The dollar/franc currency pair has not been in the area of our attention for a long time, thus, we will analyze it in more detail today. As usual, we will start with the technical picture.

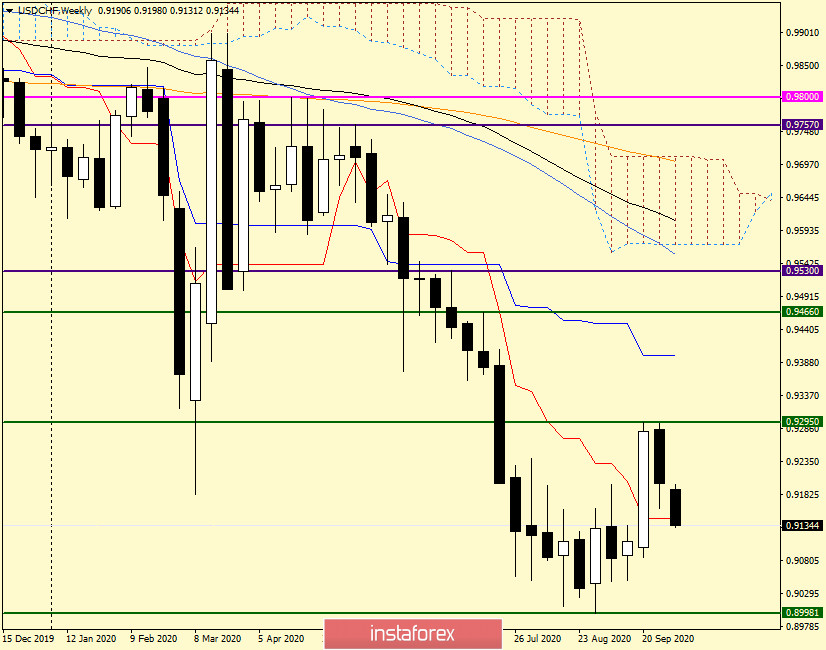

Weekly

Since this currency pair is rarely analyzed, today's analysis for the dollar/franc will start with a weekly chart. As you can see, after the corrective rise, which started from 0.8990 and ended at 0.9295, the quote again moved to the main downward dynamics. At the same time, I would like to note the technicality of the pair. Support was found near the iconic psychological and technical level of 0.9000, and resistance was met at a strong technical level of 0.9250. I believe that this is not an accident, but rather a pattern.

If you step back a little from technical analysis and recall the events that took place this week, you can recall the speech of the head of the Swiss National Bank (SNB) Thomas Jordan. At the same time, the speech of the head of the SNB did not bring any surprises. The change in the main interest rate was not even mentioned. In a quiet and peaceful Switzerland, more or less everything is normal. The situation with the spread of COVID-19 is under the control of the authorities and is much calmer compared to neighboring Belgium, where there is an active spread of the second wave of coronavirus. At the same time, some monetary pundits from the Federal Reserve (FRS) are expressing concern about the recovery of the US economy and are in favor of another reduction in the refinancing rate. Based on this, the position of the Swiss franc as a safe haven currency, in my opinion, looks more preferable. There is no doubt that the US dollar is under additional pressure from the upcoming US presidential election, as well as the inability of the White House administration to agree with the Democrats on the adoption of a new stimulus package.

Returning to the weekly chart, it is obvious that a true breakdown of the psychological level of 0.9000 can be a significant reason for the subsequent decline in the exchange rate. If the USD/CHF bulls manage to break through the mark of 0.9250, and even more so overcome another significant and strong level of 0.9300, the quote will likely rise to the mark of 0.9400, where the blue Kijun line of the Ichimoku indicator is located.

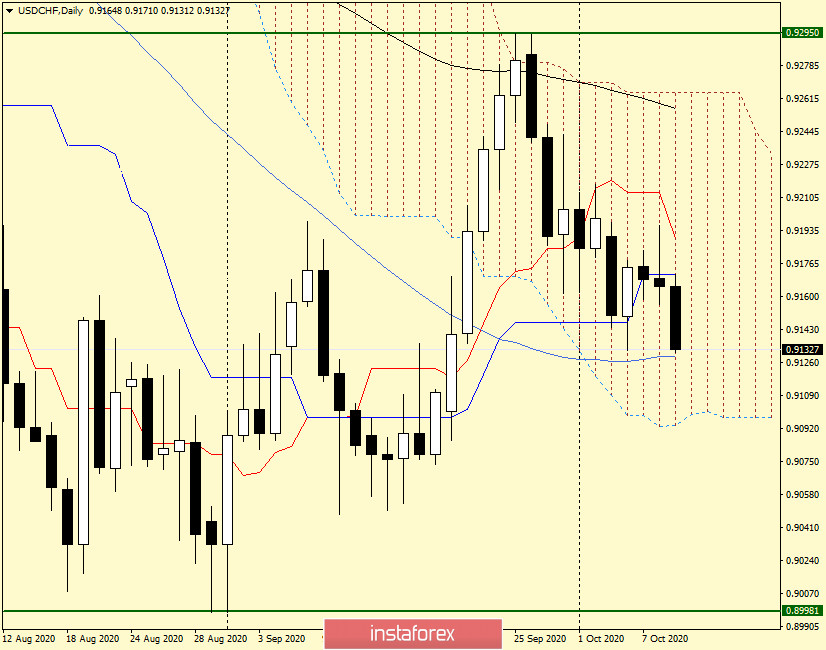

Daily

The daily chart clearly shows what a fiasco the bulls suffered on this instrument yesterday. This is indicated by the inability to break the daily Kijun line and the long upper shadow of the candle for October 8. Usually, after the appearance of such technical factors, it is time to expect a decline in the exchange rate, which is currently observed. Now the pair is trading in the lower part of the Ichimoku indicator cloud and has all chances to fall to the level of 0.9130, where the 50 simple moving average is located. I dare to assume that a true breakdown of 50 MA will send the quote to the lower border of the cloud. With this development of trading, the probability of going down from the cloud will increase significantly.

In the author's personal opinion, the main trading recommendation for the USD/CHF currency pair is sales, which are better to open after the short-term rate rises to the area of 0.9165-0.9200. If such a rise does not occur, I suggest waiting for the true breakout of 0.9000 and planning to open short positions on the rollback to this level. However, if this happens, it will most likely be next week.