Last week, the price dynamics of major currency pairs underwent drastic changes compared to the previous five-day trading period. This time, all major currencies declined against the US dollar, while only the Japanese yen showed growth. It is reasonable to assume that such a multidirectional dynamics of the US currency occurs in the run-up to the US presidential election. Naturally, the technical component also has a significant impact on the course of trading on the main currency pairs.

So, at the end of trading on October 12-16, the single European currency suffered losses against the US dollar, which amounted to 0.94%. At the same time, the lack of agreement between the White House administration and Democrats from the House of Representatives of the American Congress on the adoption of a new package of stimulus measures did not allow the US currency to strengthen across a wide range of markets. To be fair, macroeconomic statistics released last week from the United States showed that the world's leading economy is gradually recovering from the negative effects of the COVID-19 pandemic. However, in the United States itself, especially in the western part of the country, the situation with the spread of coronavirus continues to be alarming. The same can be said for many European countries, where new restrictions are being introduced to prevent the spread of the second wave of COVID-19.

Now about the EU summit, which was held on Thursday-Friday and was in the focus of the attention of market participants. As previously expected, there was no progress in concluding a trade agreement between the EU and the UK. Brussels officials fear competition from the UK and the destabilization of the single market. In response, London said that the European Union does not respect the independence and sovereignty of the United Kingdom, and British Prime Minister Boris Johnson even threatened to suspend negotiations until the attitude of the European Union towards the UK fundamentally changes. Let me remind you that the most acute and unresolved issues in the divorce process between the UK and the EU remain fishing, dispute resolution, and equal conditions for both sides. It should be noted that the wording is very vague, however, many analysts believe that the foundation for a deal is there. However, the parties must reach a compromise, and this is what has not yet been achieved, mainly due to mutual claims. For example, French President Emmanuel Macron believes that the EU is ready to conclude a deal, but not at any cost, and the UK needs to make more efforts to reach an agreement. Each of the parties tries to bargain for the most favorable conditions. Time will tell what all this will lead to in the end. It won't be long now.

If you look at today's economic calendar, you can see numerous speeches by monetary officials of both central Banks. It is quite natural that special attention should be paid to the speech of Fed Chairman Jerome Powell, which he will deliver at 13:00 (London time), as well as to the speech of ECB President Christine Lagarde, which is scheduled for 13:40 London time.

