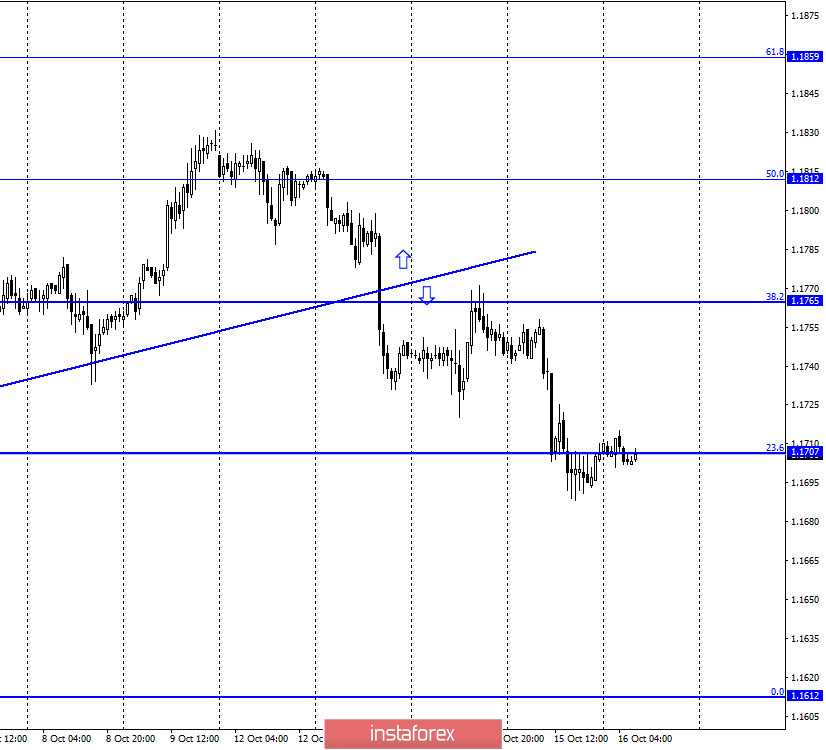

EUR/USD – 1H.

On October 15, the EUR/USD pair performed a new reversal in favor of the US currency and fell to the corrective level of 23.6% (1.1707). Fixing the quotes below this Fibo level will allow traders to expect the quotes to continue falling in the direction of the next corrective level of 0.0% (1.1612). Meanwhile, it is quite difficult to find the reasons for the growth of the US dollar at this time. There has been no major news in America or the European Union in recent days. And so COVID-2019 comes out on top. If everyone is already used to high levels of morbidity in the United States (40-60 thousand per day), then in Europe the summer was relatively calm. The first wave was suppressed in almost all European countries, but with the arrival of autumn, the number of newly ill people began to grow dangerously. And just a few days ago, the European Union surpassed America in terms of the number of diseases per 100,000 citizens. In Poland, the Czech Republic, Germany, the Netherlands, and Portugal, anti-records for the number of cases have been updated in recent days. France and Spain are once again leading the way in the number of COVID cases reported daily, and the count is already in the tens of thousands in these countries. Even the EU summit had to be interrupted because of the possible infection of the head of the European Commission Ursula von der Leyen. This is how things are now in Europe, and it seems that traders are very sensitive to the second wave of the epidemic in the EU.

EUR/USD – 4H.

On a 4-hour chart, the graphic picture remains very boring. Although the price continues to fall on the hourly chart, the pair continues to trade inside the side corridor on the 4-hour chart. The fall brought the pair to the lower border of the side corridor. Thus, a rebound from this line will work in favor of the European currency and some growth in the direction of the upper border. At the same time, fixing the pair's rate under the side corridor will increase the probability of a further fall in the direction of the 100.0% correction level - 1.1496.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a rebound from the Fibo level of 261.8% (1.1825) and a reversal in favor of the US currency. Thus, now traders can count on a new process of falling in the direction of the corrective level of 200.0% (1.1566).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 15, a new speech by Christine Lagarde took place in the European Union, and a report on applications for unemployment benefits was released in America. However, both of these events did not have any impact on trading, as traders are now closely monitoring the COVID-2019 epidemic in Europe.

