Today's review of the main currency pair of the Forex market will start with the fundamental part. As already noted many times before, after the announcement of the Federal Reserve's new approach to the inflationary component, the growth of consumer prices takes on special significance for market participants. Although, it would be more correct to write — could have purchased. However, judging by yesterday's reports, it should be noted that the growth of consumer prices in the US coincided with the expectations of economists and amounted to 0.2%. Usually, when the indicator coincides with the forecast value, it is already embedded in the price of the currency, thus, it is not necessary to count on such a rapid strengthening. If you go back to yesterday's consumer price index in the US, the indicator shows growth for the fourth month in a row. Even though consumer prices are growing at a fairly subdued pace, this indicates a gradual recovery of the American economy from the effects of COVID-19. A gradual and slow recovery that will take an indefinite amount of time. This is the language that Federal Reserve Chairman Jerome Powell has repeatedly used, and so far his forecasts are coming true.

However, yesterday's index of business sentiment from the ZEW Institute in Germany upset investors, as it turned out to be significantly worse than forecasts of 73 and amounted to 56.1. However, it is difficult to judge whether this was the main reason for yesterday's fall of the single European currency. The fact is that negative data from the ZEW institute for the Eurozone and Germany were released at noon, and the main and very strong downward momentum for the EUR/USD pair occurred during the American session, at 15:00 London time.

From today's events, it is worth highlighting the speech of ECB President Christine Lagarde, which is scheduled for 09:00 (London time), and in exactly one hour we will learn about changes in industrial production in the Eurozone. Today, at 13:30 (London time), the United States will publish data on the producer price index, and at 14:00 (London time) there will be a speech by a member of the Federal Open Market Committee, Clarida. Now we turn to the technical part of the review.

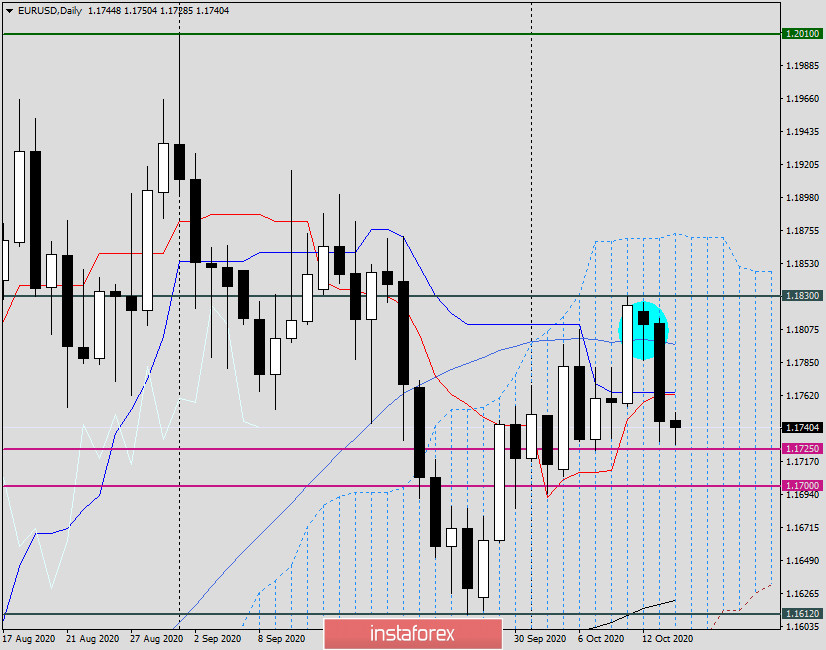

Daily

As a result of yesterday's rather strong decline, the pair broke through the Tenkan and Kijun lines of the Ichimoku indicator and ended Tuesday's trading at 1.1743. Now we can assume with the greatest confidence. That market participants still paid attention to the "hanged" candle, which appeared on October 12. This is a strong reversal pattern, and its formation under the unbroken resistance level of 1.1830 further strengthened the bearish nature of this candle. What's next? There are two possible options. If the market sentiment changes for some reason and the US dollar starts to weaken, the pair will rise and close the day's trading above the Tenkan and Kijun lines passed down. In this case, their breakdown will be considered false and you can count on the continuation of the quote rise, which will lead to a retest of the sellers' resistance at 1.1830. The second option assumes the continuation of the downward scenario, as a result of which a strong and extremely important support zone of 1.1725-1.1700 will be tested for a breakdown. If today's trading ends at 1.1700, this will lead to an even greater strengthening of bearish sentiment, and the next sellers' goals will be in the area of 1.1620-1.1600.

Now, follow the trading recommendations. The initial assumption about the growth of EUR/USD, made on Monday, has not yet been confirmed. In my opinion, the market situation has already changed or is changing. At the moment of the article's completion, the pair is in a flat and is preparing for the next move. I believe that the main trading idea for today can be considered sales, which are best considered on attempts to correct growth in the price zone of 1.1760-1.1770. If the market does not provide such a pullback, you can try selling from current prices more aggressively.