Yesterday's auction was quite calm. A typical Monday. At the same time, market participants are still interested in the situation with the spread of COVID-19 and the negative impact of the pandemic on the global economy, as well as the adoption of a new package of stimulus measures in the United States, where Democrats block all the initiatives of the White House. Let me remind you that last Sunday, the administration of President Donald Trump suggested that congressmen pass an even smaller bill aimed at supporting the economy from COVID-19 since the full package of assistance was blocked by Democrats. It can be assumed that in the run-up to the US presidential election, the Democratic Party does not want to give its Republican opponents a trump card and will hinder any initiatives by Trump to improve the situation in the economy. It is no secret that it was the economic success of the United States that Donald Trump attributed to himself and his administration. In his speeches, the American leader has repeatedly said that he has done more for the country's economy than any other US president. In my opinion, this is a rather controversial statement. After all, if the previous chairmen of the Federal Reserve System (FRS) Ben Bernanke and Janet Yellen did not conduct the right monetary policy, there would have been no economic success that was before the coronavirus pandemic. Bernanke helped the US economy survive the financial and economic crisis of 2008-2009 by effectively zeroing out interest rates and turning on the printing press at full capacity, providing maximum liquidity and incentives. After that, Janet Yellen picked up the baton, and after the situation normalized, she began to tighten monetary policy, returning rates to their acceptable normal levels. The current head of the Federal Reserve, Jerome Powell, is facing a global economic threat caused by the coronavirus pandemic. I believe that the US economy has a sufficient margin of safety to overcome the current problems, however, it will be very difficult to do this without a broad program of stimulus measures. In the current environment, the Federal Reserve has revised its policy on inflation and unemployment, and in this regard, investors are waiting with interest for data on the consumer price index, which will be published today, at 13:30 London time. Economists predict that in September, consumer prices will rise by 0.2%, let's see what are the actual numbers.

As for events, this week the attention of market participants will be focused on the European Union summit, which will be held on Thursday-Friday. The main topics of the summit will be Brexit, as well as the EU budget, taking into account the recently adopted fund for economic recovery in the region.

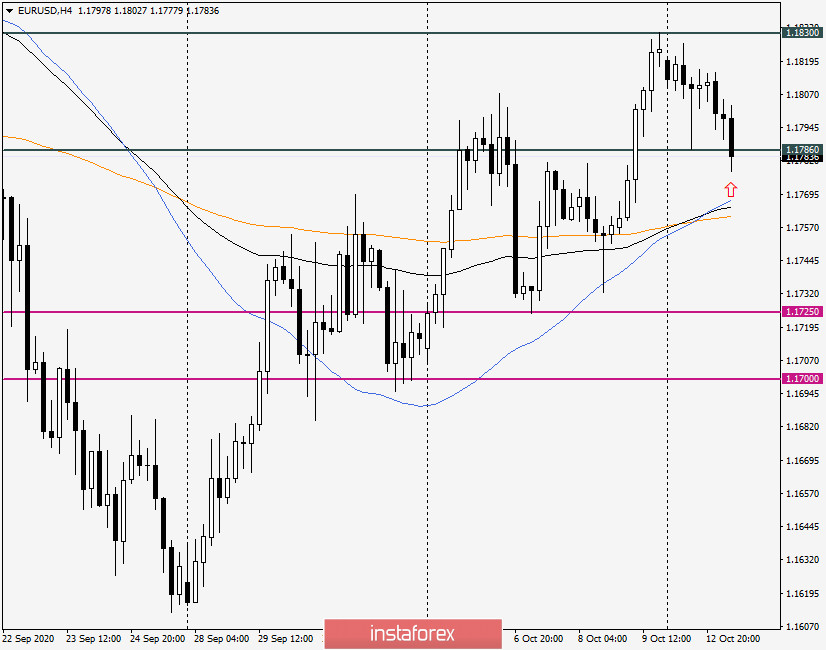

H4

As for the technical picture for the main currency pair, there were no changes. The quote is in a narrow range of 1.1830-1.1786 and is slightly reduced at the end of the review. I believe that if the downward trend continues, strong support can be provided in the price zone of 1.1786-1.1766, where the moving averages used have accumulated slightly below the support level: 50 MA, 89 EMA, and 200 EMA. In my opinion, only a true breakdown of all three moving averages and consolidation under them will indicate the readiness of the main currency pair for further decline, the immediate goal of which will be a strong and extremely important support zone of 1.1725-1.1700. Further implementation of the bullish scenario will be possible after the true breakdown of the mark of 1.1830, where there is strong resistance from sellers. If this level is passed, the next target for the euro/dollar will be 1.1870.

Given the uncertain nature of trading on EUR/USD, we can assume movements in both directions, and therefore consider options for both purchases and sales. In fact, there is no doubt that the pair will leave the current range, the question is when and in which direction? I maintain a bullish view on this instrument and suggest considering purchases after a decline in the price zone of 1.1790-1.1765 or after a breakout of the resistance level of 1.1830, on a rollback to the broken mark. In my personal opinion, it is more profitable and safe to buy lower, that is, use the first designated option.