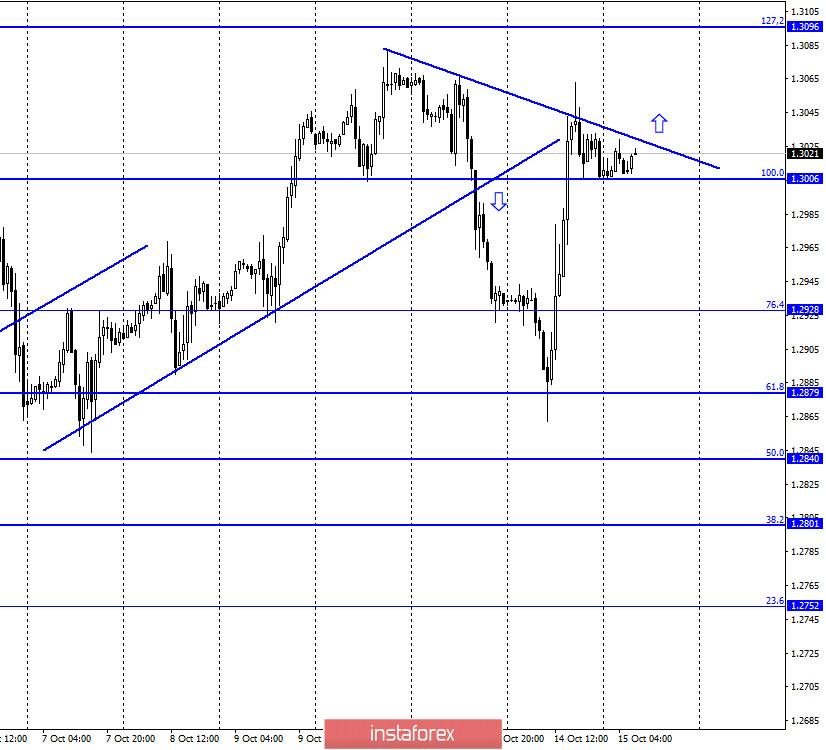

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the English currency and returned to the corrective level of 100.0% (1.3006) and a new downward trend line. The rebound of the pair from this line will work again in favor of the US currency and some fall in the direction of the Fibo levels of 76.4% (1.2928) and 61.8% (1.2879). Closing above the trend line will increase the probability of further growth in the direction of the corrective level of 127.2% (1.3096). Meanwhile, another important process has begun for the Briton. Today, October 15, the EU summit began, during which the issue of concluding a trade deal with the UK should be resolved. However, according to many experts, no deal will be announced today or tomorrow. Both Boris Johnson, Michel Barnier, and EU leaders say that progress in the negotiations is too small for a trade agreement to be concluded. Moreover, earlier Brussels and London agreed to extend the negotiations for 1 month, thus, today and tomorrow absolutely no important decisions will be made. The British Prime Minister expressed regret for the lack of progress in recent weeks and said that further decisions will be taken after the summit and the announcement of its results. However, most experts agree that the deal will not be agreed upon. The parties stand their ground and do not want to give in on key issues.

