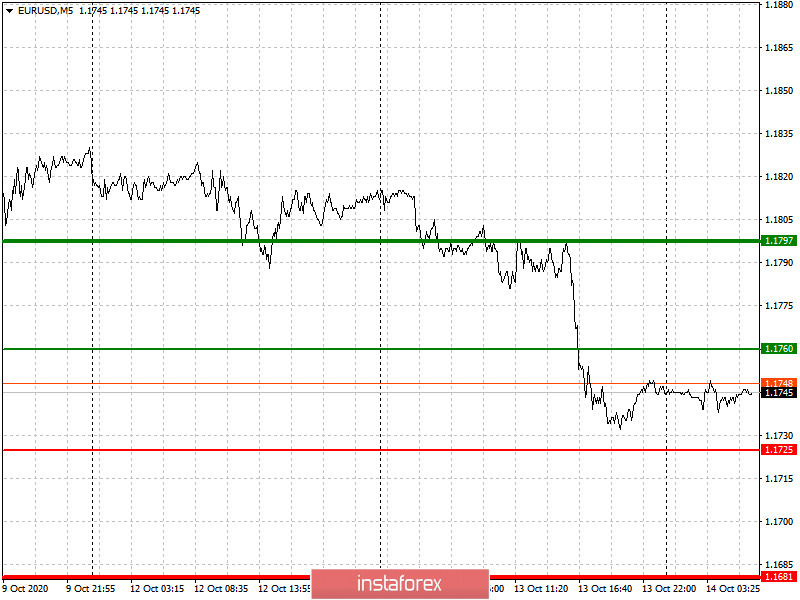

Analysis of transactions in the EUR / USD pair

The euro dropped due to the very weak report on EU business confidence, so as a result, the EUR / USD pair went down 50 pips from the level of 1.1785.

The rising inflation in the United States also added pressure on the currency pair.

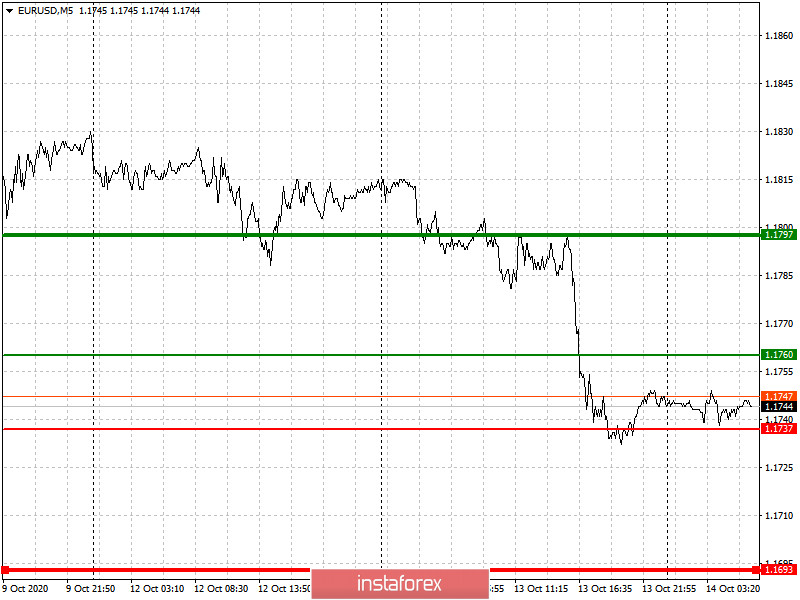

Trading recommendations for October 14

Europe is expecting a report on industrial production today. Any decrease in its volume will trigger a new wave of decline in the European currency.

Meanwhile, in the afternoon, a number of Fed representatives will make a speech, which may support the US dollar and increase pressure on the EUR / USD pair.

- Open a long position when the euro reaches a quote of 1.1760 (green line on the chart), and then take profit at the level of 1.1797. However, an upward move will occur only if good statistics are reported for the eurozone today.

- Open a short position when the euro reaches a quote of 1.1725 (red line on the chart), and then take profit at the level of 1.1681.

