The U.S. trade deficit widened to $80.7 billion in December from a revised $79.3 billion in November, according to the country's Commerce Department. Experts polled by Trading Economics expected, on average, the negative US trade balance to widen to $83 billion from the previously announced $80.2 billion in November.

The main statistic this week will be the report on the growth rate of consumer prices in the United States in January, which will be released on Thursday. Analysts polled by Trading Economics predict that US inflation accelerated to 7.3% last month.

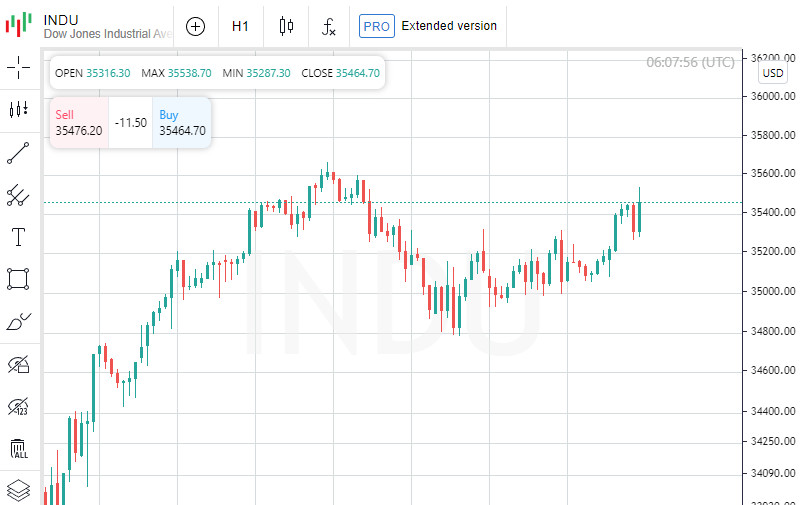

In recent days, the US stock market has seen increased volatility, partly caused by fears of a Fed rate hike. The Fed is preparing to begin tightening monetary policy at a time when the US economy is slowing down and investors are conducting a massive revaluation of assets.

The value of the Dow Jones Industrial Average on Tuesday increased by 1.06% and reached 35462.78 points, showing the best dynamics in a week.

The growth leaders in the index, in addition to Amgen, were papers of the payment system American Express Co. and insurer UnitedHealth Group Inc., which rose by 3.2% and 2.1%, respectively. Among the leaders of the fall were shares of the oil and gas company Chevron Corp. (-1.5%), sporting goods manufacturer Nike Inc. (-1.1%) and pharmaceutical companies Merck & Co. (-0.8%).

The Standard & Poor's 500 Index rose 0.84% to 4521.54 points.

The Nasdaq Composite jumped 1.28% to 14,194.45 points.

Capitalization of DuPont de Nemours Inc. increased by 6.3%. The chemical company previously reported better-than-expected earnings and revenue for the fourth quarter of 2021, raised its dividend and announced a new share buyback program.

Stock quotes for motorcycle manufacturer Harley-Davidson Inc. jumped 15.5%. The company returned to profit in the last quarter and increased revenue by 54%, stronger than analysts' expectations.

U.S. fitness equipment maker Peloton Interactive jumped 25% on news of CEO John Foley leaving to head the board and cutting the company's staff by 20%.

Amgen shares rose 7.8%. The American biotechnology company in the fourth quarter increased its net profit by 20%, although revenue was slightly worse than analysts' forecast.

The price of Nvidia Corp. rose 1.5% after news of the collapse of the deal to buy the British developer of processors Arm Holdings. Announced in September 2020, a $40 billion deal was canceled due to opposition from regulators.

Meanwhile, Pfizer Inc. fell 2.8% as the pharmaceutical company's quarterly revenue fell short of analysts' expectations.

Take-Two Interactive Software's share price tumbled 1.7% as the video game developer saw a 21% decline in net income in the third quarter of fiscal 2022, while revenue from its core business came in below market expectations.