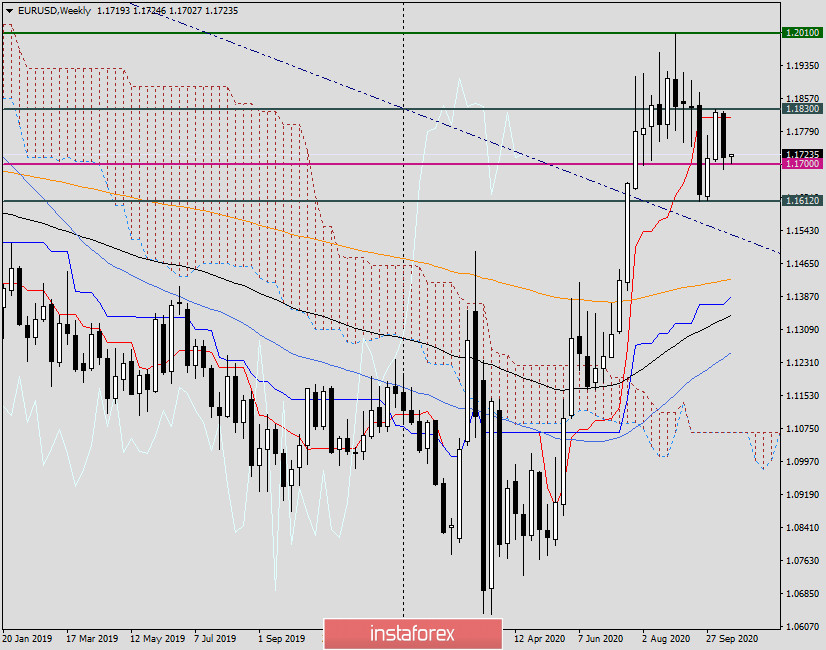

Weekly

Moving on to technical analysis for EUR/USD, let's start with the results of the end of last week. As a result of bearish pressure, a significant and strong level of 1.1700 was tested several times during the last five-day trading period. However, this mark was only punctured, but not broken, as the closing price of last week was 1.1716. Taking into account the minimum values of previous trades, we will consider 1.1700-1.1688 as a support zone. As for the resistance, it is concentrated in the price zone of 1.1826-1.1830, where the highs of the last two weeks were shown. As already mentioned, a true breakout of 1.1700 will send the quote to the area of 1.1625-1.1600. If the bulls manage to seize the initiative from their opponents and as a result of growth, the level of 1.1830 will be broken, the next targets at the top will be 1.1860, 1.1900, and 1.1917.

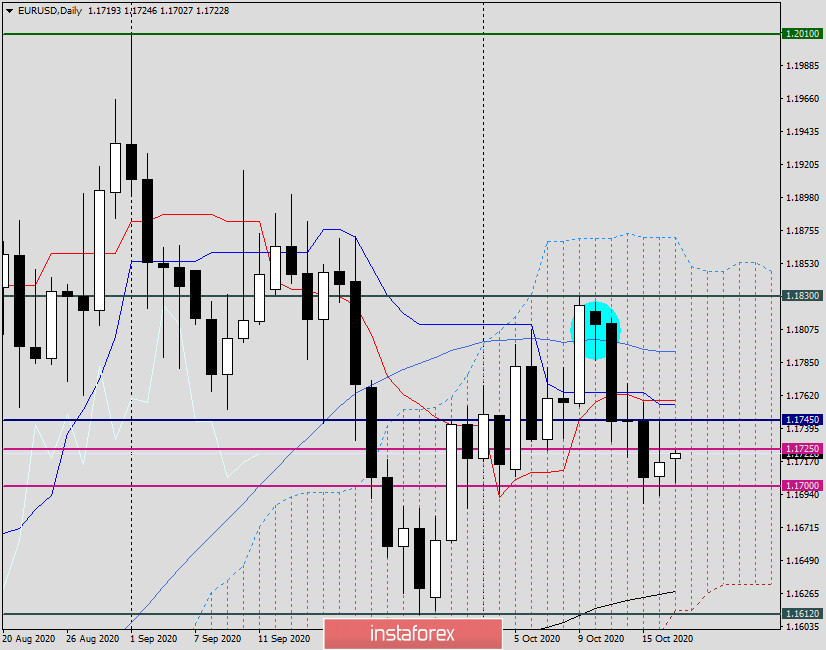

Daily

On the daily chart, the pair is trading in the middle of the Ichimoku indicator cloud, which means that further direction is possible in both directions. It is characteristic that on Friday, the euro bulls made attempts to reduce the losses incurred before, and at first, they succeeded. However, at the strong technical and historical level of 1.1745, the pair's ascent ended and a pullback followed, as a result of which the Friday candle had a fairly long upper shadow. Most often, such shadows signal difficulties encountered when trying to grow and the inability of the quote to moving up, after which a reversal occurs in the opposite direction.

In my personal opinion, the euro/dollar pair has every chance to continue the downward movement that started last week. If investor sentiment against the US dollar remains the same, then EUR/USD is likely to go under the important mark of 1.1700, after which it will go to 1.1680, 1.1640, 1.1625, and possibly to 1.1600. I believe that the main trading idea for EUR/USD will be sales, which are best opened after corrective pullbacks in the area of 1.1740-1.1760. Earlier and aggressive sales can be tried from the price range of 1.1730-1.1745. If the support zone of 1.1715-1.1690 shows reversal candlestick signals on the daily or lower timeframes, this will be the basis for opening sales with the nearest targets in the area of 1.1740-1.1760. Higher targets can be set in the resistance zone of 1.1800-1.1830.