Stock indices are changing in different directions this morning, which led to no single trend. The US dollar, in turn, goes sideways amid uncertainty about the prospects for another stimulus package.

Trump proposes to introduce more incentives than Mnuchin and Pelosi, which is more than the Democrats can offer and obviously, some Republicans are willing to do it. This perseverance is perceived as an election game, but in reality, everything is much more serious, and any future President, whether Trump or Biden, will be forced to solve the problem of falling real incomes of the population, which will then determine both the pace of the US economic recovery and the global status of the USD.

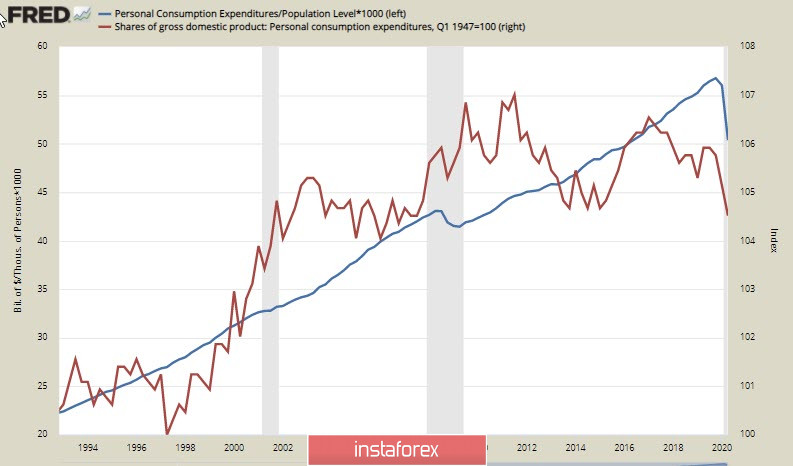

Trump's four years in the office have been characterized by huge budget deficits that have no historical precedent, while pressuring the Fed to monetize the deficit. In turn, the deficit arose due to long-term slowdown in real incomes. At the same time, the PCE index experienced the strongest drop in history in terms of the number of able-bodied citizens, almost tripling the result of 2008/09. As a result, the share of PCE in the GDP structure declined to the level of 2006.

The continuation of the trend will lead to a decline in tax collection as well as GDP, since it is simply unrealistic to maintain the standard of living with such a deficit.

The Treasury's account with the Fed currently holds about $ 1.7 million, but it can only be used after they ask permission from Congress. Accordingly, if a political resolution takes place, it can result in a strong rally until the end of the year, a depreciation of the dollar, an increase in stock indices, commodity prices, and demand for risky assets.

The Fed will continue to monetize debt as long as inflation averages below 2%. However, an inflation growth while there is a decline in PCE is unlikely without additional incentives. Fed members are increasingly using rhetoric in their public speeches about the need to step up quantitative easing as soon as there is agreement on a financial deal in Congress. Since the need to expand incentives is recognized by both sides, we need to prepare for reflation in 2021, regardless of the election results.

EUR/USD

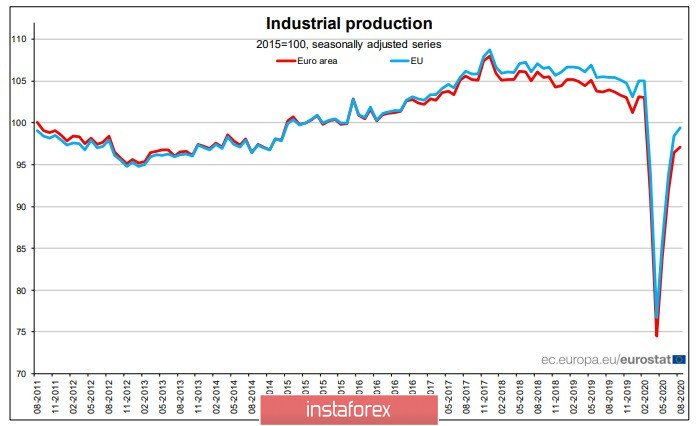

The level of industrial production in the eurozone partially recovered after the collapse in the Q1, but it only grew by 0.7% in August, with an annual drop of 7.2%. Meanwhile, the trend of slowing began to manifest itself long before the pandemic. It is clear that the Euro zone needs to prepare for its own stimulus measures.

On Tuesday, the Bundesbank published its Financial Stability Survey, in which it suggested that a sharp increase in bankrupt cases is expected by early 2021. This will increase the burden on the banking system and lead to a reduction in lending and, as a result, to a recovery slowdown.

Following their Fed colleagues, ECB members, commenting on the current economic situation, admit the expansion of stimulating measures. In particular, the head of the Central Bank of Austria, Holzmann, said yesterday that a greater level of monetary or financial accommodation is necessary in the short-term, and without restrictive measures, monetary and fiscal policy can make it to the extreme limits.

It was assumed in the previous review that the Euro is forming a local high and will start moving towards 1.15. This forecast remains relevant. Here, the nearest goal is 1.1680/1700, after which, we can continue further to the level of 1.1612.

GBP/USD

Yesterday, the pound rose after Bloomberg reported on a draft text of the EU summit declaration, which notes that although there is no progress to enter the final stage of negotiations on a trade agreement between the UK and the EU after Brexit, EU representative Michel Barnier was instructed to continue negotiations with his British colleagues.

The crucial moment will come at the end of October. Regardless of the result of the negotiations, Brexit "without a deal" will become a reality due to the inability to meet the deadline until December 31. Without a deal, the pound will make a reversal and start moving to 1.2420/50, but if positivity is confirmed, we can expect growth to 1.3150/80.