Crypto Industry News:

According to the published announcement, the government and the central bank in Russia have reached an agreement on the regulation of cryptocurrencies.

The Russian government and central bank are now working on a bill that will define cryptocurrencies as "currency equivalents" rather than digital financial assets. Cryptocurrencies would only function in the legal industry if they had full identification through the banking system or licensed brokers. Bitcoin transactions and possession of cryptocurrencies in the Russian Federation are not prohibited, however, these activities must take place through a "digital currency exchange organizer" (bank) or peer-to-peer exchange licensed in the country.

The report also stressed that you would have to declare cryptocurrency transactions worth more than 600,000 rubles - otherwise this action could be considered a crime. Those who illegally accept cryptocurrencies as payment will face penalties.

The news comes after months of speculation about how the Russian government will handle digital currencies. While it's still unclear what this decision will mean for businesses and citizens in Russia, the country seems to be slowly embracing the idea of cryptocurrencies.

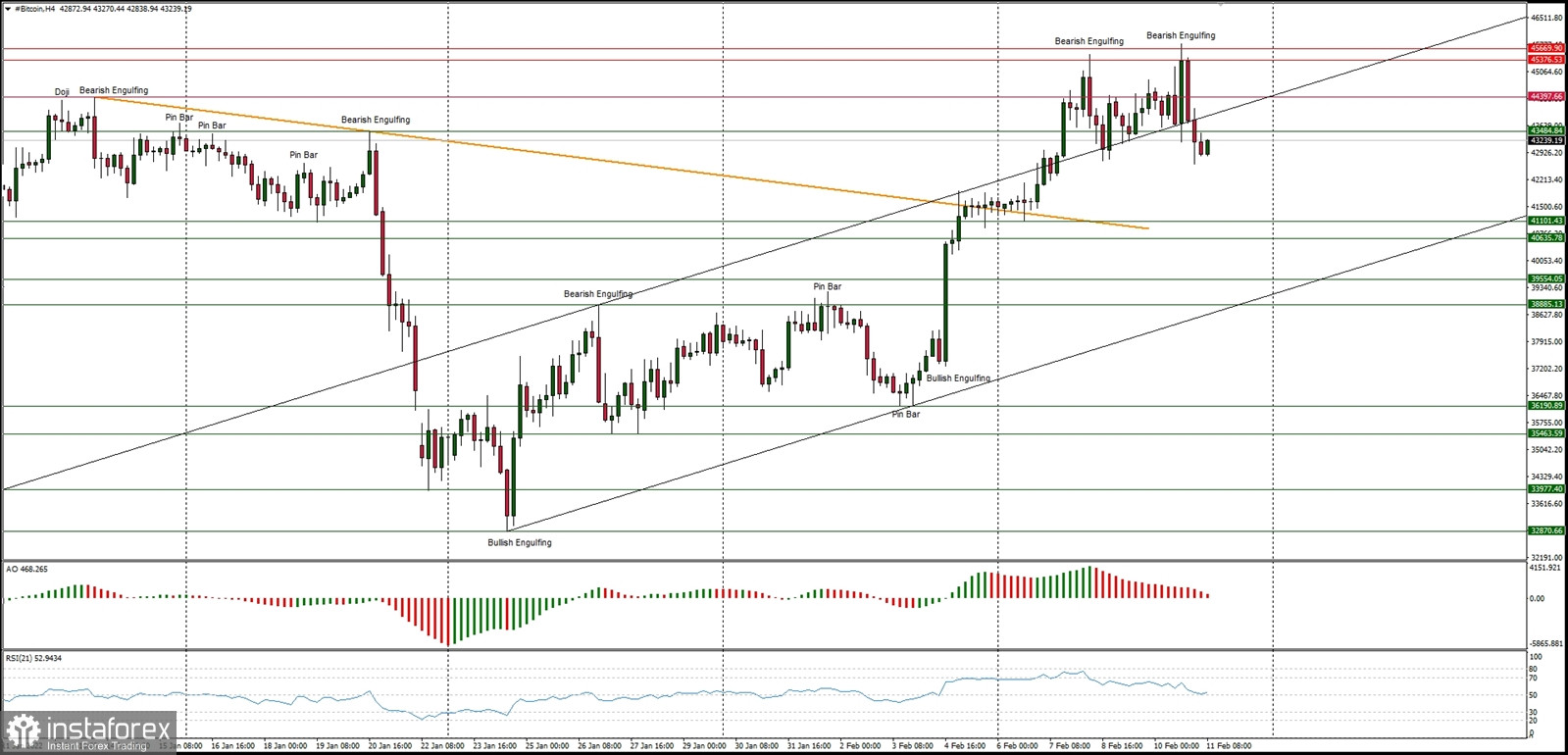

Technical Market Outlook

The BTC/USD pair has made a new swing high at the level of $45,811, but the rally was capped after the Bearish Engulfing pattern occurred again. The market pulled-back from the highs, but still remains above the upper channel line around the level of $44k. The next target for bulls is seen at the level of $46,673 (38% Fibonacci retracement level).The bulls are in control of the market on the lower time frames as the momentum is strong and positive on the daily time frame chart as well, so the market is bouncing from the extremely oversold conditions. The nearest technical support is seen at $42,700 and $43,484.

Weekly Pivot Points:

WR3 - $50,386

WR2 - $46,257

WR1 - $44,577

Weekly Pivot - $40,396

WS1 - $38,765

WS2 - $34,482

WS3 - $32,499

Trading Outlook:

The market is bouncing after over the 80% retracement made since the ATH at the level of $68,998 was made. The level of $44,442 is the next key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend.