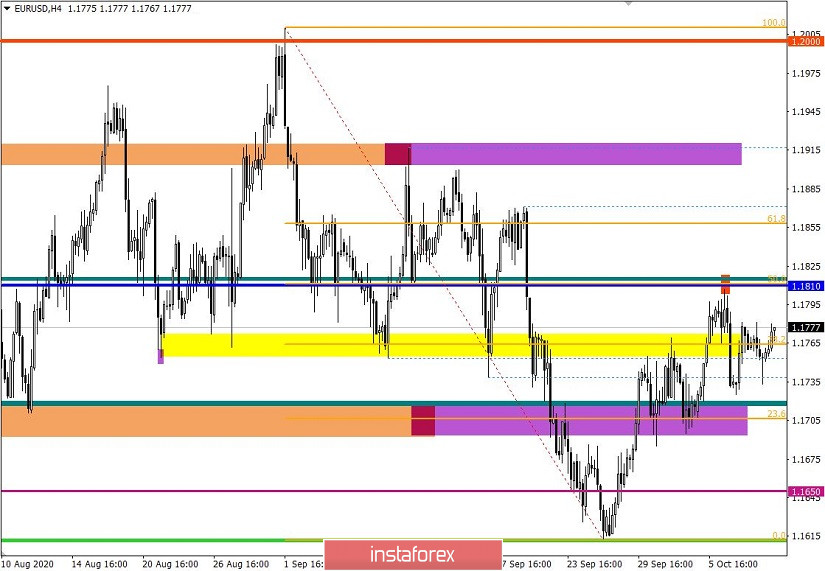

Now, an important role is played by the fact that the corrective move from the local high of 1.1612 met the range level of 1.1810 on the way, after which the local highs were not updated for three working days. In fact, this may mean that the level of 1.1810 acts as an interaction of trading forces, which led to a reduction in the volume of long positions.

It is still too early to talk about the recovery of the downward path set during the past month, since the quote, as before, is at the top of the correction course.

Analyzing yesterday's fifteen-minute, we can see speculative activity during 7:00-13:00 UTC+00, where the range of 1.1760/1.1780 was broken downwards. Meanwhile, the reversal began at 14:30 UTC+00 with the transition to the next day. Yesterday's low was 1.1733.

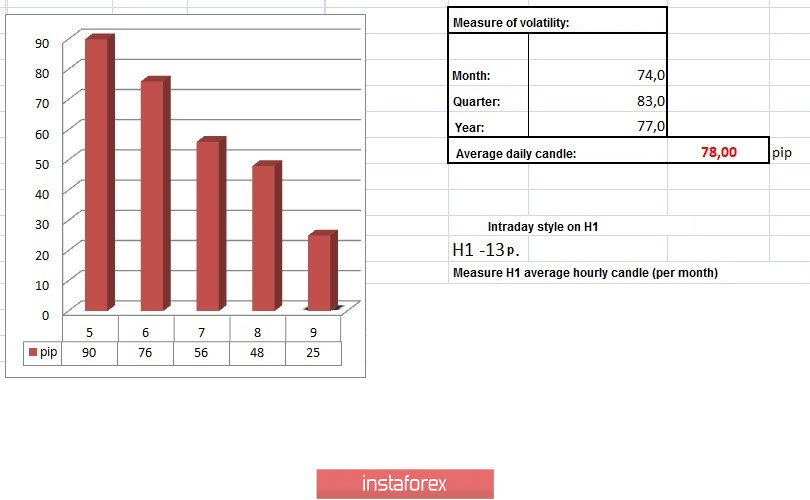

In terms of daily dynamics, the lowest indicator for 14 trading days was recorded yesterday. It amounted to 48 points, which is 38% below the average. It is worth considering that extremely low indicators have been recorded for the second day in a row, which may signal an upcoming acceleration in the market. The coefficient of speculative transactions has a high level, which is confirmed by the dynamics on minute intervals.

Considering the trading chart in general terms (daily period), we should remember that the market has a medium-term upward trend, from the spring of this year, where the current fluctuation is only a correction structure from the main trend. In other words, the downward tact for September is a trend correction, but due to the general signals from technical and fundamental analysis, the potential to change the price trend from an upward to a downward one can be assumed.