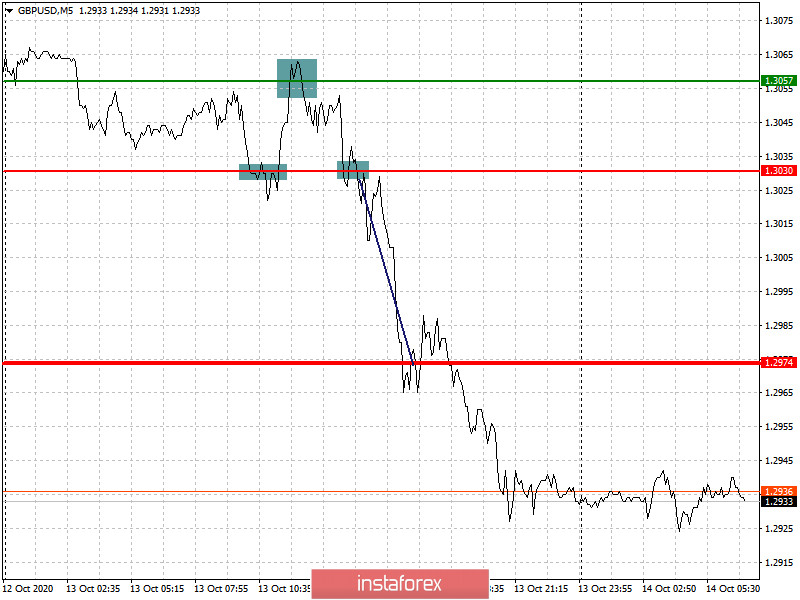

Analysis of transactions in the GBP / USD pair

Long positions were again not profitable in the GBP / USD pair, as the pound only moved downwards in the market yesterday. It was the increased UK unemployment rate that hurt the recovery prospects of the British pound.

The GBP / USD pair declined 50 pips from the level of 1.3030.

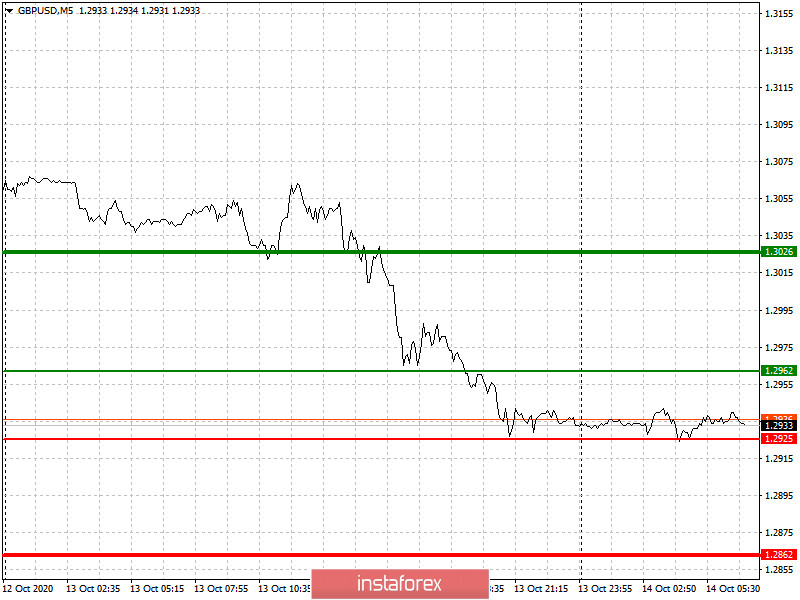

Trading recommendations for October 14

Since there are no economic statistics scheduled for release today, the focus of traders will be on Brexit negotiations, which, if fails again, will increase pressure on the British pound.

- Open a long position when the pound reaches a quote of 1.2962 (green line on the chart), and then take profit around the level of 1.3026 (thicker green line on the chart).

- Open a short position when the pound reaches a quote of 1.2925 (red line on the chart), and then take profit at least at the level of 1.2862.