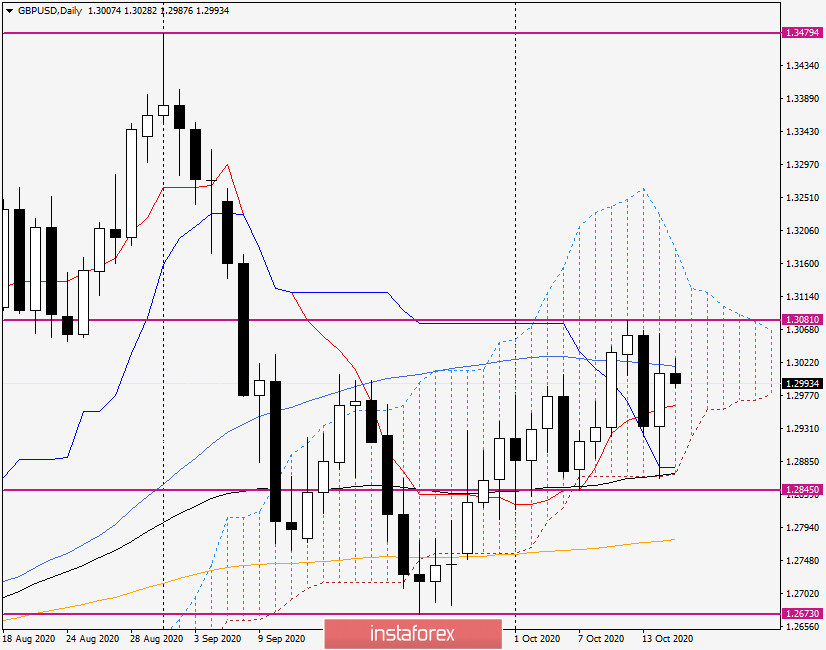

Daily

Yesterday's trading day ended with a fairly good growth for the GBP/USD currency pair — the closing price was 1.3007. The highs were shown at 1.3063, while the lows were indicated at 1.2862.

In the run-up to the European Union summit, that will be held on Thursday and Friday, the pound is clearly in a fever, which is not surprising at all. Note that one of the most important topics of this upcoming event will be the Brexit negotiations for it can eliminate all the contradictions that prevent the signing of a trade deal between the EU and the UK. However, as some reputable news agencies suggest, real prerequisites for reaching a trade agreement between the parting parties may be insufficient. If that is the case, then the upcoming EU summit risks being another "pass-through" or simply - fruitless. You can estimate options now, but it is better to wait for the results of the summit and make appropriate conclusions after the negotiations are completed.

In the technical picture, we should note that yesterday's assumptions about price dynamics were fully justified. This refers to the support that the blue Kijun line of the Ichimoku indicator, the black line of the exponential average, and the lower border of the cloud should have provided to the quote. As you can see, the pair once again flashed excellent technique and, having dropped to the lower border of the cloud and the listed indicators, began an active recovery. The obstacle to further growth is still the 50 simple moving average, which runs at 1.3017. So today, the pair made an attempt to continue yesterday's growth, but 50 MA at this stage of time does not allow the quote to go higher.

It can be assumed that the 50 MA and the red Tenkan line will be the benchmarks for further price movement of GBP/USD on the daily chart. If trading closes above 50 MA, the pair will open the road to a strong resistance zone of 1.3063-1.3081, where the highs of yesterday's session and trading on October 12 were shown. A break of 1.3081 will significantly strengthen the bullish mood for the pair, and then we will mark the next targets at the top. If the day closes below the Tenkan line, there will be a real possibility of a second attempt to exit down from the Ichimoku cloud and break through the 89 exponent.

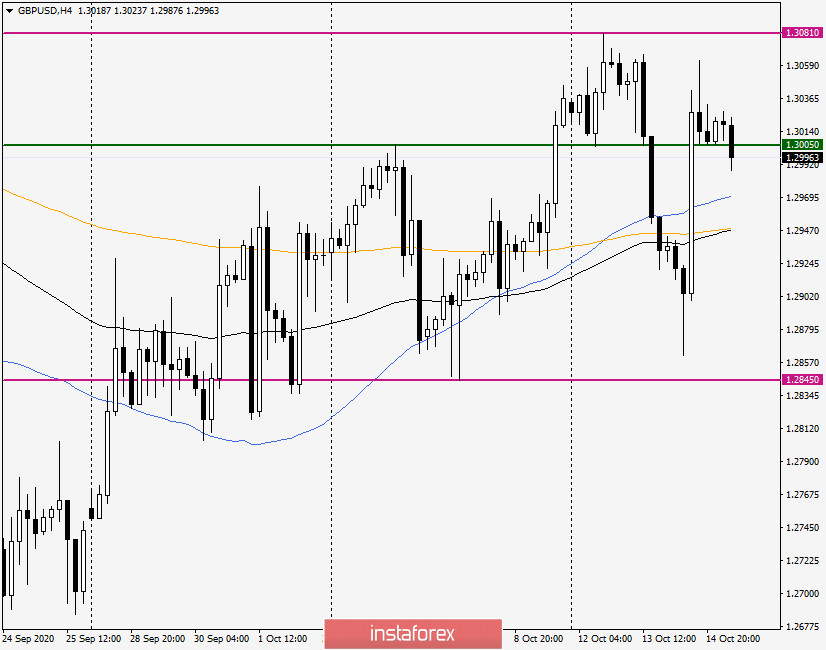

H4

In the four-hour timeframe, the pair went up the used moving averages (89 EMA, 200 EMA and 50 MA), and at the end of the review, it shows the intention to roll back to the moving averages broken the day before. If this happens, the pair may find strong support around 1.2970 and turn up.

Moving on to the trading recommendations, it is important to note that the situation for the pound is just as uncertain as for the euro/dollar. Based on this, it is better to consider both positioning options or stay out of the market until the situation is clarified. For those who want to trade, it is advisable to consider purchases after a short-term decline in the price zone of 1.2975-1.2960. At the same time, sales will become relevant after the rise to the strong and important price zone of 1.3000-1.3050 and the appearance of bearish reversal patterns of candle analysis there. We will return to the consideration of the pound/dollar currency pair tomorrow. For all we know, the situation might become more clear and trading recommendations might become more unambiguous.