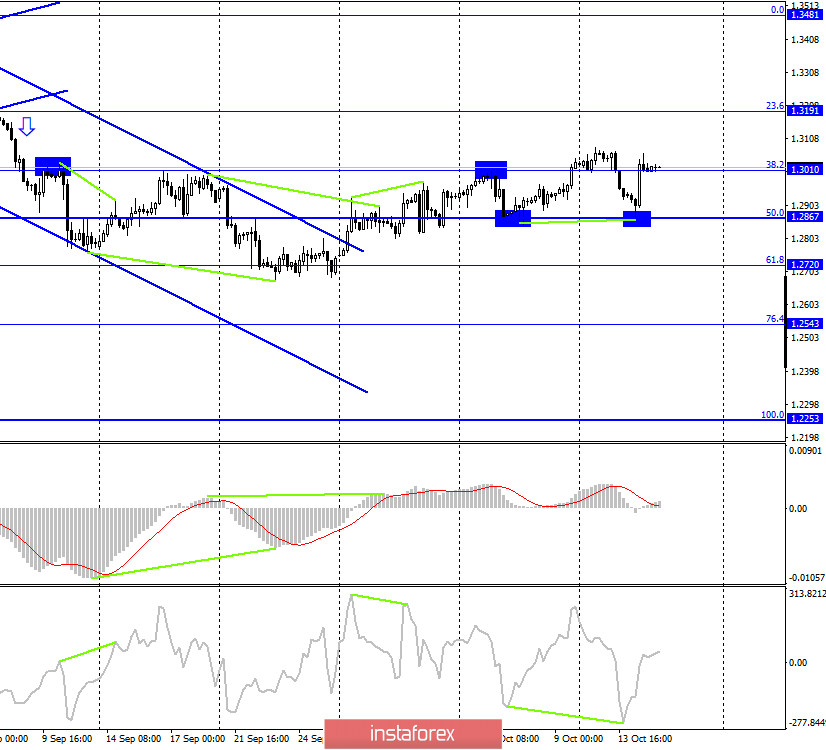

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the corrective level of 50.0% (1.2867), a reversal in favor of the British currency, and consolidation above the Fibo level of 38.2% (1.3010) during yesterday. There was also a bullish divergence in the CCI indicator, which coincided with the rebound. Thus, traders can expect further growth in the direction of the corrective level of 23.6% (1.3191), if the hourly chart manages to consolidate above the downward trend line. Otherwise, a reversal will be performed in favor of the US currency.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal near the corrective level of 76.4% (1.3016) in favor of the US currency and began the process of falling towards the corrective level of 61.8% (1.2709).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. The pair returns to a downward trend.

Overview of fundamentals:

There were no economic reports or important news in the UK or America on Wednesday. Nevertheless, the EU summit that has begun, the topic with the US elections, and the topic with the spread of COVID-2019 in the UK are of great importance for the pair.

News calendar for the US and the UK:

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On October 15, the US and UK news calendars do not contain anything interesting, however, information from the EU summit may be received. Important information for the British.

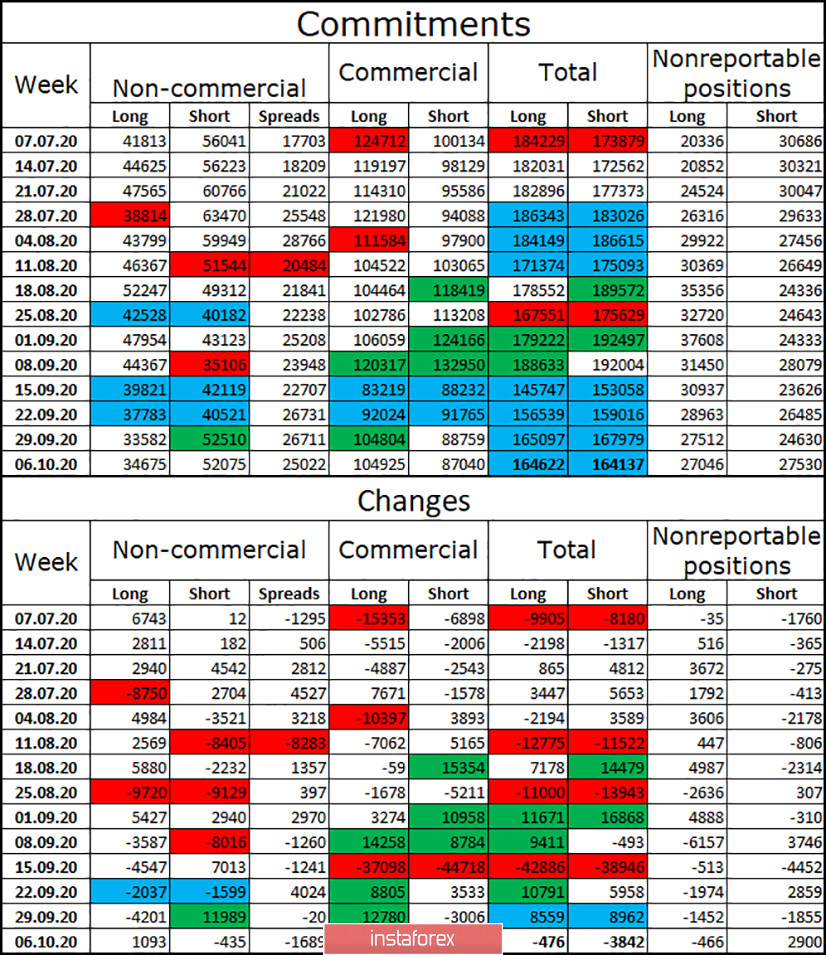

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that there were no changes as such during the reporting week. The "Non-commercial" category of traders opened only a thousand long contracts and closed 435 short contracts. Thus, the changes are minimal and do not allow us to draw any long-term conclusions. In total, speculators continue to hold a larger number of short contracts, which indicates their belief in the fall of the British dollar. And it is in the last two weeks that the number of these contracts has grown significantly. In general, the market is in almost perfect balance. The COT report shows that a total of 164,622 long contracts and 164,137 short contracts are open.

Forecast for GBP/USD and recommendations for traders:

Today I recommend buying the GBP/USD pair with a target of 1.3096 if it is fixed above the trend line on the hourly chart. I recommend selling the British dollar with the goals of 1.2928 and 1.2879 if a rebound from the trend line on the hourly chart is made and the close is under the Fibo level of 100.0% (1.3006).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.