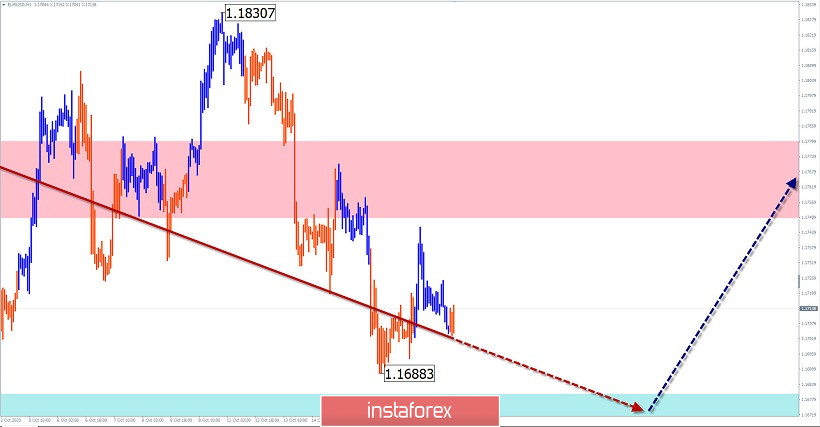

EUR/USD

Analysis:

On the chart of the major European currency, the current wave for short-term trading started up on September 25. It completes a larger upward wave zigzag. In the wave structure, the middle part of the movement is nearing completion.

Forecast:

Today, the pair's market is expected to place the price in the side plane between the opposite zones. In the first half of the day, an upward trend is likely. By the end of the day, you can expect a reversal and a decline in the support area.

Potential reversal zones

Resistance:

- 1.1750/1.1780

Support:

- 1.1680/1.1650

Recommendations:

Trading on the euro market today is only possible within the intra-session style. Until there are clear signals of a change in the exchange rate, sales remain the priority. The best tactic is to stay out of the market until the correction is complete and look for signals to buy the pair.

AUD/USD

Analysis:

The last incomplete wave of the Australian dollar in the direction of the dominant trend leads the report from September 25. It is nearing completion of the middle part (B). The price has reached the upper limit of the potential large-scale reversal zone. Since the end of last week, a bullish area with a reversal potential has been formed.

Forecast:

The end of the downward wave, a reversal, and the beginning of a price rise is expected in the near future. In the European session, you can expect pressure on the support zone. A short-term puncture of its lower border is not excluded. The ascending section is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 0.7140/0.7170

Support:

- 0.7070/0.7040

Recommendations:

There are no conditions for "Aussie" sales today. In the area of calculated support, it is recommended to track reversal signals for entering long positions.

GBP/JPY

Analysis:

The last wave of the pound cross against the yen is descending. It counts down from September 1. In the last month and a half, the price formed the structure of the middle part (B). Since October 14, the quotes have gone down. This section has a reversal potential and may be the beginning of a new downward wave.

Forecast:

The pair's price is expected to move in the side corridor between the opposite zones. Pressure on the resistance zone is likely in the next session. By the end of the day, you can expect activation, increased volatility, and a decline in the support area. There is a small chance of breaking the lower limit of support today.

Potential reversal zones

Resistance:

- 136.80/137.10

Support:

- 135.80/135.50

Recommendations:

Today, trading on the pair's market is possible only within the intra-session style, with a reduced lot. Sales are more promising.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!