The demand for defensive assets, particularly the dollar, increased amid the worsening coronavirus crisis in Europe and the U.S., as well as due to the stupor with the stimulation of the American economy. The pressure on the U.S. stock markets continues on Friday.

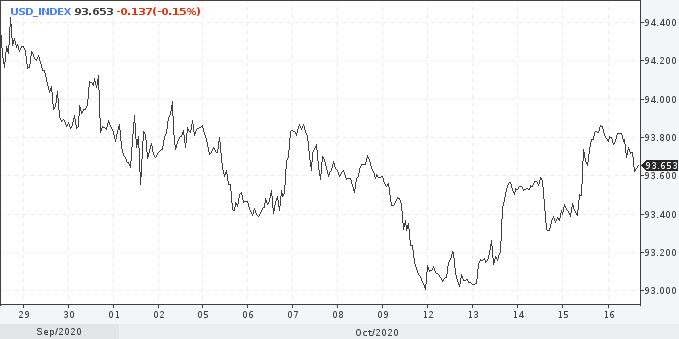

Meanwhile, the dollar index is declining again. Before the start of the U.S. session, it was trading around 93.60, which is more than 20 points below the local intra-week high. On Friday, the greenback declined against the yen, euro, and pound, whose share in the index is about 14%, 57%, and 12%, respectively.

Traders are analyzing US macroeconomic data that can give new impetus to stock markets and the dollar. Retail sales in September were up 1.9% over August. Analysts predicted less significant growth of the indicator by 0.7% in monthly terms.

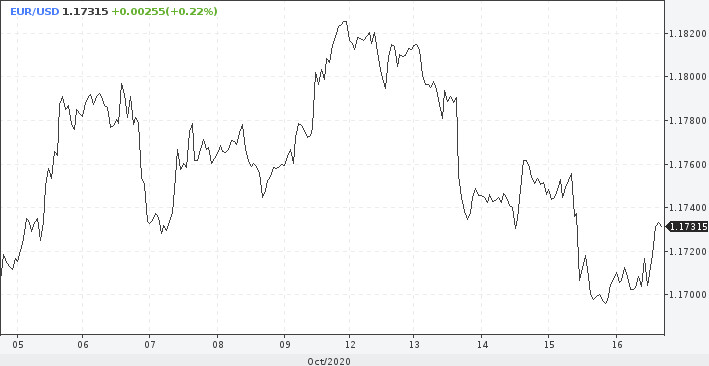

Despite the rebound on Friday, the EUR / USD pair remains under pressure due to the increase in the coronavirus cases in Europe. Several countries in the eurozone may continue to introduce quarantine measures, which will negatively affect the economic activity of the region.

Meanwhile, the adoption of a program to support the European economy in the form of a €1.8 trillion spending package at the end of July gives a positive impetus to the euro. With the resumption of the fall in stock indicators, the US dollar is likely to grow, which will force euro buyers to move away from the recent local lows at the support level of 1.1610.

If we look at the technical side of the movement of the EUR/USD pair, we can say with confidence that now the euro continues to develop a downward trend. Quotes form a correction on Friday before another decline. The target, as indicated above, is the area of the next support level 1.1610. The development of the situation with the aim of returning to the levels above 1.18 should not be excluded either.

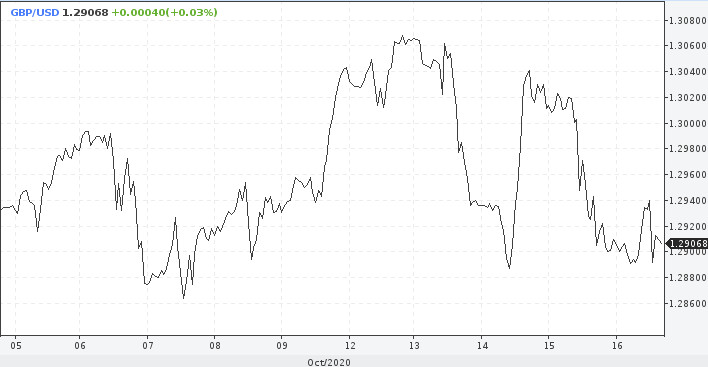

Judging by the muted dynamics of the pound, traders are not paying attention to the risk of no trade deal with the EU, and perhaps for nothing. The British Prime Minister lashed out at the EU with another criticism. Boris Johnson claims that Europe is trying to maintain control over the UK's trade, and this is unacceptable for an independent state.

Following the statements on Thursday, the EU may not plan to extend the transition period, which expires on January 1 next year. Nothing changes, and there is no point in continuing to argue and trample in one place. Thus, there are 10 weeks left for everything, and the chances of concluding a trade agreement tend to zero.

If Britain decides to leave the EU without a deal, the pound risks falling to the dollar by 1.7–4.7%. This means that sterling, which is trading just above 1.29 on Friday, may sink to 1.23.

The rejection of the deal will be a real shock to the British economy, which is already weakened due to the pandemic. Investors have long considered a no-deal exit as a real scenario, but they still have a glimmer of hope for an agreement. This means the markets' reaction to a no-deal Brexit could be disastrous.

The medal has a reverse side, which also should not be forgotten. In this case, we are talking about concluding a deal that will cause the pound to grow both against the dollar and against the euro. However, sterling is already trading at a premium to fair value, which means the rally may be limited.