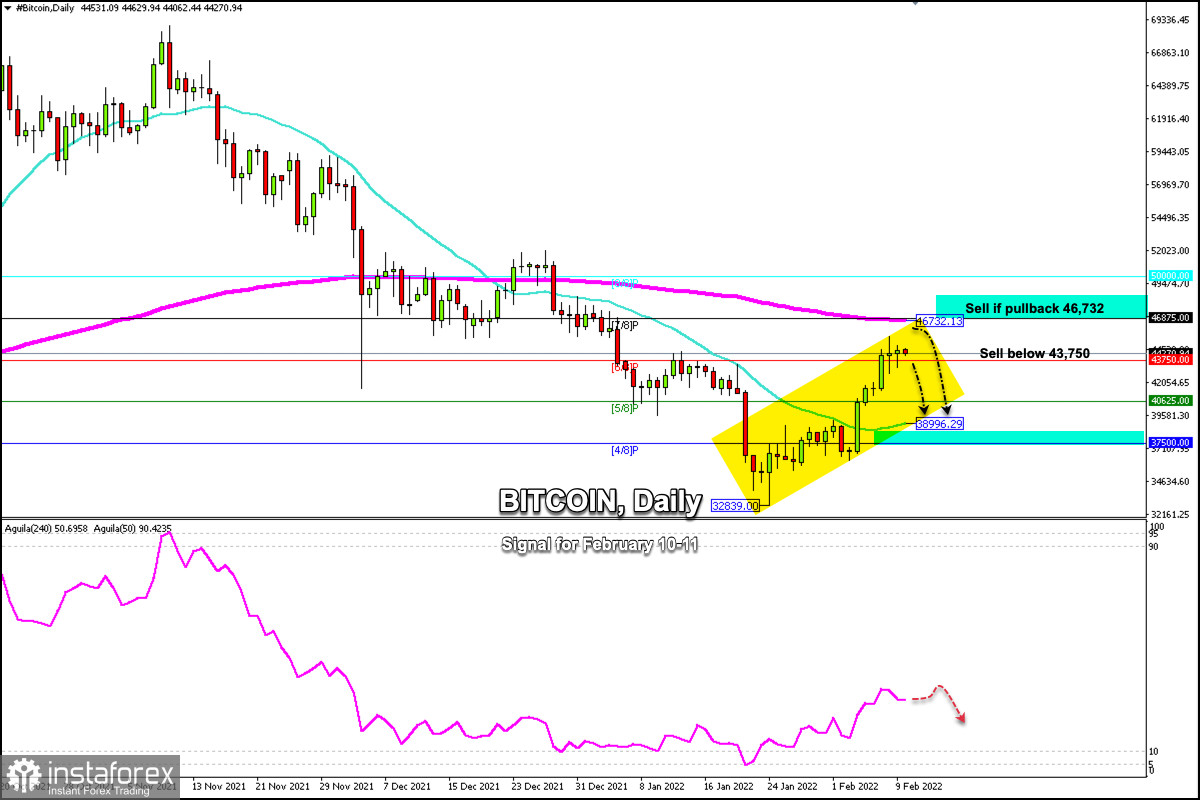

Bitcoin price is trading above the 6/8 Murray (43,750) and below the 200 EMA (46,732).

The last candles on daily charts show strong indecision in the market due to the formation of Dojis. This is a sign that a technical correction could occur in the coming days towards the area of 38,996.

The optimism of the Nasdaq-100 and the good performance of this index is helping Bitcoin to hold above the psychological level of 40,000.

Bitcoin is slowing down and has stopped just below the 200 EMA as the markets are facing some uncertainty in the face of US inflation data.

Our trading plan plan for the next few hours is to sell below 43,750, with targets towards 5/8 Murray at 40,625 and up to the 21 SMA at 38,996.

On the other hand, a pullback towards 46,732 towards 7/8 Murray will be an opportunity to sell with targets at 43,750 and up to 40,625.

The eagle indicator is showing some slowing of its bullish momentum and a technical correction is likely in the coming days.

Support and Resistance Levels for February 10 - 11, 2022

Resistance (3) 46,878

Resistance (2) 45,856

Resistance (1) 45,177

----------------------------

Support (1) 43,475

Support (2) 42,464

Support (3) 41,774

***********************************************************

Scenario

Timeframe H4

Recommendation: sell below o if pullback

Entry Point 43,750; 46,732

Take Profit 40,625; 38,996

Stop Loss 45,500

Murray Levels 37,500 (4/8), 40,625,(5/8), 43,750 (6/8), 48,875(7/8)

***************************************************************************