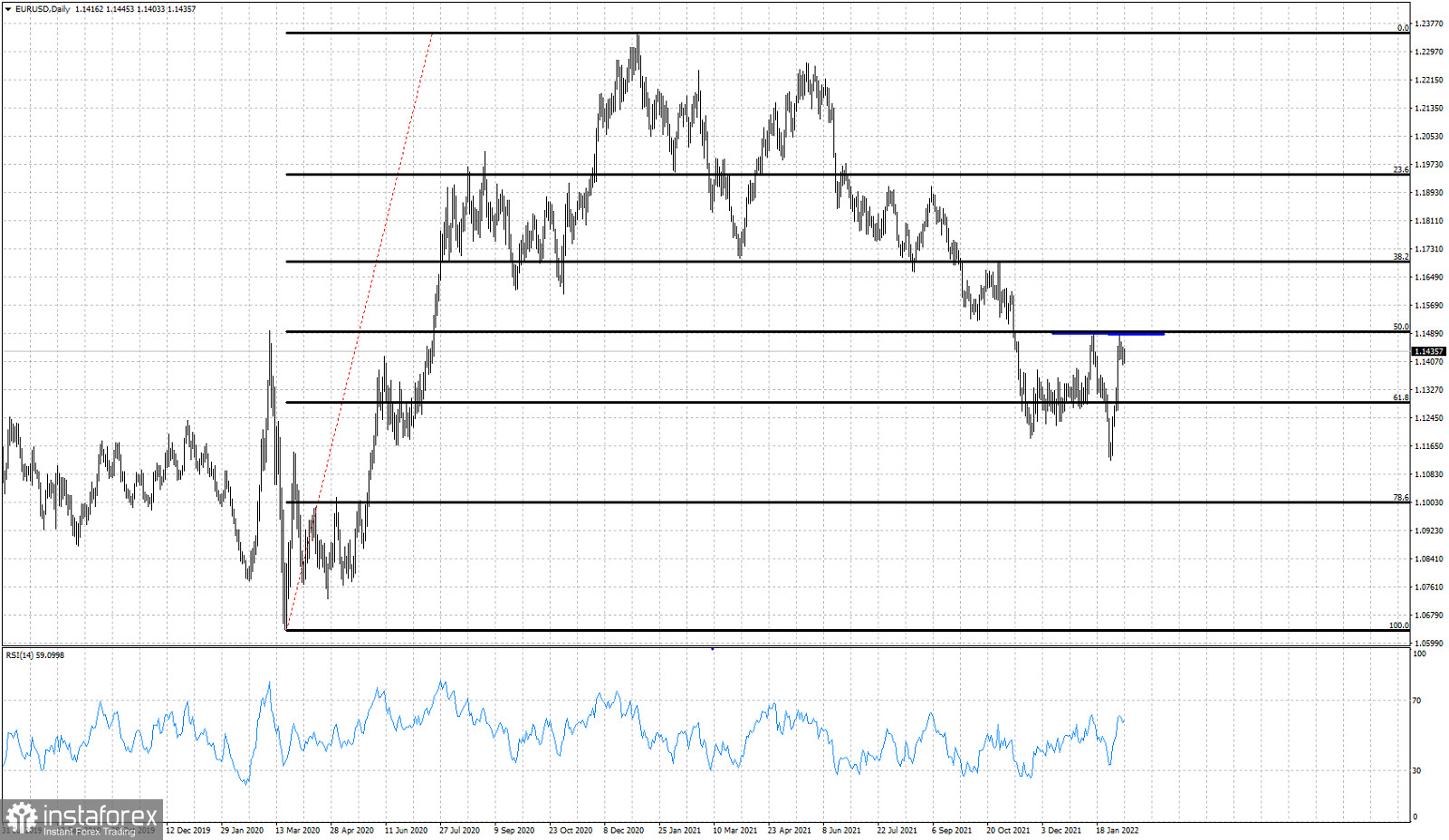

EURUSD is trading around 1.1435 steadily staying above 1.14 and above the key support of 1.1350. Short-term trend is neutral as price showed topping signs at recent highs and double top at 1.1484. However if we zoom out and see the weekly chart, price seems to be forming a base around the 61.8% Fibonacci retracement.

Black lines -Fibonacci retracements

We have mentioned many times before in all of our analysis that the 61.8% Fibonacci retracement is a key level because around this level it is very common to see trend reversals. EURUSD recently made a new lower low at 1.1122 just below the 61.8% level. The RSI did not follow. RSI made a higher low providing a bullish divergence. This is a clue we should not ignore. Specially if it is combined with a price reversal around the 61.8% level and a push above 1.15. This could mean the end of the decline from January 2021 highs and the start of a new multi week up trend.