In today's review of EUR/USD, we will summarize the results of last week and outline the future prospects for the price movement of the main currency pair of the Forex market.

Thus, at the auction on October 5-9, the US dollar weakened against all major competitors, except the Japanese yen. In particular, the euro/dollar currency pair showed strong growth and strengthened by 0.93%. The course of trading over the past five days was influenced by reports on the daily dynamics of COVID-19 infections, the struggle of the US President Donald Trump's administration with the Democrats over the adoption of fiscal incentives to combat the pandemic, and macroeconomic statistics. Thus, the minutes of the last meeting of the Federal Reserve System (FRS) did not have a decisive impact on the course of trading last week, although they led to the weakening of the US currency. Further, this is unlikely to happen, since the Fed has already placed all the emphasis, the main of which was the new approach of the regulator to assess inflation and unemployment in the United States.

As for the coronavirus epidemic, the second wave is slowly but surely covering more and more European states that are trying to counter the spread of the COVID-19 pandemic by tightening restrictive sanitary measures. At the same time, India, the United States, and Brazil are still the leaders in the daily growth of infected countries in the world.

If we identify the main macroeconomic events that may have an impact on trading in EUR/USD, then we can consider the US consumer price index, which in the light of the Fed's new approach to inflation indicators will be taken with special attention by the market participants. Important statistics are expected, which will be mentioned directly on the day of its release. It is also worth noting that this week two speeches are planned by the President of the European Central Bank (ECB) Christine Lagarde, the first of which will take place today, at 12:00 London time.

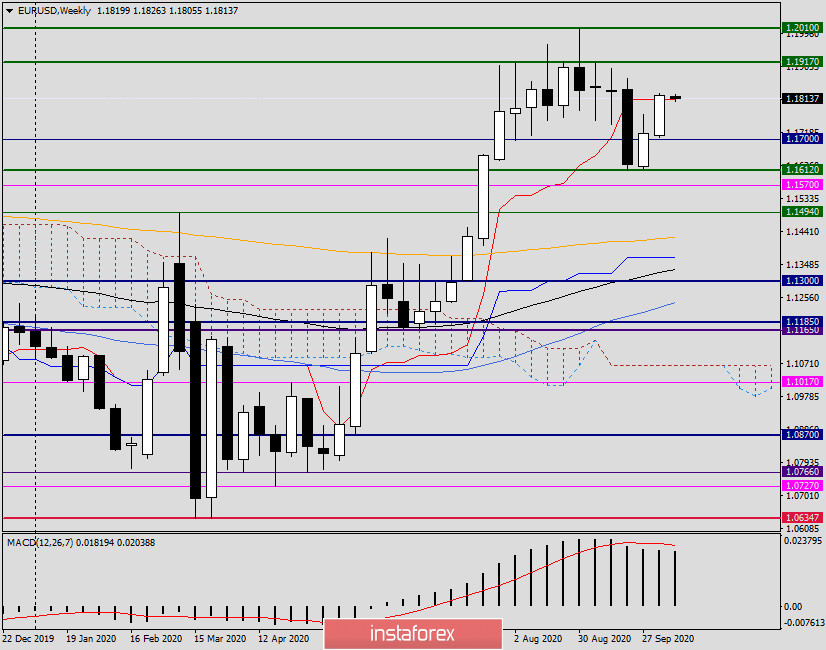

Weekly

Well, it's time to move on to the technical part of the review, and, as usual, on Mondays, we'll start with the corresponding charts. As already noted at the beginning of the article, the euro/dollar currency pair showed an upward trend last week. And, the last weekly candle actually has no upper shadow. This factor indicates a fairly strong bullish sentiment that was observed at the auction for the main currency pair, and the closing price of 1.1830 only confirms this conclusion. You should also note that the previous weekly trading closed above the Tenkan line of the Ichimoku indicator. All this taken together suggests a further strengthening of the exchange rate. If this happens, then the next targets for the euro bulls will be a strong technical level of 1.1860 and the mark of 1.1917, where the maximum trading values were shown on September 10 this year. In the event of a change in market sentiment in favor of the US dollar, the pair will again fall to the important level of 1.1700, a true breakdown of which will send the quote to a strong support zone of 1.1620-1.1600. These are the immediate prospects for the EUR/USD price movement on the weekly timeframe.

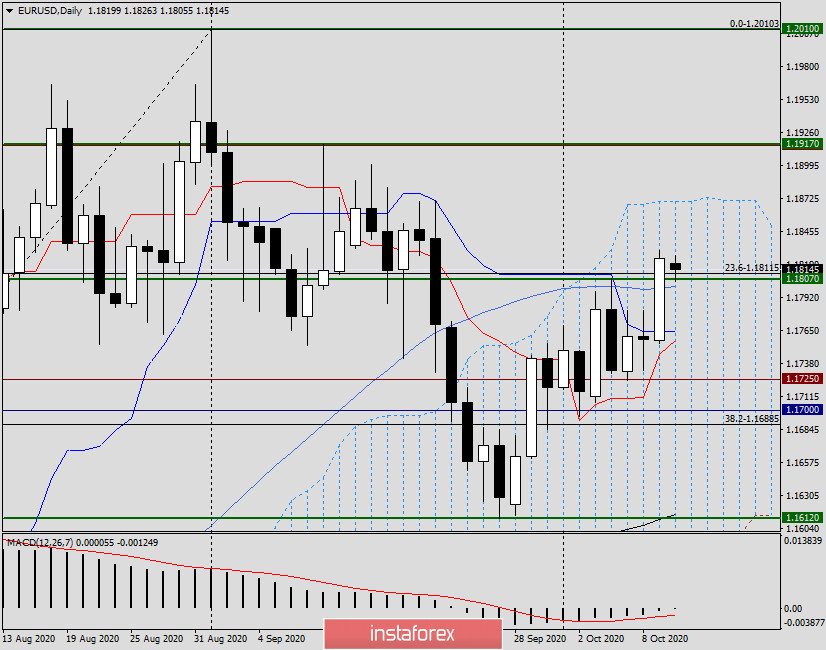

Daily

The daily chart also shows the instrument's tendency to grow. This can be seen by the pair passing up the Kijun line of the Ichimoku indicator and the 50 simple moving average. At the same time, please note that the euro/dollar is still trading within the daily cloud of the Ichimoku indicator, the exit from which will only increase the bullish mood for the main currency pair. It is important to note that the upper limit of the cloud passes at 1.1870, which is slightly higher than the previously mentioned strong technical level of 1.1860. This factor once again confirms the importance and significance of the price zone of 1.1860-1.1870, the passage of which will largely determine the future prospects for the direction of the EUR/USD exchange rate.

If we go to the trading recommendations, then taking into account the previous weekly growth and the closing price above the important and significant level of 1.1800, I think the main trading idea is to buy after declines to the broken resistance of 1.1807 or after a short-term price flight to the area of 1.1770/60. At the same time, as long as the pair has not fixed three consecutive daily candles above 1.1807 and has not come out of the daily cloud, it is impossible to exclude movement in the south direction. If bearish candlestick signals appear in the price zones of 1.1860-1.1870 and 1.1900-1.1917 on the daily four-hour or hourly timeframes, this will be a signal to open sales. This is all for today, and we will consider smaller time intervals in tomorrow's review of the main currency pair.