News calendar for the United States and the European Union:

EU - consumer price index (09:00 GMT).

US - retail trade volume change (12:30 GMT).

US - industrial production volume change (13:15 GMT).

US - consumer sentiment index from the University of Michigan (14:00 GMT).

On October 16, the European Union is scheduled to report on inflation, and in America, the report on retail trade will attract the most attention.

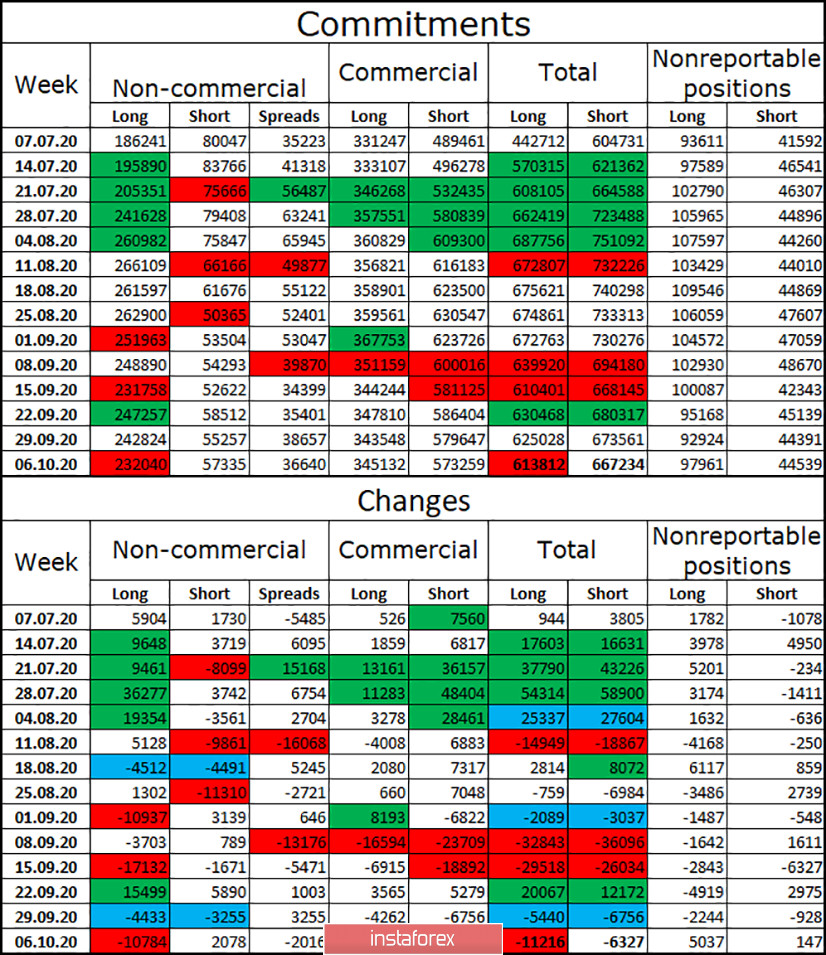

COT (Commitments of Traders) report:

The latest COT report was quite informative. The most significant and important category of "Non-commercial" traders continues to get rid of long contracts, closing almost 11 thousand during the reporting week. Also, about 2 thousand short contacts were opened, so the mood of major players concerning the European currency has become much more "bearish". However, in general, I can't say that in recent months, major players have started to look in the direction of selling off the euro. Since the beginning of August, the total number of long contracts in the hands of speculators has been decreasing, but the total number of short contracts is also decreasing. In total, there are four times more long contracts in the hands of Non-commercial than short contracts. Thus, I would say that the chances of the continued growth of the European currency are still high.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1612, if the close is made under the level of 23.6% (1.1707) on the hourly chart and under the lower border of the side corridor on the 4-hour chart. Purchases of the pair today will be possible with a target of 1.1765 if a rebound is made from the lower border of the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.