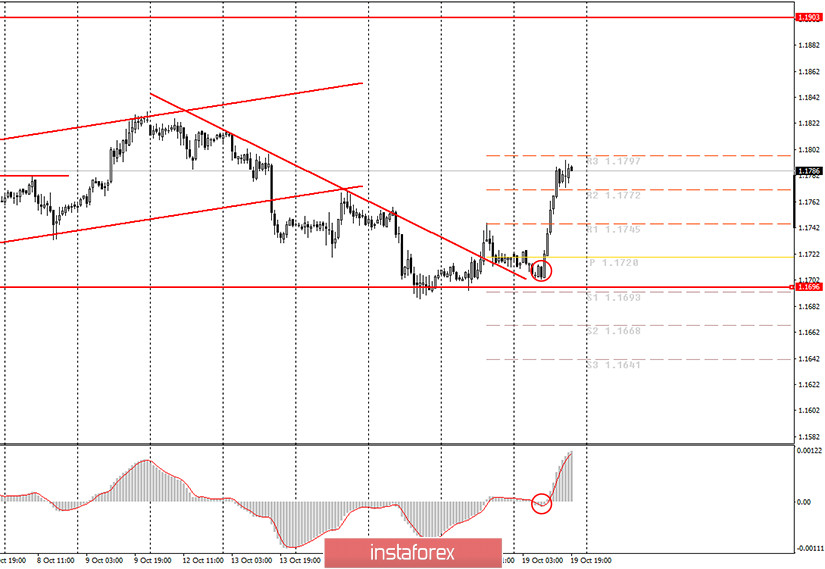

EUR/USD hourly chart

On Monday, October 19, the EUR/USD currency pair moved sharply upwards in the early trade. We mentioned this scenario in our yesterday's article. We have also warned that the level of 1.1696 is rather strong, so the two consecutive pullbacks from this level could trigger a new round of an upward movement. Thus, we recommended buying the pair following a new buy signal of the MACD indicator. Those traders who have opened buy deals have received a profit of about 50 pips, which is a fairly good result. After a strong upward movement during the day, we expect the pair to enter the phase of a downward correction. The trend has changed to an upward one. However, we recommend opening new long positions only after the pair completes the correction and the MACD indicator returns to the zero level. Currently, there are no new trendlines or channels seen on the chart, and they are unlikely to form in the near future. Moreover, the pair will most likely stay within the 1.17-1.19 sideways channel where it has spent the last three months.

On Monday, there were no key macroeconomic releases in the EU and the US. However, there were two speeches delivered by the heads of the EU and US central banks. While Jerome Powell spoke about the creation of digital currencies, Christine Lagarde said that the EU economy would face new challenges due to the second wave of COVID-19. She also mentioned that by the end of 2020, the EU economy would shrink by 8-12% instead of a 5% decrease expected earlier. Therefore, this news was unlikely to cause an uptrend in the pair. Nevertheless, it was the European currency that advanced today. Thus, we believe that the reason for this rise is connected with the technical factors rather than fundamental ones.

On Tuesday, no significant economic events are expected in the US or the EU that novice traders need to pay attention to. Therefore, we believe that the technical factors should also prevail tomorrow. However, there are plenty of topics that can potentially influence the trajectory of the EUR/USD pair. For example, Democrats and Republicans may still reach an agreement over a new stimulus package for the US economy. In case the two parties reach a compromise, the US dollar will benefit greatly from this. In addition, we should not forget about the surge of coronavirus cases in Europe. The higher the infection rate is, the more likely that the EU economy will slow down again. Of course, this is a negative factor for the European currency.

Possible scenarios for October 20:

1) Buy deals on the EUR/USD pair have become relevant at the moment, as the price has moved above the descending trendline. We recommend that beginners wait until the downward correction is completed and the MACD indicator returns to the zero level. Following a new buy signal, you can start opening new long positions with the targets at 1.1797 and above. Tomorrow morning, new support and resistance levels will be formed. We do not advise novice traders to open new long positions before this time.

2) You can consider selling the currency pair only when the downtrend is starting to form or the current upward trend is about to finish its formation. However, in the next few hours, this scenario seems impossible. So at least until tomorrow morning, the euro/dollars bears can relax and just observe the situation.

On the chart

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trendlines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exit the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.