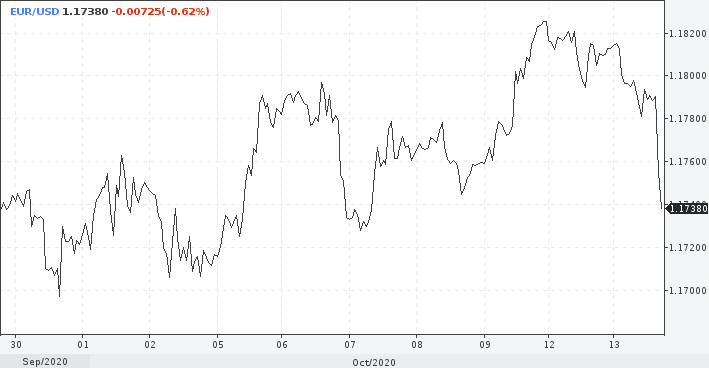

The euro accelerated its fall against the dollar on Tuesday after the publication of data from Germany. The index of investor confidence in the country's economy collapsed to 56.1 points in October from September's 77.4 points.

Recall that in two weeks, the EUR/USD pair has risen by more than 200 points. However, the upward trend that has been developing since the end of September was unstable, and the pair failed to overcome its previous high at 1.1870.

If the European currency closes Tuesday's session at levels below 1.1750, then it can quickly fall to the level of 1.1600. A breakdown of the local support level of 1.1610 will strengthen the downward trend. A breakout of the support level of 1.1285 can finally return the EUR/USD pair to the bearish trend.

However, despite today's decline, the further forecast for EUR/USD remains positive. The formation of the EU recovery fund and the general weakening of the dollar should contribute to the upward dynamics of the euro.

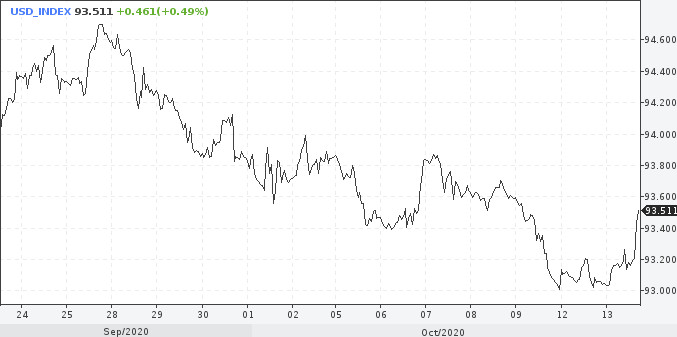

One of the reasons for the decline in the US currency is the outcome of the US presidential election. Joe Biden is ahead of incumbent President Donald Trump and the gap in the rating is constantly increasing. Markets are betting that this time the majority in the Senate will be with the Democrats, who will begin to control the work of Congress. In this case, the economy will receive the expected financial assistance, which will support the population and businesses. The Fed will also do its part, and the regulator will continue to do everything possible to restore the economy.

Societe Generale expects that the EUR/USD exchange rate will be trading around 1.20-1.30 in the new year. As mentioned above, the EU recovery fund will help to strengthen the economic growth in the region.

It is worth noting that in the medium term, the gap in the rate of economic recovery will grow and the difference in real interest rates will be corrected. The euro should benefit from this. The aggressive reaction of the US regulator to the coronavirus crisis indicates that the dollar is now only at the beginning of a long decline.

Meanwhile, on Tuesday, the greenback managed to strengthen its position after news of Johnson & Johnson's failure with the coronavirus vaccine. However, the growth of the dollar is unlikely to be large and even more stable. In addition, the overall tone remains positive for risk.

Today in the US session, the dollar index hinted at a change in the trend, breaking up the boundaries of the downward trend. The US currency is only trying to gain a foothold at higher levels, thus, the stability of this trend is out of the question now.