Yesterday, the US dollar received support in the wake of lower demand for risky assets and some profit taking.

News that Johnson & Johnson and AstraZeneca, which are working on COVID-19 vaccines, put pressure on stocks in Europe and the United States and generally, on demand for risky assets in the world. It also seems that investors have already fully soften the idea of new stimulus measures in the US in the post-election period, which previously contributed to a convincing rally in equity markets.

On this general wave of the coronavirus pandemic, the US dollar received support. The ICE dollar index gained sharply for the first time in the last few days, holding above the 93.00 point mark and is currently at 93.55. In addition, its local strengthening can be attributed to the current picture in the US government bond market, where 2-year and 10-year notes diverged in their yields.

The investors simply ignore the emerging economic statistics, as they are completely focused on the subject of vaccines against COVID-19, as well as the results of the US presidential elections. But there really is something to see with these data.

US manufacturing inflation will be released today. It is assumed that it will grow from -0.2% to 0.2% in annual terms, and on the contrary, it will slow down the growth rate from 0.3% to 0.2% in monthly terms. Despite the fact that the market mainly monitors consumer inflation, the dynamics of industrial inflation is also important and can serve as a kind of leading indicator indicating that consumer demand will remain low, which means that interest rates in the future will be at extremely low levels.

Today, the values of industrial production in the euro area will be released. Its August growth is expected to decline from 4.1% to 0.8%. Among the important events, we should also focus our attention on the speech of ECB's President, Lagarde, Fed members Clarida and Bostic, and members of the Board of the Central Bank of Canada Lane and a member of the Bank of England Haldane.

In general, we expect that the emerging sideways trend in the markets will continue today.

Forecast of the day:

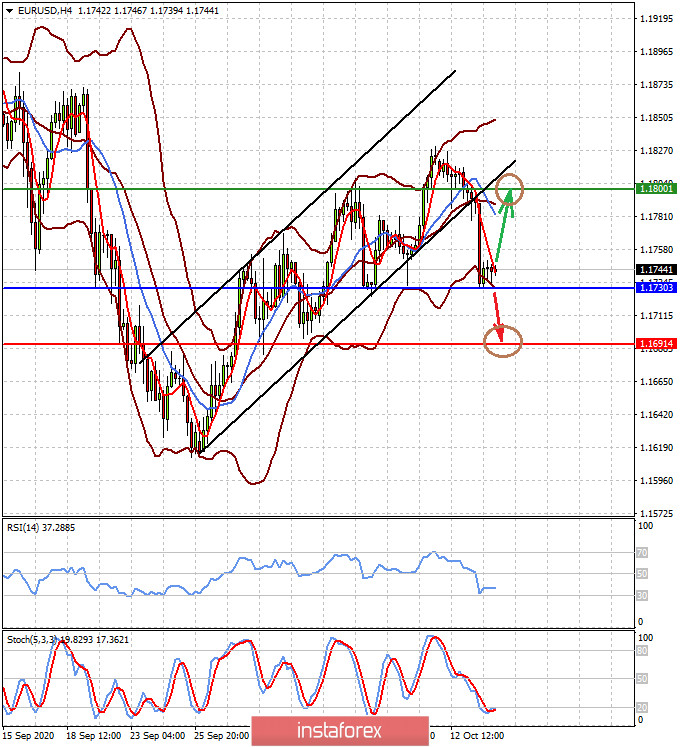

The EUR/USD pair is holding at the strong support level of 1.1730 again. If it doesn't hold out, it will decline to 1.1690. But if it resists, then the pair will turn upward and rush to 1.1800.

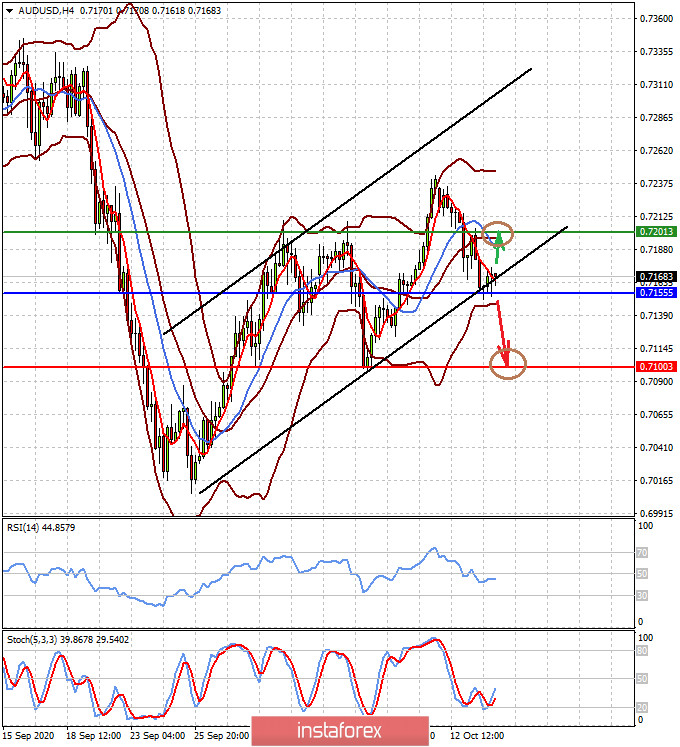

The AUD/USD is also in between. If it holds the level of 0.7155, it will rise to 0.7200. But if it declines below, it will lead further to the level of 0.7100. For this pair, the growth in demand for risky assets (shares of companies on the stock market) will be important.