Yesterday's news background included US weekly data on applications for unemployment benefits, where the volume declined. So to start, it is worth highlighting the fact that the previous data was revised in favor of growth, and the current indicators came out with an impressive margin, which may signal a recovery in the labor market.

Initial applications will be reduced from 849,000 to 840,000, while reorders can be reduced from 11,979,000 to 10,976,000.

At the same time, the minutes of the ECB meeting last September 9-10 were published, where an interesting formulation was noticed regarding freedom of action in the fight against the damage from the COVID-19 crisis.

In terms of the information background, the market hopes for the early adoption of new stimulus measures by the US government to support the economy during this pandemic, however, the chances are extremely low before the presidential election.

In terms of the economic calendar, we do not have statistics in Europe and the US worthy of attention today. Thus, we will pay special attention to technical analysis and information background.

In terms of statistical indicators, the upcoming trading week has the final data on inflation in Europe and the United States, which most traders are interested in. At the same time, we should recall hot topics such as: Brexit, COVID-19 and the US elections.

[All time zones are in Universal time]

Tuesday October 13

USA 12:30 - Inflation for September

Wednesday, October 14

USA 12:30 - Producer price index for September

Thursday, October 15

USA 12:30 - Claims for unemployment benefits

Friday, October 16

EU 9:00 - Inflation for September

USA 12:30 - Volume of retail sales for September

USA 13:15 - Volume of industrial production for September

Further development

Analyzing the current trading chart, it was seen that the quote approached the upper limit of the range 1.1760/1.1780 during the Asian session, where the price regularly rebounded in a downward direction.

Based on the location of the quotes and price levels, it is possible to make a trading forecast from several possible market development scenarios.

The coordinate 1.1780 continues to act as a resistance, which leads to a speculative price rebound and movement towards 1.1760-1.1740.

The coordinate 1.1780 being a resistance level is still not very important, since it appeared due to the recent range (1.1760/1.1780). Thus, if the price is consolidated above 1.1785, further growth towards the main resistance level 1.1800/1.1810 can be considered.

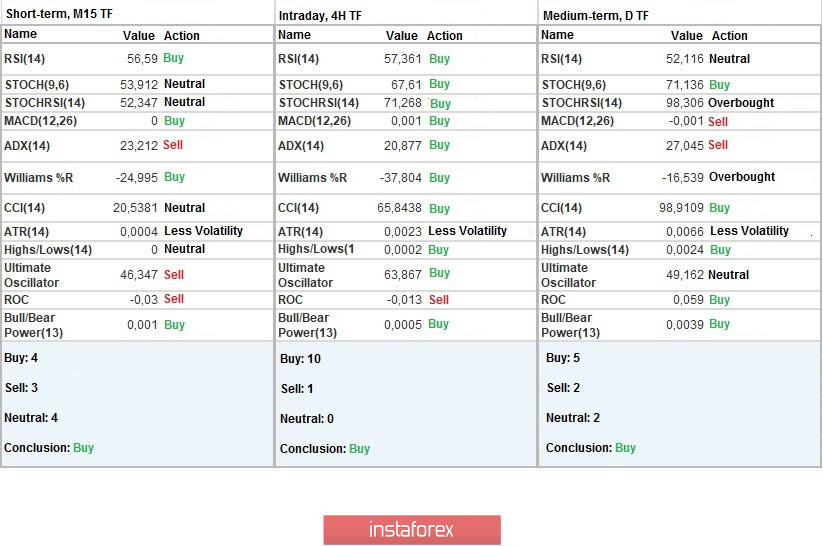

Indicator analysis

Analyzing different sectors of time frames (TF), we see that the indicators of technical instruments on the hourly and daily TF signal a buy, as the price is located at the upper part of the correctional course.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month / Quarter / Year.

(October 9 was built taking into account the publication time of the article)

The volatility of the current time is 25 points, which is 67% below the daily average. We can assume that volatility will continue to grow, due to speculative activity.

Key levels

Resistance zones: 1.1810; 1.1910; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825

Support zones: 1.1700; 1.1650 *; 1,1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***.

* Periodic level

** Range level

*** Psychological level